Heavy industry has one of the toughest paths to net-zero emissions, but new policies in Europe and the US are boosting investment in projects looking to produce low-emissions materials. This new bi-annual Industrial Decarbonization Market Outlook tracks the progress in scaling low-carbon steel, aluminum, petrochemicals and cement. Companies today are largely relying on recycling to produce green aluminum, green steel and sustainable plastics, while buying more clean power to reduce emissions. But most firms are only aiming to scale up net-zero solutions such as hydrogen, carbon capture and electrification in the 2030s.

- Policy: The Industrial Demonstrations Program (IDP) in the US and the carbon contracts for difference auctions in Germany together allocated $10.3 billion to support new industry decarbonization projects in 1H 2024. We expect both these schemes to stimulate decarbonization investments and offer new templates that other regions could adapt to their needs and preferred technologies.

- Investments: Annual investments in industry decarbonization projects tripled between 2018 and 2023 to exceed $48 billion, led by funding for clean steel projects. Companies including SSAB, Baowu Steel, Nucor, Posco, Holcim and Hydro announced some $7.4 billion in new investment commitments for emissions reduction projects in the aluminum, steel and cement industries in the first four months of 2024.

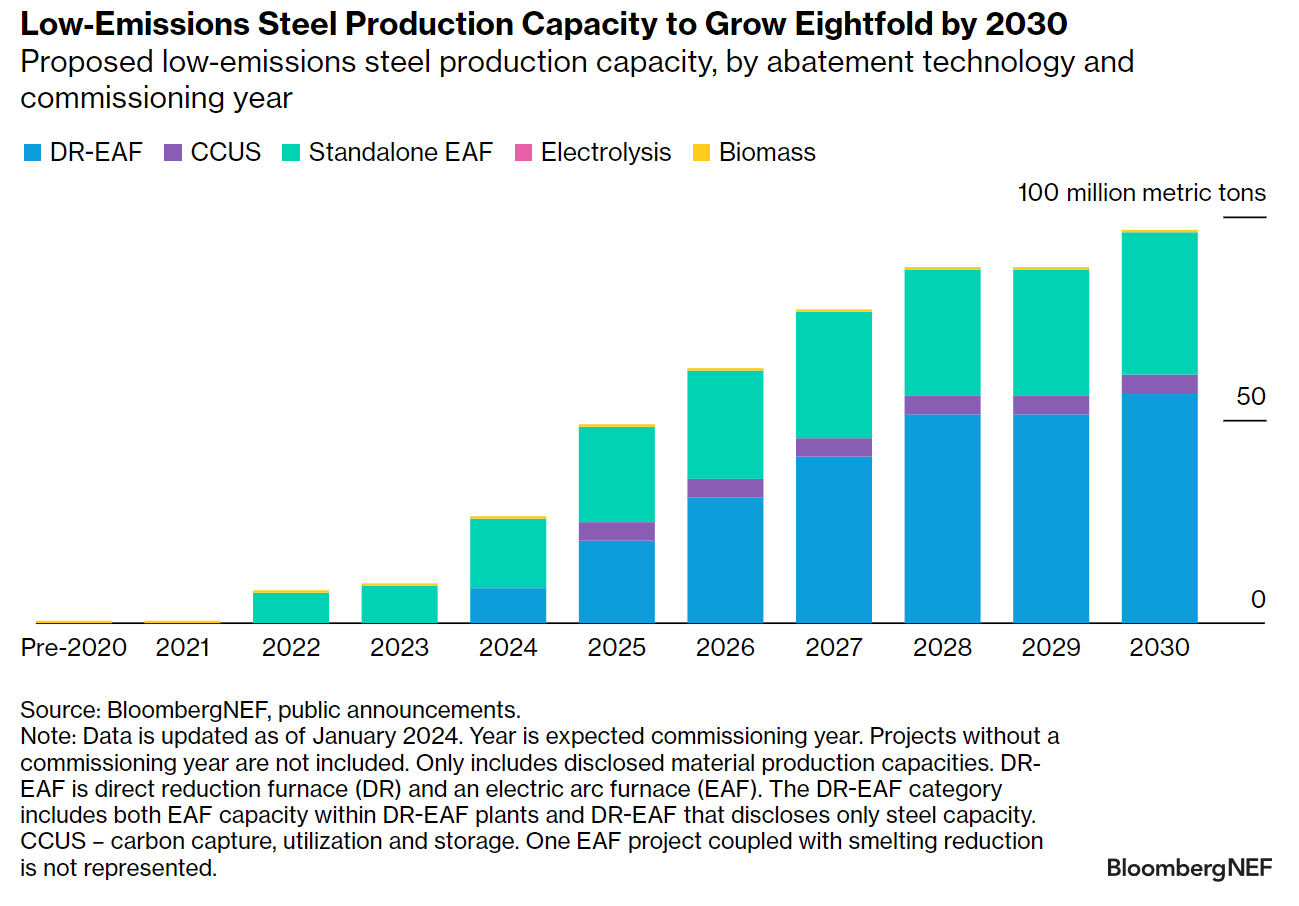

- Steel: Manufacturers have proposed about 100 million metric tons per year of low-emissions steel production capacity globally by 2030 (Figure 1). Direct-reduction coupled with an electric arc furnace is the most popular technology pathway in this decade, largely due to the relatively attractive economics compared to blast-furnace projects as well as the incentives available for hydrogen in markets such as the EU.

- Petrochemicals: Most plastics sold as ‘sustainable’ today are recycled. However, in a major milestone for the sector, BASF, Sabic and Linde commissioned the world’s first electric cracker demonstration project in Germany in April 2024. Nevertheless, companies show very little appetite to deploy large-scale electrification projects for petrochemical refineries in this decade, delaying emissions cuts in the sector.

- Aluminum: Producers of aluminum remain focused on recycling and the procurement of clean power to reduce emissions. Companies including Rio Tinto, Novelis and Egyptalum procured some 3.4 gigawatts of renewable electricity through power purchase contracts in 1Q 2024. Efforts to decarbonize alumina and recycled aluminum production using hydrogen or electrification are targeted for large-scale deployment only in the 2030s.

BNEF clients can access the full report here.