By Justin Wu

Head of Asia-Pacific

BloombergNEF

If U.S. President-elect Joe Biden has an inbox on his desk in Greenville, Delaware, it is no doubt overflowing. The coronavirus emergency, and the need to revive the economy, will be prominent – but so will two other issues that actually threaten to complicate each other in the years ahead. One is trade tension with China. The other is the low-carbon energy transition.

Biden will be wary of Chinese intentions – U.S. political opinion has shifted markedly since his time in the Obama administration. But he will be encouraged that, very recently, Asia’s three largest economies – China, Japan and South Korea – have all announced carbon-neutrality goals for 2050 or 2060. This means that over 60% of the world’s emissions are now covered by some sort of ‘net-zero’ pledge, and that term has entered the vocabulary of policymakers and boardrooms in Asia.

He may quickly conclude that his administration faces a balancing act: how to strengthen the U.S position in the key industries and technologies of the unfolding low-carbon revolution while at the same time encouraging China to push as hard as it can to achieve net zero.

A researcher at a government-affiliated think tank in China recently told me that if the new U.S. administration were to make a net-zero pledge, all of the world’s most advanced economies would have then committed to carbon neutrality. This implies that we would have the technological knowhow to solve the climate problem. His comment made me realize something that was perhaps already obvious – that U.S.-China relations and our effort to combat climate change are inextricably tied. It also made me wonder how the U.S. and China compare with each other in key decarbonization technologies, and what would happen if relations between the two countries worsen further.

Below I look at five such technologies crucial to the low-carbon energy transition, examine how the U.S. and China compare in each, and explore what might happen if U.S.-China relations continue to deteriorate, including what would transpire if the U.S. were able to convince its allies to join it in abandoning trade ties with China.

First, three hard realities both sides must bear in mind:

- China has invested heavily in key decarbonization technologies in the past decade, such as solar and batteries, and now has a significant edge over the U.S. The U.S. retains an advantage in advanced materials and software.

- A U.S.-China trade decoupling would cut America off from low-cost clean energy equipment and deprive Chinese clean energy companies of access to a key export market.

- Further decoupling between China and U.S. allies such as Australia, Europe and Japan would be extremely damaging to Chinese companies – but also to the global effort to combat climate change.

One last dose of reality: the relationship between China and the rest of the world is, to a large degree, symbiotic and could well be critical if we are to have any real shot at addressing climate change. Chinese companies benefit from exporting low-carbon energy equipment and need healthy trading relationships to thrive. But importing nations benefit as well, often by accessing the lowest-priced equipment on Earth. Lower prices make clean energy more cost-competitive with fossil incumbent sources of power and mean faster proliferation. All of this suggests the future low-carbon economy will need to be interconnected, with China very much involved.

Solar power

Solar power is the cornerstone of the transition to low-carbon energy. Since 2009, the cost of generating electricity from solar has fallen by more than 86%, and the world has added more solar generation capacity than that of any other technology – renewable or non-renewable. By 2050, based on economics, BNEF expects solar to provide 23% of the world’s electricity, up from only about 3% today.

Solar is also one technology where we already have an undeniable winner: China. The country dominates the manufacturing of solar photovoltaic equipment, accounting for 73% of the world’s module capacity. Nine out of 10 of the largest solar manufacturing companies in the world are Chinese and they control the entire supply chain, from the processing of silicon to the inverters that connect modules to the grid. In contrast, the U.S. has only 3% of the solar module assembly capacity of China, and a number of the factories on U.S. soil are actually owned by Chinese companies.

Despite China’s dominance, its solar companies rely on overseas markets and would be crippled in the event of a devastating trade dispute. In 2019, some 75% of modules made in China were exported. Exports of solar equipment, including PV cells, modules and inverters, topped $20 billion in 2019, a 42% increase from the year before. Over $9 billion worth were exported in the first half of 2020 despite Covid-19 slowing down projects in several countries. China’s own solar market is huge, likely to account for 31% of global solar installations in 2020. This share will gradually decrease, to 19% by 2050, as demand in other markets grow, according to BNEF projections.

