By Natalia Castilhos Rypl, Latin America Associate, BloombergNEF

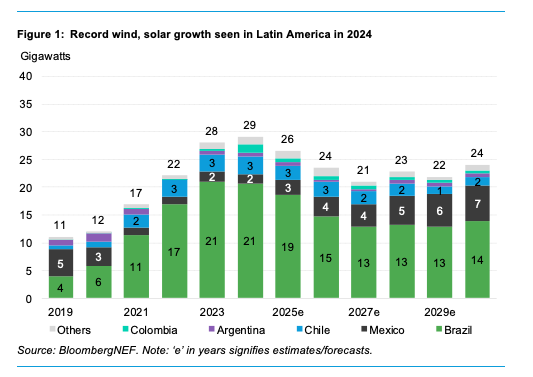

Wind and solar installations in Latin America have been on a dramatic growth trajectory. Small-scale solar build in Brazil has driven the market to quintuple over the past five years, and new energy bills in Argentina and Mexico promise to promote clean energy investments. Regional build should hit its peak this year. Annual additions are expected to slow down in the coming years as rising transmission tariffs impact small-scale solar, and curtailment as well as lack of power purchase agreements depress utility-scale build.

The massive growth rates that have marked the energy transition in Brazil, the largest market in the region, are expected to cool off soon. Both wind and solar projects face an oversupply of energy, transmission bottlenecks and severe curtailment. Brazil’s booming small-scale solar, responsible for most of the investment in clean energy in Latin America, also faces hurdles linked with rising transmission tariffs, difficulties in getting permits from energy distributors, competition with the wholesale market and import taxes on modules.

In Mexico, the new President Claudia Sheinbaum took power in October and has already promoted important changes in the energy market. A recently approved bill caps market share from private power generators at 46%. The new legislation is an attempt to foster private investment while maintaining state control over the sector. That should make the outlook for renewables marginally better than under the previous administration. A more business-friendly environment would help in meeting these targets.

In Argentina, the President Javier Milei approved a major economic reform in July that will impact the energy sector directly. Clean energy, power transmission, oil and gas, and mining assets can benefit from the Large Investment Incentive Regime (RIGI), which will offer benefits for new projects with investments above $200 million and is aimed at attracting long-term foreign investment. Milei also revoked Argentine market administrator Cammesa’s ability to sign power purchase agreements (PPAs) via public auctions. As a result, BloombergNEF expects new PPAs for renewables to be signed exclusively through the corporate market.

Chile has been adding to its renewable energy installations over the past few years. Wind and solar provide a third of its power – the largest share in the region – and the country will reach a record in wind and solar deployment, at the same time as it shuts down coal-fire generation plants. Longstanding problems will slow renewables growth through the end of decade, however. Transmission bottlenecks are the cause of severe curtailment for many projects. On the flip side, these bottlenecks have pushed developers to couple energy storage assets with their wind and solar projects in an effort to reduce financial losses. Chile is currently the largest storage market in Latin America, and its annual energy storage build will double this year.