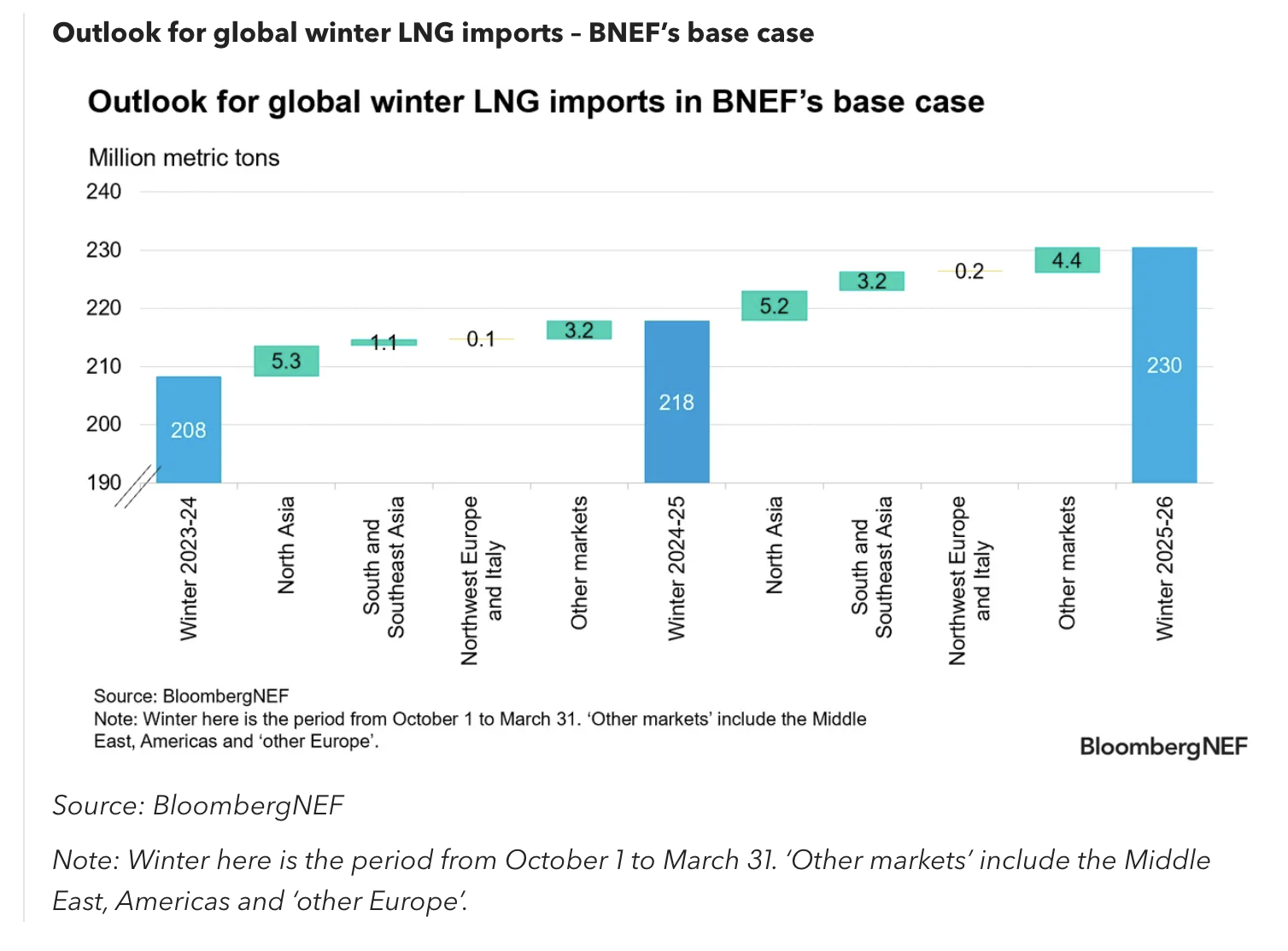

Global demand for liquefied natural gas is expected to climb by 5% in the upcoming winter from a year earlier, to hit 218 million metric tons. With growth in North Asia and smaller markets squeezing the available LNG volumes for Northwest Europe and Italy, this could raise competition for cargoes and bring a slightly bullish sentiment for prices entering the winter. Delays to the start-up of new supply projects, unplanned outages or a deterioration in geopolitical tensions could further tighten the global LNG balance and drive up prices.

- BloombergNEF estimates Northwest Europe and Italy could import slightly less LNG this winter as other markets snap up more of the supercooled fuel, resulting in larger withdrawals from storage to meet higher gas demand. The region is forecast to end March with its gas inventories 40% full, assuming 10-year average weather. That is short of the 56% averaged over the past two years. The uptick in gas demand will be led by residential and commercial consumers, mainly reflecting increased heating needs versus the milder winter last year. The power sector will also see higher gas burns driven by coal plant phase-outs.

- North Asia’s LNG demand is set to rise by 5% year-on-year to 114 million tons over winter 2024-25. The momentum will be led by South Korea due to a greater need for gas-fired power and city gas demand. Mainland China is estimated to follow but will see slower growth than last year. Japan is the only shrinking market in the region due to nuclear reactor restarts.

- Smaller markets in Southeast Asia and the Middle East will also support LNG demand this winter. Gas demand growth will push up imports in Thailand, whereas declining domestic gas production will force Egypt to purchase LNG cargoes to meet its gas needs. However, elevated Asian spot LNG prices will limit the spot purchases of buyers in South Asia.

- Weather is a crucial factor driving the change in LNG demand, as are prices. The outlook for Asia’s benchmark Japan-Korea Marker and Europe’s Title Transfer Facility is slightly bullish for the start of winter in BNEF’s base-case scenario, due to a tighter global balance. The trend is likely to persist into the next summer with Europe’s need for more gas injections to fill its storage from a lower level at the start of April. In the event of an extremely cold winter for both North Asia and Northwest Europe, Europe is likely to fully deplete its storage and would need to fiercely compete for spot LNG cargoes.

- Global LNG supply is expected to inch up 4% this winter, to 222 million tons, mostly propelled by the US with the start-up of new projects, as well as debottlenecking at Freeport LNG in Texas. In contrast, the Pacific Basin is poised to see the biggest decline in exports, driven by Malaysia. The fate of Russia’s Arctic 2 is still in limbo. The kick-off of new projects and their ramp-up will further raise supply post winter, although, a six-month delay could remove over half of the new supply expected next year.

BNEF clients can access the full report here.