Solar is no stranger to trade wars. Since 2012, the U.S., EU, and India have all implemented tariffs against Chinese-made solar equipment in a bid to protect their domestic manufacturers. Each time they’ve failed, as Chinese companies have improved their manufacturing techniques, cutting costs faster than tariffs could keep up. As a result of previous trade disputes, the U.S. no longer buys solar equipment directly from China, but instead from Chinese-owned factories in neighboring Asian countries. On the other hand, Europe, India and most emerging markets still rely heavily on Chinese-made solar, with more than 80% of modules and cells in Europe coming from there in 1H 2020, and 90% of those in India.

In India, ongoing efforts to localize solar production gained new urgency earlier this year, as a border dispute with China and pressure from the U.S. worsened relations between Asia’s two largest countries. But with a highly competitive auction system producing the cheapest solar projects in the world, the Indian government’s efforts to grow a domestic PV manufacturing industry have repeatedly fallen short. Duties placed on PV modules and other components imported from China have been more detrimental in some cases, by raising the input costs of materials for domestic manufacturers.

Given surging demand, it’s unlikely other countries will stop buying Chinese solar equipment anytime soon. But any move toward decoupling from China could be devastating not only for Chinese solar companies, but for access to cheap solar equipment.

Lithium-ion batteries

Lithium-ion batteries have been widely used in consumer electronics since the 1990s. Growing deployment in electric vehicles and grid applications has turned them into a critical technology for the transition to low-carbon energy. Unsurprisingly, countries around the world are eager to benefit from the battery supply chain, and competition is growing.

