This article first appeared on the BNEF mobile app and the Bloomberg Terminal.

- Blackstone has stakes in three solar and storage firms

- Strict credit rules limit the attractive deals available

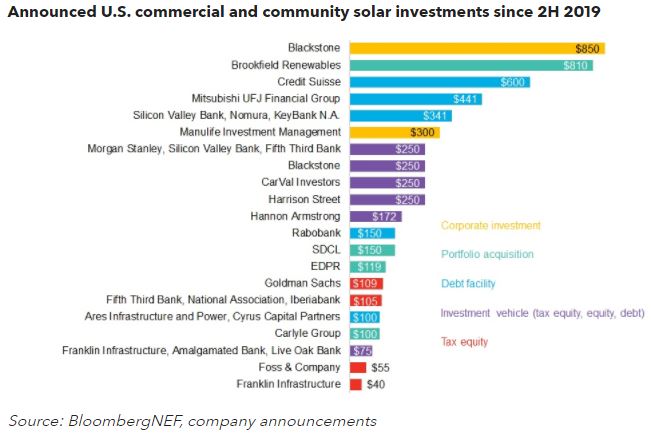

Asset managers like Blackrock, Blackstone, Brookfield, Credit Suisse and Morgan Stanley are active in the U.S. commercial and industrial (C&I) solar market. Investors like the diversification of project types and locations in portfolios of commercial solar, but a lack of contract standardization and strict credit requirements makes closing deals harder.

Institutional money has found many ways to get involved in U.S. C&I solar. Some investors, like Blackstone and Blackrock, acquire or invest directly in mid-sized developers. Others like to participate in financing vehicles by providing debt, long-term equity or tax equity, a form of capital used to monetize U.S. federal tax credits for solar.

Cheap capital for C&I solar comes with strict credit requirements, and most projects that secure debt sell solar power to investment-grade entities. These conditions limit the market size, because the vast majority of U.S. businesses are non-investment-grade.

BNEF Shorts are research excerpts available only on the BNEF mobile app and the Bloomberg Terminal, highlighting key findings from our reports. If you would like to learn more about our services, please contact us.