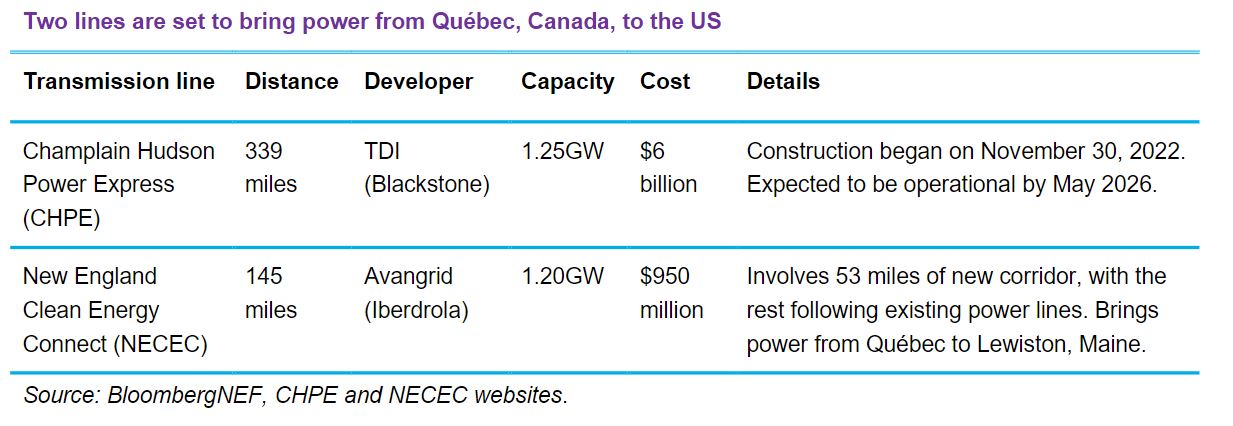

Canadian power major Hydro-Québec expects to start exporting electricity from Québec to New York via the $6 billion underground and underwater Champlain Hudson Power Express by May 2026. It also hopes to restart work soon on another link to the US: the New England Clean Energy Connect.

These lines will enable the absorption of more renewables in the grid, Serge Abergel, chief operating officer of Hydro-Québec Energy Services, told BloombergNEF, underlining the critical role that hydropower has in the energy transition and the benefits of cross-border collaboration. Power could flow in the other direction from the US to Québec too, especially once planned offshore wind installations come online.

“You can see a future where Québec’s hydro-reservoirs with their storage capacity become a form of battery that provides support when there is not enough wind, or when there is too much wind,” said Abergel.

Hydro-Québec is Canada’s largest electricity producer, with over 37 gigawatts of installed capacity.

The company recently completed the acquisition of Great River Hydro, taking control of its 13 hydro stations totaling 589 megawatts in New England. “Our view is that these assets are going to have a great future…the natural course of events will make these assets valued in a way they are not currently,” Abergel said.

He expressed concern, however, about the time taken to receive approval for grid projects in the US. New transmission links are critical for energy transition. “The Biden administration has talked about tripling the grid, but if it takes 15 years to approve one link, some rethinking is required,” said Abergel.

Hydro-Québec is currently expanding its wind power portfolio. Last month, it invited bids for 1.5 gigawatts of wind power and it is in the process of finalizing contracts for another 1.3 gigawatts.

The following Q&A has been lightly edited for length and clarity.

The $6 billion Champlain Hudson Power Express will be operational by May 2026. What are the milestones between now and then?

Building CHPE [the Champlain Hudson Power Express] is no small challenge. There is over 300 miles of underwater-underground transmission lines all the way from the Québec border. There is a small section in Québec – roughly 35 miles – and then it runs to New York City. We had the ground-breaking ceremony in Whitehall with the Governor of New York [Kathy Hochul] in November.