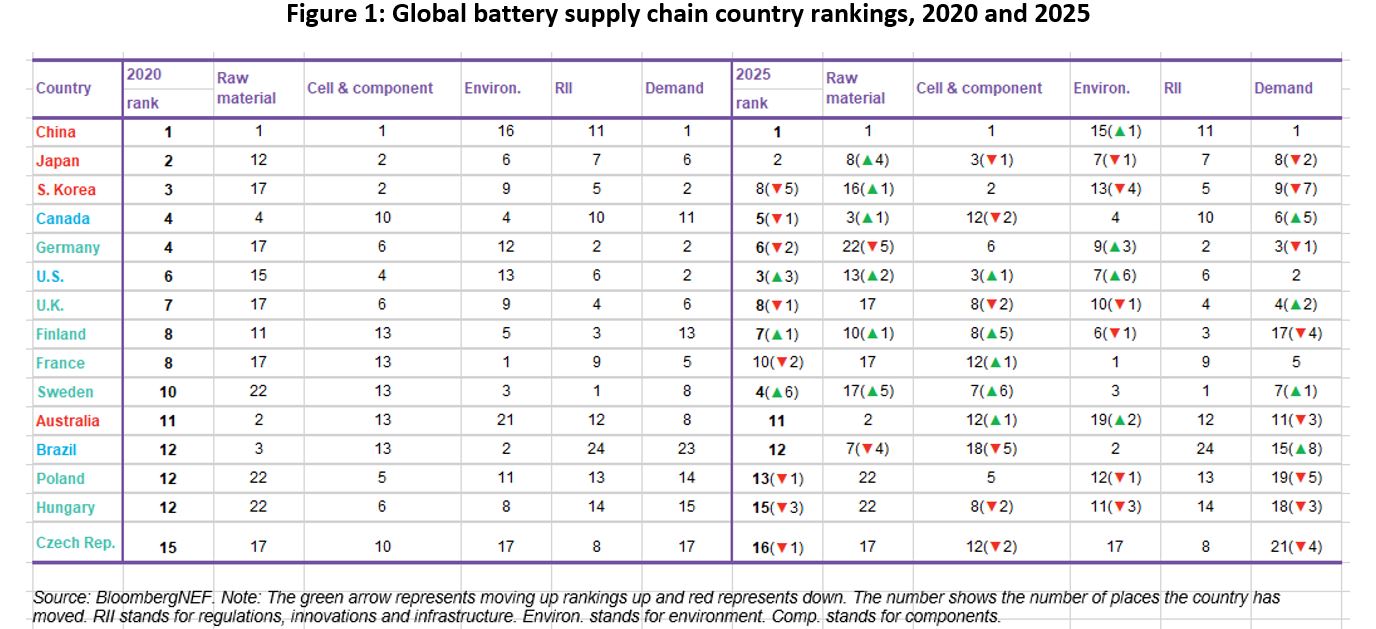

China was an early mover, enacting a robust set of national and regional policies to support electric vehicle sales, building domestic manufacturing capacity, and investing heavily in raw materials and mining at home and abroad. The country currently holds the top spot in BNEF’s global lithium-ion battery supply chain rankings, thanks to its large domestic battery demand, control of 80% of the world’s raw material refining, 77% of the world’s cell capacity and 60% of component manufacturing (Figure 1).

In contrast, the U.S. is currently sixth, with its key strengths being its large and robust automotive market and consumer electric vehicle favorite, Tesla. But a lack of clear policy direction, especially at the federal level, on electric vehicle adoption and battery supply chains is threatening American competitiveness. The U.S. also lacks supplies of key raw materials and the refining capacity to produce battery-grade materials. However, companies such as Albemarle, Rio Tinto, and Tesla, are starting to address this weakness by investing in and boosting critical materials production in the U.S.

China will retain its top spot in battery supply chains and technology over the next five years as it continues to lead the world in electric vehicle sales and battery manufacturing. But the U.S. is also forming a critical materials alliance with Australia, Canada, Europe, Japan, and Korea, which will help boost its access to raw materials. For instance Canada, the highest-ranking country outside of Asia, has access to four out of five of the key battery raw materials, and the U.S. can take advantage of this through free trade agreement with Canada.

The battery industry is especially vulnerable to trade disputes – countries risk being caught in the middle of U.S.-China tensions that would threaten their access to crucial battery components and raw materials. Furthermore, large auto markets, such as the U.S., Europe, and in the future other emerging economies, are critical for the success of Chinese battery manufacturers. Aware of their exposure, Chinese battery makers are responding by diversifying their production facilities away from home and to these other regions.

Hydrogen

While renewable energy and batteries can decarbonize large parts of the economy, other sources of greenhouse gases can’t easily be cleaned up. The manufacturing of steel, cement, and chemicals, for instance, requires fossil fuels, both as a reactant for chemical reactions and as a fuel to create the extreme temperatures needed. Similarly, long-distance and heavy-duty road transport, ships and airplanes may find it difficult to be powered by batteries. Hydrogen, a clean-burning molecule that can be produced carbon-free from water and renewable electricity by using electrolyzers, is a promising solution for these hard-to-abate sectors. The process is expensive, but costs will fall as electrolyzers and renewable generation become cheaper with scale.

China currently produces 60% of the world’s electrolyzers at costs as little as one-fifth of those made in the west. But the industry is small and Chinese makers, benefiting from cheaper raw materials and labor, are focused on the more established alkaline electrolyzers used in established industries. On the other hand, European and American companies specialize in proton exchange membrane (PEM) electrolyzers, which are more expensive, but operate more efficiently and are potentially better suited for the production of green hydrogen. However, if the demand for green hydrogen surges, increased competition in the field could drive down costs and lead to significant expansion for both electrolyzer technologies. The U.S. currently holds a key technological advantage in the polymer materials that are used in PEM electrolyzers and fuel cells. Any U.S. action against China in this area could hamstring China’s ability to progress on fuel cell and electrolyzer technologies in the near term.

Regardless of electrolyzer technology, scaling up cheap, renewable hydrogen production will require a significant long-term policy commitment and investment by companies and governments. Many countries, including the U.S. and China, have shown an interest in supporting hydrogen, but few have set clear policies to expand the technology or put money toward subsidies to encourage investment. For the moment, neither country has made a move.

