If 2021 was a defining year for clean hydrogen, hold on to your hats for 2022. Electrolyzer sales are projected to quadruple this year — driven by the Chinese, U.S. and European markets — and clean hydrogen demand from industry is set to exceed use in cars several times over. Meanwhile, capitalizing on investor enthusiasm, a flurry of hydrogen companies will go public this year, and more than 20 countries are expected to release a national hydrogen strategy.

1. Electrolyzer sales will quadruple, with China being the largest market

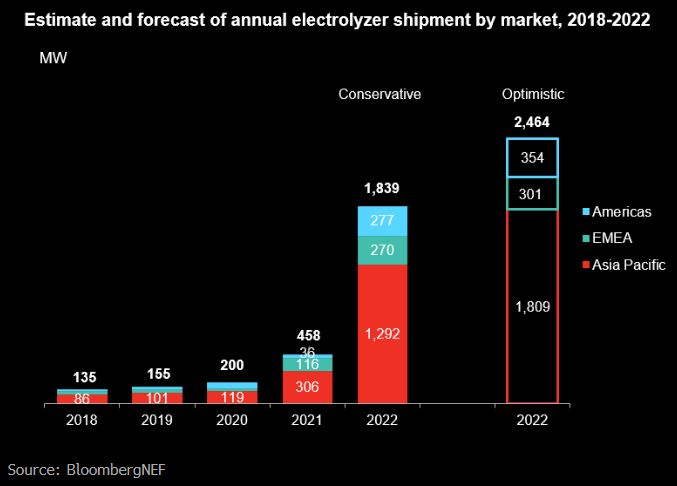

Electrolyzer manufacturers delivered 458 megawatts in 2021, and BNEF expects shipments to at least quadruple in 2022, to between 1.8-2.5 gigawatts. China will account for 62-66% of total demand, driven by state-owned enterprises keen to show compliance with national decarbonization goals.

2. The U.S. will see many hydrogen project announcements, but action will lag

The U.S. is expected to be the second largest electrolyzer market this year, behind China. U.S. developers will rush to announce projects in 2022, as the government readies a multi-billion-dollar investment in hydrogen as part of the Infrastructure Investment and Jobs Act. But with actual funding spread over the next five years, construction is likely to lag.

3. New subsidies will spur a boom in the European hydrogen market

European developers have been waiting for policy support and regulations before moving forward with their plans. Announced projects will finally start construction in 2022, as a wave of European Union funding is released and national subsidy programs begin.

4. A flurry of hydrogen companies will go public in 2022

Taking advantage of heightened investor interest, at least four hydrogen companies intend to go public in 2022. These include Italian electrolysis equipment manufacturer Industrie De Nora SpA, which is eyeing an initial public offering (IPO) on the Milan Stock Exchange, and hydrogen-based synthetic fuel maker eCombustible Energy LLC, which aims to go public via a merger with a special purpose acquisition company (SPAC) in the U.S.

5. Hydrogen strategies will be adopted by 22 countries in 2022

The number of countries with a hydrogen strategy doubled in 2021, from 13 to 26. This year, 22 more could follow. While not all roadmaps are equal, the strategies from the U.S., Brazil, India and China could redraw the world’s hydrogen map once released — if followed by policies to boost clean hydrogen use in promising sectors.

6. Net zero will drive hydrogen demand more than carbon pricing

Carbon pricing will be key for clean hydrogen demand to grow — so goes the mantra repeated by industry participants, policymakers and even BNEF. While true in the long run, national and corporate net-zero goals will drive more clean hydrogen demand in 2022 than carbon pricing. Hydrogen projects will be built to show compliance with emission reduction targets, as low prices and free allocations dent the impact of carbon pricing schemes.

7. Heavy industry will dominate clean hydrogen demand

Heavy industry is likely to be a dominant end-use for hydrogen as the world strives for net zero by 2050. Five sectors — steel, ammonia, methanol, chemicals and oil refining — will use more clean hydrogen in 2022 than all the world’s 51,000 hydrogen cars combined.

8. Green ammonia announcements will rise

Ammonia will help companies transport large volumes of green molecules across borders well before hydrogen pipelines become viable. The supply chain for shipping ammonia is already established and this can be easily leveraged for hydrogen exports. BNEF expects more green ammonia project announcements in 2022 as firms take advantage of this relative maturity.

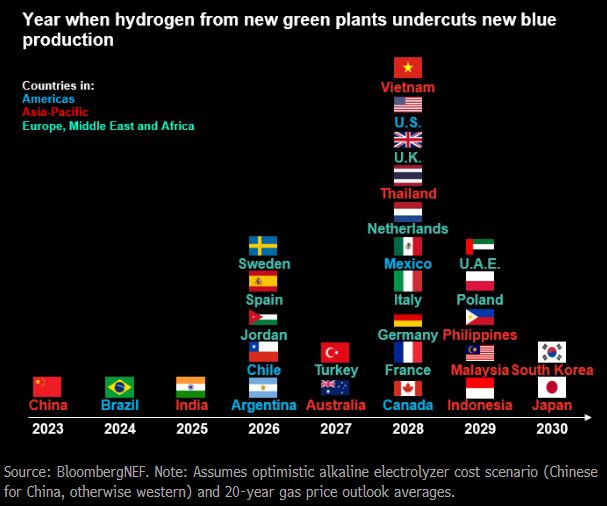

9. Policy will keep blue hydrogen on life support

As the price of electrolyzers rapidly declines, ‘green’ hydrogen from renewables will be cheaper to make than ‘blue’ hydrogen — produced from natural gas with carbon capture and storage — across the world by 2030. Blue hydrogen project developers will increasingly need subsidies to stay viable.

10. Alkaline electrolyzers will increase their market share over other technologies

The two most established technologies to make green hydrogen are alkaline and proton exchange membrane (PEM) electrolysis. BNEF expects alkaline products to hold an even greater share of the global electrolyzer market in 2022 than it did in 2020-21, accounting for 75-78% of shipments. This is because alkaline electrolysis is cheaper and better suited to large-scale projects, more of which are set to start construction in 2022.