Competition between Northwest Europe and North Asia for liquefied natural gas is set to be less this winter, contrasting last year’s fears of a supply shortage. This comes amid brimming European gas storage and the expectation of muted demand in Japan and South Korea.

Rising appetite for LNG in mainland China is unlikely to raise spot purchases due to high contract levels. An increase in contract volumes will also mostly drive growth in emerging Asian markets versus last winter.

On the supply side, an expansion in production will be supported by the return of Freeport LNG in the US, which was shut by outages last winter, and five new liquefaction projects starting operations. Strikes at Australian plants could tighten the market in an unlikely scenario.

- BloombergNEF expects Northwest Europe and Italy to end the upcoming winter (which runs from October to March) with its gas storage 44% full, assuming 10-year average weather. That is below the levels seen last year. Total LNG imports to the region over winter 2023-24 are likely to be slightly lower than last year as full inventories at the start of winter limit cargo arrivals. Gas demand may come in above last winter, prompting increased storage withdrawals. It could be supported by higher gas consumption in the power sector despite continued demand destruction in the residential, commercial and industrial segments.

- The outlook for Asian spot LNG prices over the winter remains slightly bearish in BNEF’s base-case scenario, compared to futures prices as of August 22, based on normal weather and assuming no strikes in Australia. The current contango in fourth-quarter Japan-Korea Marker (JKM) prices appears to be mostly driven by the expectation of colder-than-normal weather-related demand upside in peak winter or unplanned supply outages. If the weather turns out to be normal or mild, a likely scenario due to a possible El Niño in Asia, first quarter JKM prices will likely decline as inventories are healthy in mainland China (hereon referred to as ‘China’), South Korea and Japan. BNEF expects the August spike seen in JKM futures contracts for winter from possible Australian strikes to cool down, as the impact on supply, even if the strikes happen, is likely to be limited. This assumes strikes at the two Chevron-owned export plants will be limited to a week or two, if they proceed, and may not result in full shut-ins of facilities due to operational difficulties in plant shutdown and subsequent restart.

- Winter risk appears to be spilling over to summer 2024 futures prices. While Europe needs to have attractive netbacks for high LNG inflows to refill its storage, a lack of drivers for high spot demand in North Asia over summer 2024 may limit competition for cargoes and put downward pressure on the futures curve. Emerging Asian buyers are unlikely to enter in a price competition with European buyers to meet demand.

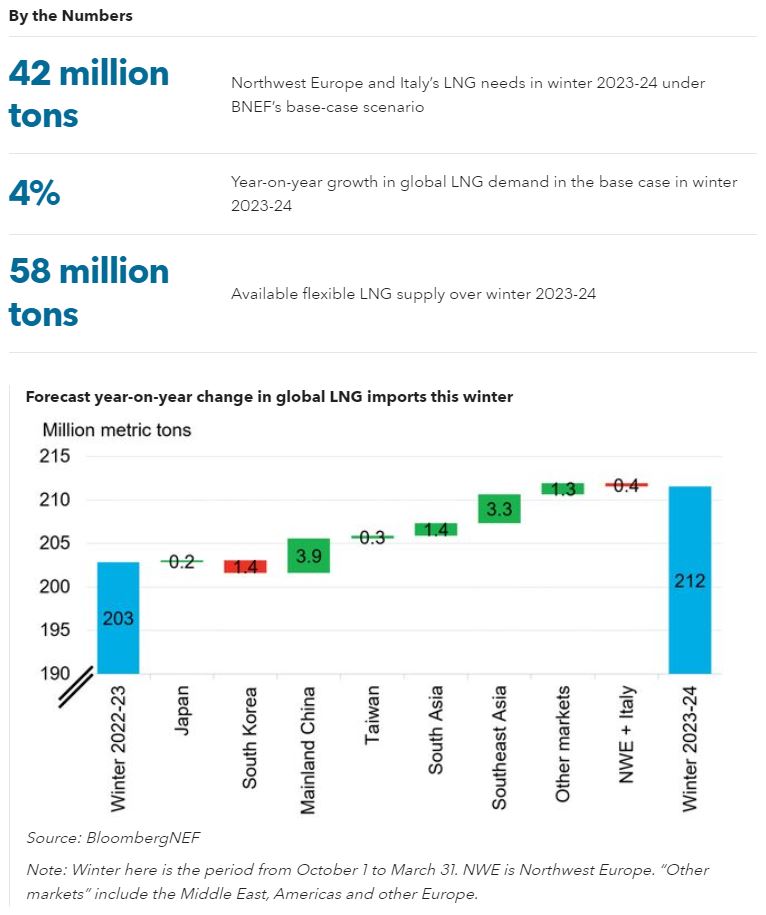

- China is set to lead LNG demand growth in the winter, with a 12% year-on-year increase forecast to meet expanding gas demand. The transport sector is likely to see the fastest growth amid more affordable LNG prices, improving the economics of natural gas-powered commercial vehicles. The competitiveness of gas-fired power plants could also rise due to the lower prices, increasing demand. Yet, cheaper domestic gas production and pipeline imports will limit the rise in LNG imports. Japan’s LNG imports are forecast to be stable winter-on-winter. With normal weather assumed in the base case versus the warmer-than-average temperatures seen last year, city gas demand from heating will rise. However, more nuclear generation will lower gas demand for power, keeping LNG imports stable from last winter. In South Korea, imports are expected to decline due to the rise of nuclear power generation, with one reactor due to commission in the fourth quarter of 2023.