Notably, China has not yet laid out a national hydrogen strategy, despite already making a pledge of carbon neutrality by 2060. Although BNEF expects hydrogen to play a major role in decarbonizing the world’s economy, government advisors in China are still mostly looking at its more niche applications such as fuel cell vehicles. When China announces its hydrogen strategy (and we do expect that it will announce one), it will receive very close attention from both the clean energy sector and rival economies. It will matter a lot in terms of cost reduction and speed of adoption globally whether hydrogen technologies also become subject to trade disputes.

Finally, as with solar and batteries, the role that U.S. allies play in deploying hydrogen technologies will affect how well each country does. The European Union has come out in front with an ambitious $550 billion Hydrogen Strategy as part of its Green Deal and Covid recovery plan. But as Michael Liebreich, BNEF founder and senior contributor, noted in two recent articles, a lot more investment, including from the private sector and from other countries, will be needed if Europe wants to scale up hydrogen to hit its emission goals.

Another vocal supporter is Japan, which has long harbored ambitions of creating a hydrogen economy. However, it has recently fallen behind other countries in terms of investment. In addition, Japan has focused on consumer applications for hydrogen, such as cars and residential fuel cells, both of which face cheaper battery or electric alternatives.

Nevertheless, the enormous costs of developing and scaling hydrogen technologies, and building the infrastructure necessary for a global hydrogen economy, means that not one single country could go it alone. Here again, China would miss out if it were not able to collaborate with the U.S. and its allies. On the other hand, the rest of the world could not develop a hydrogen economy for decarbonization if it left out its largest emitter.

Smart grid software

A “smart” grid, run by advanced software systems, can help improve the sustainability of a country’s power system by reducing curtailment of clean energy and by integrating decentralized energy sources such as rooftop solar and electric vehicles. Smart grid software includes programs that can remotely monitor power assets, analyze performance data, or run drones to conduct inspections automatically.

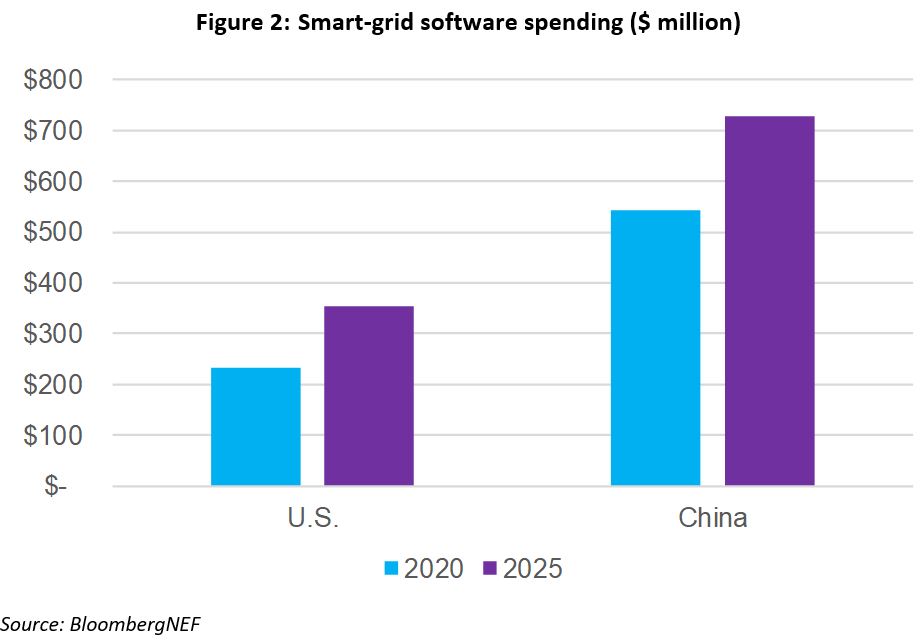

The U.S. and China are both investing heavily in smart grid software over the next five years, with China outspending the former nearly 2-to-1 (Figure 2).

