Many companies have plans to make hydrogen, but many fewer are enthusiastic to buy it. Only 10% of the clean hydrogen capacity planned by 2030 has identified a buyer, BloombergNEF research shows. BNEF launched a Hydrogen Offtake Agreement Database that tracks 149 offtake agreements for clean hydrogen and derivatives.

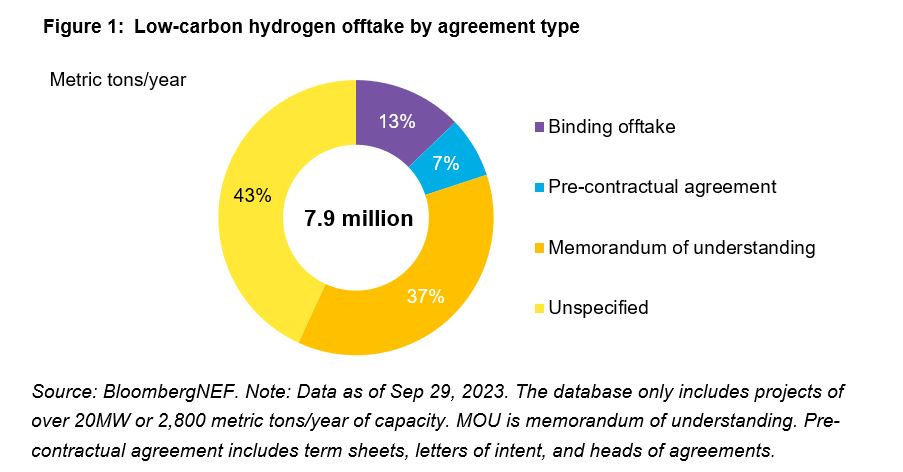

According the BNEF database, only 13% of the contracted volume (or 1 million metric tons/year) is binding. Another 7% are pre-contractual agreements with a solid chance of becoming binding contracts. The remaining 80% are either memorandums of understanding or unspecified. These might take a while to become binding, if they ever do.

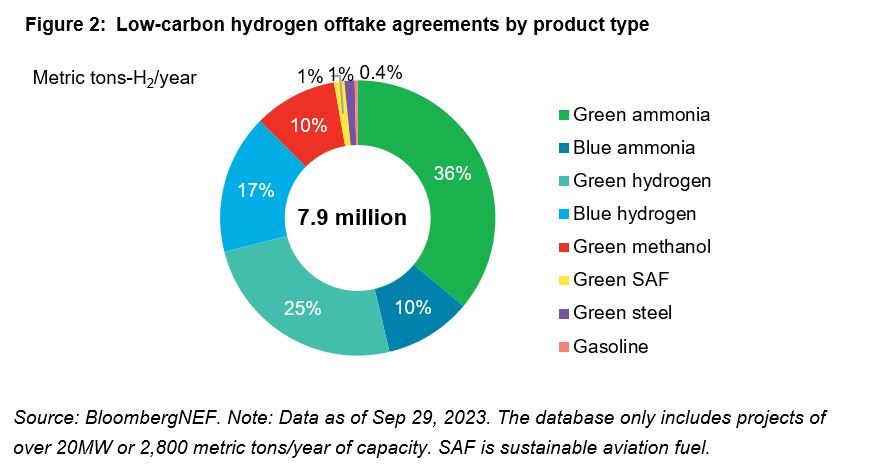

Nearly half of the contracted hydrogen volume is planned to be delivered in the form of ammonia (NH3), a gas that is much easier to transport than hydrogen. Buyers of ammonia include fertilizer companies and offtakers for export projects aiming to use ammonia as a hydrogen carrier.

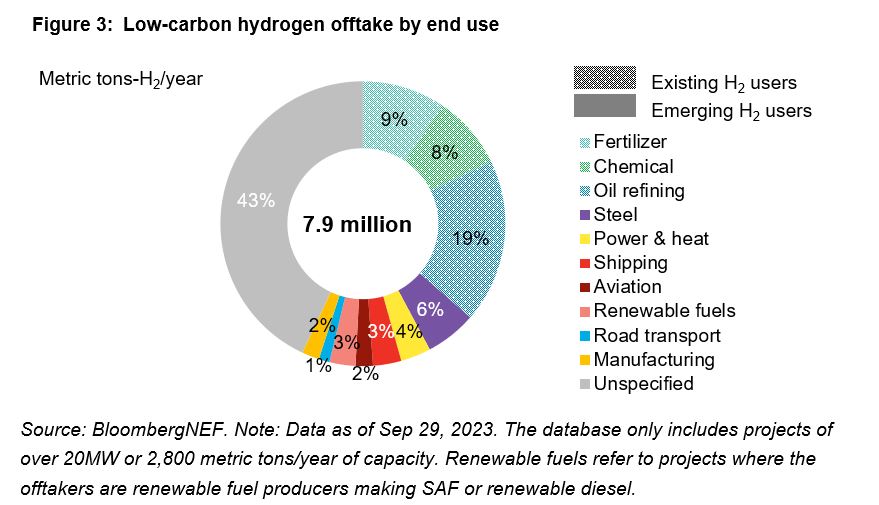

One third of the contracted volume will go to replace emission-heavy ‘gray’ hydrogen, which is produced from fossil fuels, while emerging applications such as steel, power and heavy transport fuels account for 20%. The remaining 43% of contracted volume has no specified end use and is planned for overseas export.

Among projects that identified offtakes, the US is the largest supplier, followed by China, Canada and Australia. Most offtake capacity is for domestic use, while 36% – 2.8 million tons/year – targets export. This is slightly over 10% of the announced clean hydrogen export pipeline by 2030. South Korea and Europe are the largest export destinations.