This year – 2023 – is what we call a staging year, which involves preparing the route for cable laying and the construction of the zero-emissions converter station in Astoria, Queens, in New York City. On that site, our partner TDI [Blackstone-owned Transmission Developers] is dismantling six oil tanks that have been there since 1940 for fossil-fuel generation and remediating the area. Further, 2024 and 2025 will be construction and cable-laying years with power flowing in 2026.

And what is the status of the other line under construction – the New England Clean Energy Connect?

A lot of work has been done on the NECEC [New England Clean Energy Connect] project. When the project was paused, our partner had already spent about $500 million toward building the NECEC. We hope to have a court decision on the project sometime this spring and restart construction to deliver the NECEC’s economic and climate benefits to folks in New England.

Both the projects are the same size and bring enough clean power from Québec to power a million homes each. We have 62 hydroelectric generating stations in Québec with over 37 gigawatts of installed capacity, and are bringing that clean power all the way to New England and New York City where electricity generation relies heavily on fossil fuels. The whole goal of this cross-border collaboration is to work together toward a clean energy future. Our neighbors are also ramping up their own sources of clean power with offshore wind, which is a really good fit with hydropower.

We also keep hearing about the New England Clean Power Link. What is the status of that?

It is a proposal that has been put forward by our New York partner in the CHPE project – TDI, which is a Blackstone portfolio company. It is a viable solution, should, at some point in the future, there be a need for it. However, Québec’s long-term baseload energy commitments over new interties are reserved for the NECEC and CHPE projects.

Our strategic view is that interlinkages are extremely important to Canada and the US, and are the best way for us to work together toward the energy transition. The contracted flow of baseload energy is 10.4 terawatt-hours toward New York City (20% of the City’s needs). As the transition evolves in these regions, and as New York builds its renewables portfolio, there will be a need for two-way trade. These power lines are conceived to be bidirectional. You can see a future where Québec’s hydro reservoirs with their storage capacity become a form of battery that provides support when there is not enough wind, or when there is too much wind. The ambition is to store this excess power in our reservoir for future use in the northeast region, instead of wasting it.

Does the Inflation Reduction Act change anything for you? Are there new incentives that can be tapped?

From a Canadian perspective, no. From our partners’ perspective, I understand they are trying to analyze different options and see if there is anything that can be done with the IRA provisions.

In addition to being the supplier of power, is Hydro-Québec a co-developer of the transmission link too?

We are primarily the supplier of clean power. We are also the developer for the Québec portion of the line (35 miles) and the Hertel converter station. On the US side, TDI is building the link and converter station in Queens.

What is the tariff that has been decided for the power that you send across and how does it escalate? Does inflation impact the cost of the project?

Our contract with NYSERDA [the New York State Energy Research and Development Authority] is for the sale and purchase of renewable energy credits associated with energy delivered into New York City (under the Tier 4 program). That uses a structure that provides 25 years of predictable pricing for RECs.

Even with the current exceptional inflationary pressures, we feel that we are good in terms of the cost of the project. The large quantity of renewable energy from CHPE will reduce electricity price volatility driven by sharp changes in fossil-fuel prices, such as the 28% jump from December 2021 to January 2022.

How do you view hydro’s role in the energy transition?

This transition is not about ideology. You cannot transition an economy – especially not an economy of the size of New York’s or Québec’s – without having available on-demand power, or baseload power. You can have as much intermittent resources as you want, but these will not do the job at the times when you don’t have wind or sun. There is battery storage, but it is short duration – a few hours. If you have a wind gap for a week, you have a problem. You will be relying on fossil fuels, and not meeting your emissions-reduction goals, your climate goals. So, pragmatically, hydropower absolutely has a role to play. There are not many sources of clean baseload power available.

We go back to the science and look at the greenhouse gas emissions from different power generation options. When you compare the different sources over a 100-year lifespan – you look at GHG emissions from wind, you look at solar, look at hydro and fossil-fuel power sources – hydro is on par with wind. A hydroelectric generating station, if maintained, can live forever. In Québec, we have some that are over 100 years old.

