By Martin Tengler, Head of Hydrogen Research, BloombergNEF

The year 2023 disappointed many hydrogen sector watchers as project developers continued to delay investments. Policies passed in 2023, such as EU quotas, US tax credit guidance and Japan’s contracts for difference, should help more projects move past feasibility studies in 2024. But many challenges still abound. Read on for BloombergNEF’s 10 things to watch for in 2024.

- Electrolyzer shipments will rise. European policies will drive hydrogen (H2) use in existing sectors such as oil refining, while shipping and aviation companies will also increase H2 purchases; US developers will get the clarity needed to take advantage of lucrative tax credits; and Japan and South Korea move from talk to action with significant subsidies.

- Blue and nuclear hydrogen could also get a boost as the EU, which has so far favored renewable H2, clarifies its regulations and offers subsidy programs and targets for their use.

- But challenges still abound. Electrolyzers are likely to face more technical issues as the first batch of large green H2 projects starts operation. Electrolyzer shipments could rise slower than expected if policies are delayed. Depending on their design, planned clean H2 auctions could suffer from higher costs and reveal prices that put tears in taxpayers’ eyes.

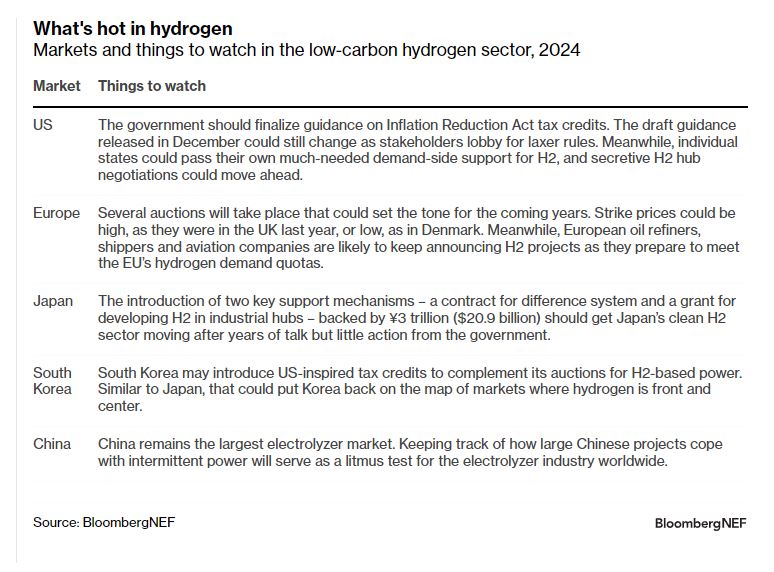

- The key markets to watch in 2024 will be the US as it finalizes its H2 tax credit guidance and negotiates support for seven hydrogen hubs, Europe as it runs its first hydrogen auctions, Japan and South Korea as they try to reclaim their leadership in the hydrogen sector, and China, which continues to be the largest market for clean hydrogen today.

BNEF clients can access the full report here.