REPORT

Greener Heavy Industry Is Possible, But Only With Smart Policy Support

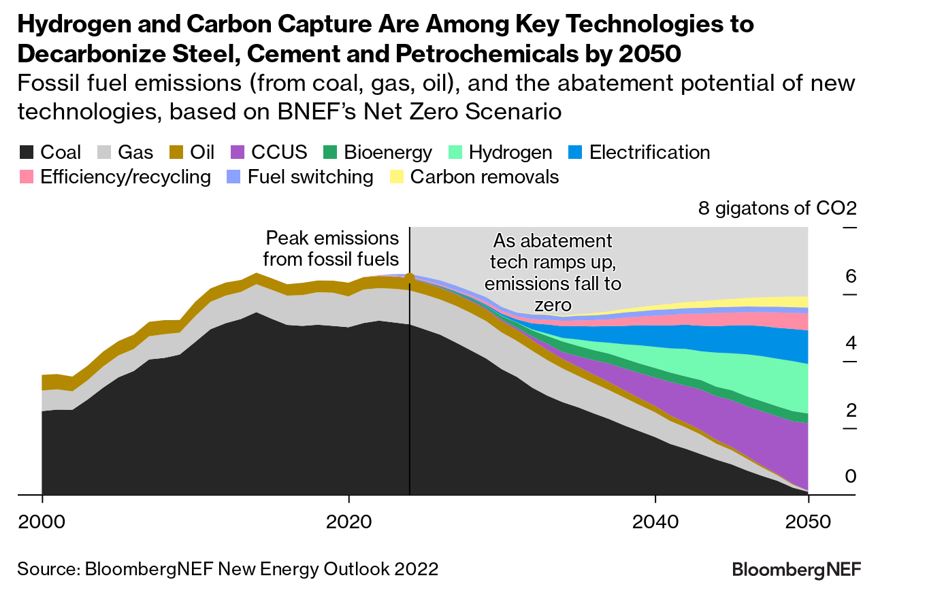

Global supply and demand for green industrial products – such as net-zero steel, cement and fertilizers – will be crucial to delivering on international climate targets. While the technologies to decarbonize these hard-to-abate sectors exist, their commercialization is still at early stages, and policy support has lagged.

That will have to change – and soon – or the low-carbon technologies needed to decarbonize heavy industry will not reach commercial scale in time for a net-zero economy by 2050.

It’s time for smart policy and investments to rise to the occasion

It took decades of public-sector support for solar, wind and electric vehicles to compete with traditional alternatives powered by fossil fuels. These technologies are now mature, scaled and economically viable. Yet policymakers and financiers have offered much less support for hard-to-abate sectors.

Roughly 97% of all investments in the energy transition in 2022 went to relatively mature clean energy technologies, such as renewable energy projects, EVs, clean heating in homes and energy storage. That left less than 3% of investments for industry – even though the production of steel, cement and petrochemicals accounted for 13% of global CO2 emissions in 2022.

The technologies for ‘greening’ industry are out there – now they need support

Green hydrogen, green ammonia, carbon capture, process electrification and recycling are some of the key technologies required to accelerate industrial decarbonization.

Getting these technologies off the ground will require smart policy interventions. Governments can directly incentivize new projects and investment, or they can gradually raise penalties on consumers or companies to get them to reduce emissions. Some countries have already implemented technology-specific policies, while others are targeting specific sectors or activities.

Policymakers can also introduce measures that tighten lifecycle emission thresholds for materials, reduce material demand and increase recycling. While there is a diverse catalog of tools available to address industrial emissions, most interventions are underutilized across heavy industry.