- Southeast Asia’s LNG imports are set to climb to the tune of 38% winter-on-winter. The demand growth will be driven by Thailand’s falling domestic gas production, boosting its need for LNG. Singapore’s LNG deliveries under new contracts, as well as Indonesia’s domestic shipments from the upcoming Tangguh Train 3 projects, will also lift demand. South Asia is also projected to contribute to the LNG demand growth winter-on-winter. India’s LNG demand will be buoyed by the recovery in lost contract volumes, while both India and Bangladesh will likely see higher spot purchase due to lower prices.

- BNEF’s base case sees gas storage in the ‘Europe Perimeter’ – Northwest Europe, Italy and Austria – being 44% full by the end of winter 2023-24, compared to the 31% average over 2016-2020. This is lower than the inventories at the end of March 2023, as warmer-than-average weather and widespread demand destruction left storage at over 50% full. Winter gas demand will get a boost of 10 billion cubic meters year-on-year, due to a rise in consumption from the power sector. German lignite and nuclear power plant retirements are set to bolster gas generation as a substitute. That growth will be limited by lingering demand destruction among residential and commercial users (13% below weather-sensitive modeled values) and industrial consumers (28% below the 2016-2020 average) due to gas tariffs remaining elevated. However, a larger flexible supply pool will make such purchases less challenging than last winter. European gas storage is set to be close to 96% full by the end of summer 2024. Inventory build throughout the summer will be supported by the recovery in Norwegian gas production summer-on-summer, as 2023 has seen extended outages, and higher LNG imports. Lower maintenance in Norway over summer 2024 will support more output. Persistent demand destruction will also compensate for cuts in Russian sendout and a decline in Dutch gas production.

- Global LNG supply is expected to rise by 6% winter-on-winter, to 220 million metric tons. US LNG exports are set to recover with Freeport LNG project being online, after a long outage last winter. This is compounded by the start-up of new facilities, namely Arctic LNG 2 in Russia, Altamira Fast LNG in Mexico, Tangguh Train 3 in Indonesia, the Tortue floating LNG project offshore Mauritania and Senegal, and Tango FLNG in the Republic of Congo. US exports are set to climb 17% during the winter, driven by Freeport’s return, as well as higher utilization of Calcasieu Pass. Most US projects will see higher output this winter. The Cameron LNG project is the exception, with lower production expected year-on-year due to anticipated maintenance. Russia’s LNG production is projected to grow 3% winter-on-winter with the start-up of Arctic LNG 2. BNEF assumes the project will begin exporting in January 2024 and ramp up in the following two to three months. Australia’s exports are forecast to rise marginally winter-on-winter in our base case, owing to higher production at QCLNG and Prelude, which will offset a slowdown in exports at aging assets. BNEF sees extended shut-ins at Chevron’s plants unlikely if strikes do happen.

- Weather, uncertainty over China’s LNG demand and Europe’s gas demand, and disruption to supply could drive deviations from BNEF’s slightly bearish base-case price outlook. The residential, commercial and industrial sectors could need an additional 2.8 million tons of LNG imports above the base case if demand destruction is less than expected. In China, lower-than-expected pipeline imports from Central Asia could boost LNG demand by 1.9 million tons. Similarly, lower nuclear generation in Japan and South Korea would boost gas demand. Cold winter in North Asia and Europe could add 6.1 million tons and 14 million tons, respectively, to the base case LNG demand. A two-week shutdown at Chevron’s plants could lower Australian output by 1.1 million tons. Delays in the Arctic 2 ramp-up will decrease Russian supply.

- Global LNG demand in summer 2024 is set to grow 2% year-on-year, with emerging markets in Southeast Asia and South Asia as the main drivers of growth. Singapore is set to see additional contract deliveries, Indonesia will get more domestic shipments from the new Tangguh Train 3 project, and the Philippines and Vietnam will take a few more cargoes than in summer 2023. India will ramp up imports at the Dhamra terminal, and Pakistan may purchase a few spot cargoes up from zero this summer. Northwest Europe’s LNG imports could grow summer-on-summer due to higher storage injection needs. North Asia’s demand is set to recede as South Korea sees higher nuclear generation year-on-year. China’s LNG imports will be squeezed as cheaper supply sources expand to meet a modest rise in gas demand. Supply growth in summer 2024 is likely to be 4% year-on-year and will be dominated by Russia due to the ramp-up of Arctic LNG 2. New projects in West Africa and Mexico will also see rising output as they start operations in winter 2023-24.

- Global LNG demand in winter 2024-25 is set to be 3% higher than in the previous year. Higher stockpiling needs in Japan and South Korea, continued growth in emerging Asia, and more imports to Europe will drive the momentum. LNG supply in winter 2024-25 is forecast to grow 2% versus estimates for the coming winter. The ramp-up of Plaquemines Phase 1 and Golden Pass will propel the US to the lead position in supply growth. Russia will follow as Arctic LNG 2 raise its winter-on-winter production.

BNEF clients can access the full report here.