China’s main advantage is that over 80% of its grid is owned and operated by one large public sector company, State Grid, which is implementing an aggressive plan to digitalize most of its operations by 2024. This includes spending $3.5 billion on digital infrastructure and forming partnerships with 41 Chinese technology companies, including Tencent, Alibaba and Huawei, specializing in everything from blockchain to robotics. State Grid’s plan sits within the Chinese government’s longer-term ‘internet-plus’ strategy, which pushes state-owned firms to embrace digitalization and aims to create 3-5 world leading industrial Internet of Things companies by 2025.

In contrast, the U.S. grid is a network of interconnected local electricity grids owned by private companies. Regulators dictate the revenues of these utilities by determining their rate base and allowed rates of return, which in effect limits their options to pursue new businesses that do not utilize their existing assets. In other words, U.S. utilities have a harder time partnering with third-party technology providers to start new software-based businesses.

However, U.S. companies still hold an edge in the actual technologies needed to run a smart grid and the country has world-leading vendors in grid software, including General Electric and Microsoft. Furthermore, the U.S. has more experience with distributed energy resources and has a competitive market for software vendors, which encourages learning and innovation. State Grid, meanwhile, will come under increasing pressure from Chinese regulators and competition from technology companies if it begins to monetize the data it collects from its domestic customers through its digitization program.

Digital technologies are already a tense flashpoint in U.S.-China relations. With collaboration less likely, China will not be buying software from U.S. vendors and will instead have to develop its own code.

Carbon fiber

Carbon-fiber-reinforced plastic is a high-performance composite material used in everything from fighter jets to sports equipment. As an alternative to structural materials such as steel, carbon fibers can make everything lighter and stronger, allowing products from electric cars to wind turbines to become more energy-efficient. Improved recycling technologies can further improve their sustainability benefits, as material is reused, reducing the need for energy-intensive manufacturing processes.

China views carbon fiber as a strategically important material, and it is investing heavily to build a domestic industry. Its strategy includes ramping up production capacity to lower costs, and stimulating demand by developing the domestic automotive and aerospace industries.

But the U.S. has a strong technological advantage when it comes to carbon fibers, with companies able to produce far higher-quality materials. It’s also one of the biggest producers, and markets, for carbon fibers and has attracted investment from European and Japanese companies.

An escalating U.S.-China trade dispute could potentially cut China off from this strategically important material, and from the technological knowhow of producing more advanced composites. China’s best hope is to rely on Japan, the world leader in composites manufacturing, for high-quality supplies and technology. Japan’s strength lies in the upstream of carbon fiber manufacturing, with its three main suppliers currently making up more than half of global capacity. Over 80% of this is exported, mostly to the U.S. and China, where most of intermediate processing and end-use takes place. The carbon fiber industry has high barriers to entry due to protection for intellectual property and high capital costs, and these help protect Japan’s leading position.

Although it’s unlikely Japan will cut China off from carbon fiber supplies (even with U.S. pressure), China sees its dependence on imports as a growing vulnerability that it needs to address.

At the start of this year, I wrote that governments and companies across Asia will have difficult choices to make in this new decade, if we hope to bend the emissions curve in our favor before 2030. The difficult choices would involve not only changing the way the power system operates, but how corporations or entire economies run. Decarbonization is no longer a side project, but will need to be front and center of all national efforts.

For its part, China is also undergoing a transition, though not one of leadership. The 14th Five-year Plan, which covers 2021 to 2025, will be implemented from next March and will outline a new set of economic, social and political priorities for the country. And like President-elect Biden’s inbox, it will be overflowing with complex issues that need to be resolved, including how to balance post-Covid economic growth with decarbonization. An early draft of this plan also highlighted the Chinese leadership’s awareness of its worsening relations with the rest of the world – the word “security” is mentioned more than any other keyword in this document. In the 13th Five-year Plan, which was enacted in 2016, “innovation”, “international” and “open” were the most commonly mentioned words.

Worsening U.S.-China relations will make an already complex issue like climate change, even more challenging. The hard choices are not just for Asia, or China in particular, however. They are also for the West, and particularly for the U.S. Biden’s advisors may tell him that there is a way forward but, just like U.S. presidential elections, it is a “narrow path”.