There remains considerable uncertainty about the magnitude and composition of global energy investment required to achieve meaningful decarbonization. The most frequently referenced scenarios, under which in most cases the average global temperature rises no more 1.5°C, offer very different outlooks on population growth, energy demand, and technology development.

Download the complete report here.

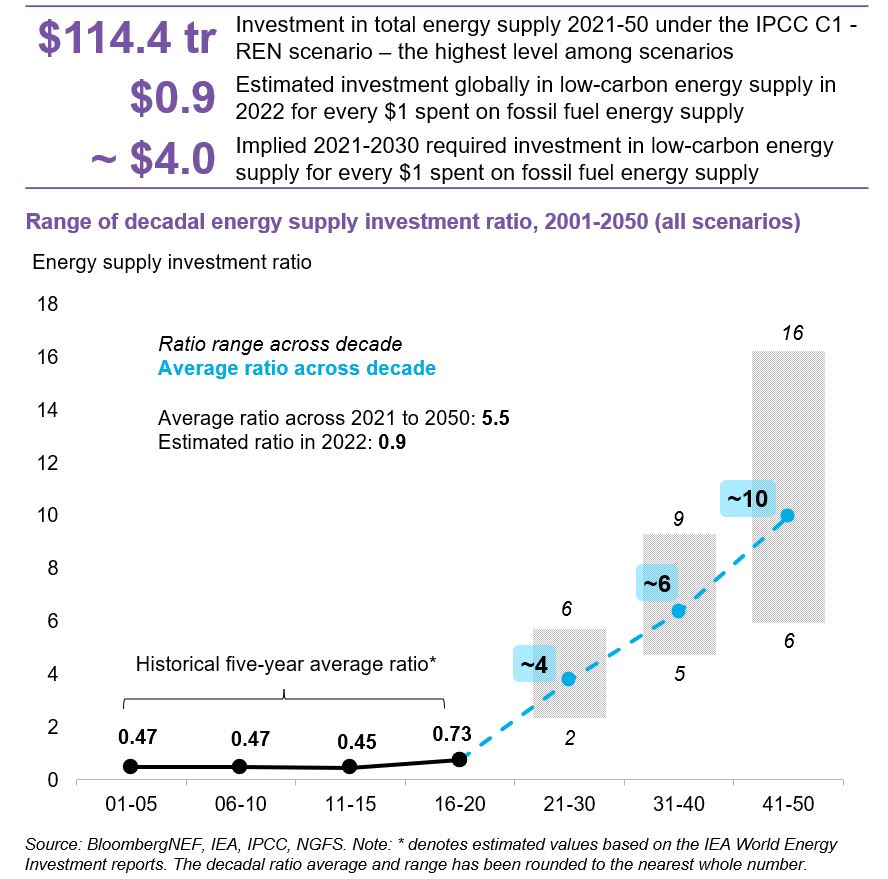

To better understand potential capital flows up to 2050, BloombergNEF (BNEF) has analyzed International Energy Agency (IEA), Intergovernmental Panel on Climate Change (IPCC), and Network for Greening the Financial System (NGFS) long-term scenarios. BNEF compared investment required under each for low-carbon technologies and compared that to potential investment for fossil fuels to produce decadal “energy supply investment ratios”. Scenarios assessed included the IEA Net Zero Emissions scenario (NZE), four* IPCC scenarios aligned with a 1.5°C rise and two NGFS Phase 3 net-zero scenarios.

Note: *IPCC P2 and P3 from the 2018 special report on global warming were excluded as there was insufficient data.

- Across the scenarios, total energy supply investment into all technologies ranges from $40.2-114.4 trillion by 2050. Fossil fuel supply spending greatly reduces by 2050, with coal nearing zero beyond 2030.

- The 2011-2015 low-carbon to fossil energy supply investment ratio was 0.5 low-carbon vs. 1 fossil. For 2016-2020, it was 0.7:1 and in 2022 0.9:1.

- Over the next decade, the implied change is considerable. From 2021 to 2030, it reaches roughly 4:1 on average, meaning for each dollar invested in fossil fuel energy supply, four would be invested in low-carbon energy supply.

- Beyond 2030, the ratio of low-carbon to fossil fuel energy supply investment rises to ~6:1 for 2031 to 2040 and ~10:1 for 2041 to 2050.

Investment today

- Total energy supply investment averaged $1.6 trillion per year 2020-2022, with $766 billion (a 48% share) allocated to low-carbon energy supply.

- Low-carbon energy supply spending has grown from $718 billion in 2020 to an estimated $815 billion in 2022, indicating the upward trend in the allocation of capital to low-carbon technologies since the Covid-19 pandemic.

- The global energy supply investment ratio has never crossed 1:1, peaking at 0.97 in 2020.

2021-2030 investment

- The total energy supply investment ranges from $15.2 (IPCC P1) to $49.4 trillion (IPCC C1-REN) across 2021-2030. This is equivalent to $1.5 to $4.9 trillion per year. All but the IEA Net Zero scenario front-loads total energy supply investment.

- Across 2021-2030, the ratio varies from 2.3 (IPCC P1) to 5.7 (IPCC C1-REN). The average ratio across the decade is approximately 4, indicating the need to ramp up from 2022 ratio value, which stands at 0.9. The scenarios imply a significant scale up in the level of low-carbon energy investment throughout this decade.

2021-2050 investment

- Total energy supply investment varies from $40.2 trillion (IPCC P1) to $114.4 trillion (IPCC C1-REN) across 2021-2050. The large range is explained by the differing scenario narratives and socio-economic drivers. This is equivalent to $1.3 trillion to $3.8 trillion per year.

- Investment in fossil fuel energy supply from 2021-2050 varies from $5.3 trillion (IPCC P1) to $18.2 trillion (NGFS Net Zero). This equates to $0.2 trillion to $0.6 trillion per year respectively. This is lower than investment into fossil fuel energy supply in 2022, estimated at $0.90 trillion. All scenarios depict a deceleration in fossil fuel spending as economies phase out their use and turn to lower-carbon alternatives.

- The ratio of investment in low-carbon energy supply to fossil fuels ranges from 4.1 to 8.1 across 2021 to 2050, hitting an average of 5.5. The IEA NZE scenario falls closest to this mean value, with a ratio of 5.8. The two NGFS scenarios have ratios at the lower end of the range, at 4.4 and 4.9.

- All of the scenarios illustrate a trend where the ratio of low-carbon to fossil fuel energy supply investment rises over the next three decades.

- Overall, the average energy supply investment ratios are approximately 4, 6, and 10 across the next three decades, respectively.

- Investment in low-carbon alternatives to meet energy demand gradually reduces consumption of fossil fuels, limiting risks of price spikes and volatility.