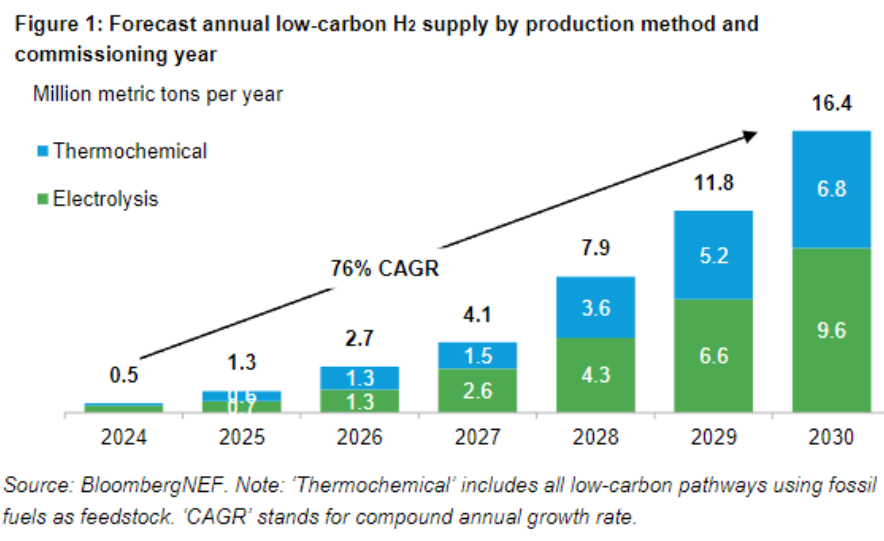

BNEF expects clean H2 supply to skyrocket 30-fold to 16.4 million metric tons per year by 2030, driven by supportive policy and a maturing project pipeline. Still, this is not sufficient to meet most government targets. Less than a third of the 1,600 projects that have been announced to date materialize in BNEF’s bottom-up analysis, and often later than planned.

-

From 0.5 million metric tons (Mt) of capacity online today, annual low-carbon hydrogen supply could grow 30x by 2030.

Only around 30% of all currently announced supply for commissioning by the end of the decade is likely to be built – a total of 477 projects.

-

Over half of supply in 2030 comes from electrolysis, but blue H2 plays a significant role

(Figure 1). Most policies favor green H2 production but economics, demand from Asia and a mature project pipeline will support large volumes of blue H2 as well.

-

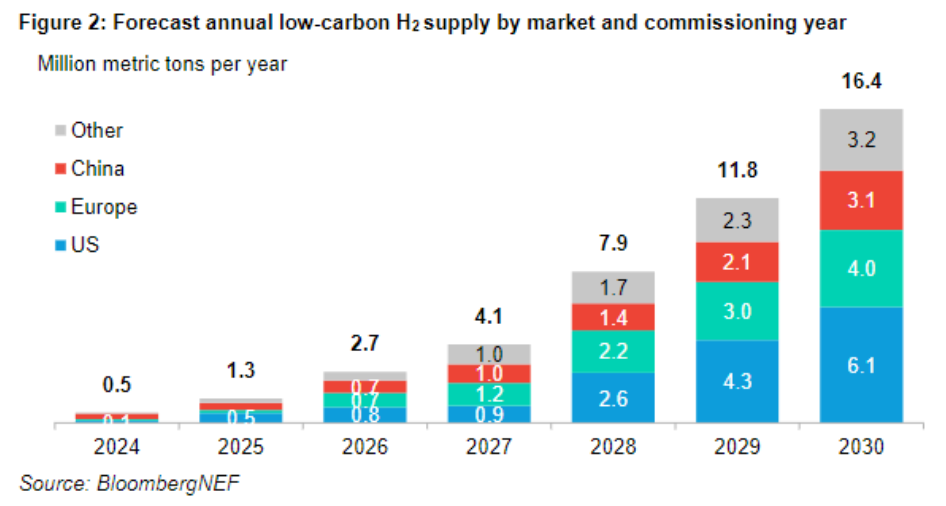

The US is expected to become the single largest producer of clean H2 by 2030

, accounting for almost 37% of global supply. The US hosts the most mature project pipeline globally, dominated by big blue H2 projects which are likely to benefit from tax credits.

-

China, Europe and the US could account for over 80% of clean H2 supply

by the end of the decade, driven by supportive policies and a pipeline of advanced projects (Figure 2). This means other regions with large project pipelines but less policy support, such as Latin America and Australia, may only play a minor role in global clean H2 supply to 2030.

-

Governments are likely to miss their aggregate H2 demand goals for 2030

by almost two-thirds due to longer project completion timelines and insufficient policy support.

-

Up to 31% of BNEF’s 2030 forecasted H2 capacity is export-oriented, but actual exports could be much lower

. Over half of supply intended for exports likely comes online in North America supported by tax credits. How much of each project’s output will be exported is still unclear and a significant share of output could also serve local demand. Policies for clean H2 imports across Europe, Japan and Korea alone could support up to 1.6Mt by 2030.

-

Around 95 gigawatts (GW) of electrolyzers could become operational by the end of 2030,

almost 10x the capacity that is already past final investment decision (FID) today. Around 40% of this 95GW is past FID or in advanced planning compared to 60% for all low-carbon H2 supply, showing the lower maturity of electrolysis projects relative to blue H2. Most forecasted electrolyzer capacity (~58GW) is driven by announced policies and is therefore still subject to uncertainty around policy implementation. This capacity will largely be based in Europe and China.

-

Some 10Mt per year of H2 production capacity is past FID or in advanced planning stages.

This supply is very likely to be built by 2030. Around 2.7Mt per year are past FID with the remainder at front end engineering design stage in markets with strong policy support. The remaining capacity in this forecast is subject to large uncertainty.

-

Deployment in China is the largest uncertainty to this outlook.

The market is difficult to predict as projects are not announced well in advance and deployment is driven by policy targets, which are still lacking for 2030. Supply in China is based on BNEF’s view on market adoption and assumptions around a replacement rate for gray H2. As China accounts for 38% of forecast electrolyzer capacity, changes to installations could strongly affect 2030 capacity.

-

Several other uncertainties exist.

Most forecasted electrolyzer capacity is still at early planning stage and only materializes if announced policies are implemented. BNEF’s outlook accounts for policy delays but major changes to announced programs, such as a remodel of the US IRA tax credits after the November presidential election, would impact this forecast. New policies or advanced projects that do not take FID could also change BNEF’s outlook.

BNEF clients can access the full report here.