If you are going to heat your house with electricity, like we do in Québec, you need something that is available on demand – sources that are 100% reliable when you need them. There are not many sources.

Does Hydro-Québec plan to grow its own portfolio by building new plants or acquiring built-up assets?

The last generating station that we finished building recently is Romaine-4. It takes 15-20 years to plan and build a large hydroelectric project. It is a long-term investment. Our strategic plan and our vision for the next 10 years focuses on three elements.

Firstly, we are bringing much more wind power online. Multiple gigawatts. We are involved in some of the projects directly, or we are procuring through private companies that sell to us.

The second element is adding capacity to our existing hydropower generating stations by 2035. We have ongoing refurbishments which will yield about 2,000 megawatts of additional power through optimization using the latest digital tools, so every replaced generating unit ends up giving 5-10% additional power, squeezing more out from the same resources.

The third element is energy efficiency. Hydro-Québec has 4.5 million customers and almost 90% of them heat their facilities or homes with electricity in winter. Through automation, smart meters and interconnected devices, you can reduce peak power demand, create efficiencies and save energy. Our outlook for 2030 is about 10 terawatt-hours of saved energy.

There are no new hydro plants planned for now in Québec. But there will come a time when the Northeast region will face an intermittency problem and there will be a need for more clean baseload sources of power. This conversation is unavoidable at some point.

I was once told that baseload as a concept will be retired in a smart, modern power system. Do you agree?

Baseload power is not a trendy cool concept to talk about when we talk about the transition. However, the intermittency issue is real. There are only two ways to balance out intermittent sources for an extended period of time at the moment – burning gas, coal or oil. But those unfortunately pollute. The other is hydro and nuclear which are clean.

Hydro-Québec just completed the acquisition of Great River Hydro in New England. Are you open to more acquisitions?

Yes, we are open to further acquisitions. What you have seen with Great River Hydro is really us looking to invest further in our specific area of expertise, which is hydropower. Most of the 13 generating stations have a head reservoir. It is very similar to what we have in Québec, though on a smaller scale.

When you look at a grid that is entirely decarbonized – meaning you won’t be able to burn something to get electricity or you will have to compensate somehow – hydropower will become critical. Our view is that these assets are going to have a great future because they are in regions that have aggressive climate goals, and the natural course of events will make these assets valued in a way they are not currently.

What is the biggest task before you as Hydro-Québec’s lead in the US?

Completing these projects – NECEC and CHPE – is the top priority for our US presence, obviously. We realize that there is a need for a greater understanding of our role. We are engaging in advocacy, and contributing to the conversation. Our goal is to have a strong US presence and to be a long-term partner.

What do you say to those who argue that instead of exporting clean power, you should use that power to make something and then export it after some value-addition?

There are folks in Québec that want to keep all the power locally and use it to attract businesses. I think we can do both. This is a question that comes to many economies as they transition, because the value of green power is very high. There is going to be a lot of thinking about this. Being a partner to our neighbors for this transition is a very important part of our philosophy.

The leadership at Hydro-Québec is changing. Could that lead to a change in strategy and philosophy?

Hydro-Québec is a large organization with over 22,000 employees. We have changed CEOs before. Certain fundamental aspects will remain the same. Clean energy exports to the US and the pollution they allow to avoid is something we are proud of.

When we look around at the transmission throughout the US, it is a challenging business. There aren’t many projects moving forward. CHPE is a success, but it took 15 years to get all the approvals. It should not take this long. It is also a wake-up call. Maybe we ought to change the way we do things, because a lot more of these will need to be built. The Biden administration has talked about tripling the grid, but if it takes 15 years to approve one link, some rethinking is required. There are bigger challenges ahead. People will have to understand and get used to the fact that to transition, you will need new transmission infrastructure. The energy transition is costly, but not transitioning is going to be even more expensive.