By Sanjeet Sanghera, Head of Grids & Utilities, BloombergNEF

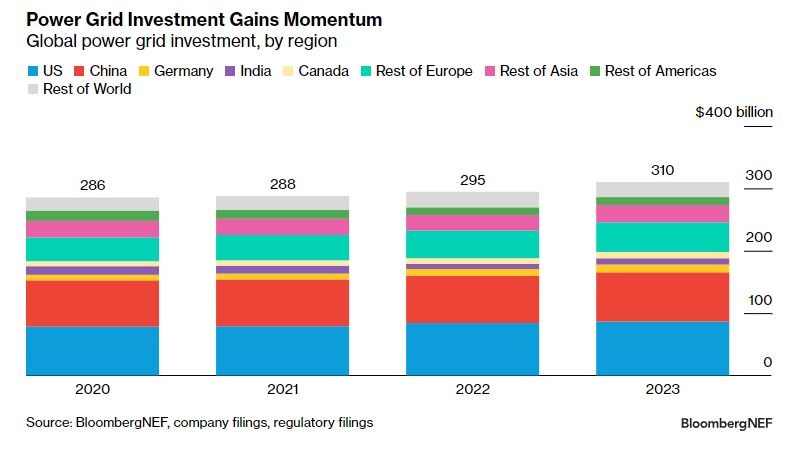

Capital investment in global power grids jumped 5% in 2023 from the previous year to $310 billion, according to analysis by BloombergNEF, welcome news in a period that otherwise saw increased grid congestion and longer interconnection queues.

The US led the pack spending $87 billion, with significant portions for increasing grid resilience to threats such as storms, including by burying power lines. Distribution grids took the lion’s share of spend in the US at 64% with the balance going to transmission grids. Distribution grid investment is growing most in countries that have rising electricity demand or are experiencing rapid growth in distributed clean energy resources, both of which are taking place in the US.

China followed closely with $79 billion in investment, with the integration of large renewable energy clusters and improvement to interregional transmission capabilities, particularly in central regions, playing a key role. In contrast, India’s grid investment fell to $10 billion in 2023, continuing a gradual decline from a high of $14 billion in 2020. Europe’s investment reached $60 billion, with a greater share of spend on digitalization and upgrading high-voltage transmission networks, reflecting a varied approach in strengthening grid infrastructure across the globe.

Several nations, driven by various imperatives, are converging on the need to expand and modernize their power grids. Although some of these investments are about addressing immediate needs, they could also help right-size the power grid for longer-term net-zero ambitions.

A high-level summary of the Energy Transition Investment Trends 2024 report is available here