Policy can take the form of ‘carrots’…

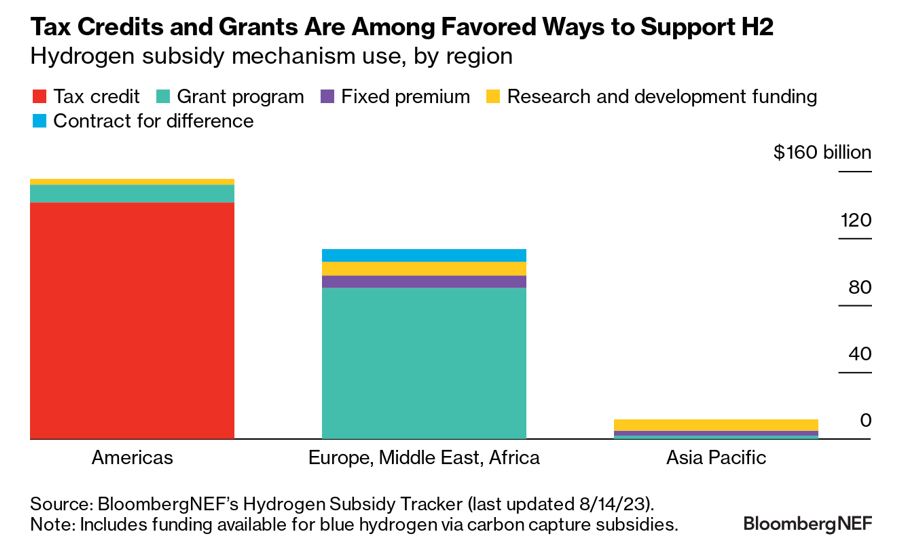

Financial incentives will likely be key to accelerating the commercialization of nascent technologies. Tax credits, which work by reducing the amount of income subject to tax, are becoming a more common incentive, especially for supporting hydrogen and carbon capture. Globally, BNEF estimates that $141 billion is available to low-carbon hydrogen projects in the form of tax credits.

The US has implemented a recurring, output-linked payment mechanism under the Inflation Reduction Act, designed to encourage the uptake of hydrogen and carbon capture. These measures are advantageous because the subsidy paid depends on the realized quantity of hydrogen produced or CO2 captured, which could have direct emissions benefits on every dollar spent.

Governments can also offer other types of operational subsidies, such as contracts for difference or even carbon contracts for difference, to support the additional cost of procuring or producing low-carbon technologies and materials.

…or ‘sticks’

Carbon pricing is one of the most impactful tools for encouraging industries to adopt new technologies and reduce emissions. An emissions trading scheme, such as the European Union’s Emissions Trading System, which tightens the supply of emissions allowances for each sector over time, allows market forces to determine the appropriate carbon price needed to achieve the desired level of total emissions in a given region.

Some European industrial producers will become increasingly exposed to rising carbon prices as the EU phases out free allocations from 2026. At the same time, the EU carbon border adjustment mechanism will impose levies on imports of iron and steel, aluminum, cement, fertilizer, hydrogen and electricity based on the carbon intensity of their production, to level the playing field between industrials located inside and outside of the carbon market.

Europe is also looking for ways to directly incentivize and derisk investment in new green technologies for producing materials like steel and cement. Revenues from the carbon market are already being used to support new projects.

Coupling carbon pricing with direct incentives for green technologies in heavy industry could become increasingly popular. In markets with (or planning to introduce) a carbon pricing mechanism, carbon contracts for difference could boost up-front investment in new green industrial production while reducing the subsidy bill for governments through carbon market revenues in the long run.

Robust green standards are the backbone of effective net-zero industrial policy

Regulations and subsidies for green technologies in heavy industry will be ineffective unless there are robust rules defining what is ‘green’. Clear definitions, along with progressively strenuous emissions benchmarks, will allow producers reduce their manufacturing operations emissions in an effective and strategic way.

For more on key policy solutions for greening heavy industry, see the full report here. This report was produced by BloombergNEF in partnership with Bloomberg Philanthropies, as part of the NetZero Pathfinders initiative.

About Pathfinders

NetZero Pathfinders is a public resource that provides concrete, actionable policy ideas for achieving a decarbonized economy. Pathfinders leverages the capabilities of Bloomberg L.P., Bloomberg Philanthropies and numerous partner organizations to make these policy solutions available via this web portal. The initiative aims to serve municipal, regional, national and international policy makers, financiers, business leaders and others.

Scaling Technologies for Greening Heavy Industry assesses some of the most promising policy solutions to scale up the technologies needed to decarbonize the hard-to-abate industrial sectors, delivered through the lens of success stories, where policies are already demonstrating strong potential to drive technology deployment or emissions abatement.