By Natalia Castilhos Rypl, Latin America Associate and Giulia Lopes, Latin America Research Analyst, BloombergNEF

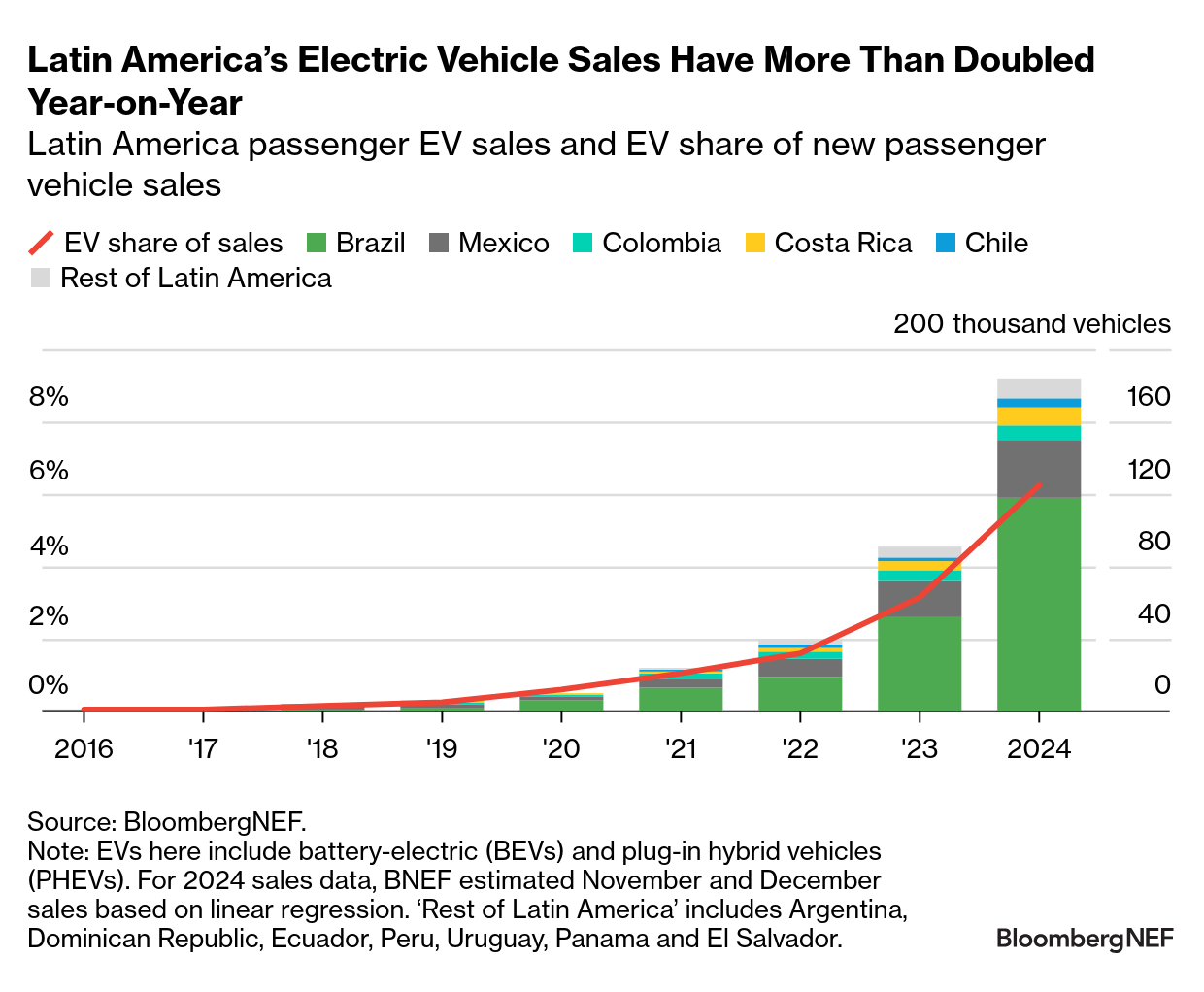

When all is done and dusted, Latin America will likely see 184,000 electric vehicles sold this year. That’s peanuts compared with 11.8 million EV sales in China, and miles behind Europe and the US. Yet the figure points to major changes that are underway in the region’s transportation landscape.

Passenger EV adoption in Latin America has long been sluggish, held back by high upfront prices for electric cars.

Yet with the arrival of affordable Chinese models from automakers such as BYD, EV adoption is accelerating. Sales have doubled year-on-year, and the EV share of new car sales passed 6% this year – up from just 2% two years ago.

Encouraged by policies designed to support domestic clean-car manufacturing, Chinese brands are also set to start assembling EVs on Latin American soil next year.

BYD plans to start assembling cars in Brazil in May 2025 and hopes to reach full production by the end of the year. Great Wall Motor also plans to start assembly in Brazil next year. That could soon push upfront prices for clean cars down until they’re more or less even with prices for internal combustion engines.

On a local level, some markets tell an even more optimistic story. In absolute terms, Brazil is the biggest automotive market in the region, followed by Mexico and Colombia. Yet Costa Rica boasts the highest EV share of sales in Latin America, at 16%, followed by Uruguay at 15.6%. BloombergNEF expects EVs’ share of new passage car sales in Latin America to reach between 10% and 20% by 2028.

BNEF clients can access additional outlook for Latin America’s EV transition, a deep dive into Brazil’s EV market and an analysis of the total cost of ownership between electric vehicles and internal combustion engines, in BNEF”s Latin America Electric Vehicle Outlook 2024-28.