BloombergNEF’s annual battery price survey finds a 14% drop from 2022 to 2023

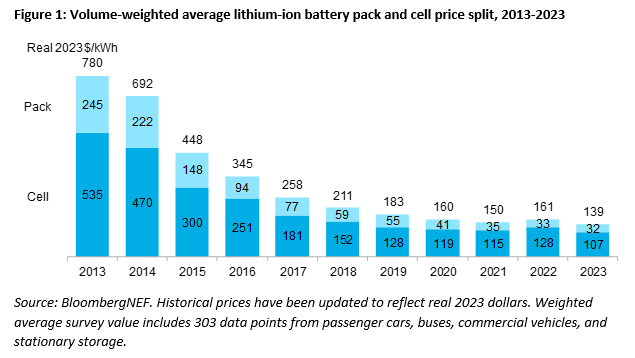

New York, November 27, 2023 – Following unprecedented price increases in 2022, battery prices are falling again this year. The price of lithium-ion battery packs has dropped 14% to a record low of $139/kWh, according to analysis by research provider BloombergNEF (BNEF). This was driven by raw material and component prices falling as production capacity increased across all parts of the battery value chain, while demand growth fell short of some industry expectations.

The analysis indicates that battery demand across electric vehicles and stationary energy storage is still on track to grow at a remarkable pace of 53% year-on-year, reaching 950 gigawatt-hours in 2023. Despite this growth, major battery manufacturers reported lower utilization rates for their plants, while demand and revenue fell short of many companies’ expectations. As a result, many EV and battery makers revisited their production targets, which in turn impacted battery prices. Lithium prices reached a high point at the end of 2022, but fears that prices would remain high have largely subsided since then and prices are now falling again.

Evelina Stoikou, energy storage senior associate at BNEF and lead author of the report, said: “It is another year where battery prices closely followed raw material prices. In the many years that we’ve been doing this survey, falling prices have been driven by scale learnings and technological innovation, but that dynamic has changed. The drop in prices this year was attributed to significant growth in production capacity across the value chain in combination with weaker-than-expected demand.”

The figures represent an average across multiple battery end-uses, including different types of electric vehicles, buses and stationary storage projects. For battery electric vehicle (BEV) packs, prices were $128/kWh on a volume-weighted average basis in 2023. At the cell level, average prices for BEVs were just $89/kWh. This indicates that on average, cells account for 78% of the total pack price. Over the last four years, the cell-to-pack cost ratio has risen from the traditional 70:30 split. This is partially due to changes to pack design, such as the introduction of cell-to-pack approaches, which have helped reduce costs.

On a regional basis, average battery pack prices were lowest in China, at $126/kWh. Packs in the US and Europe were 11% and 20% higher, respectively. Higher prices reflect the relative immaturity of these markets, higher production costs, lower volumes, and the diverse range of applications. There was also intense price competition domestically in China this year as battery manufacturers ramped up production capacity aiming to grab a share of the growing battery demand.

The industry continues to switch to the low-cost cathode chemistry known as lithium iron phosphate (LFP). These packs and cells had the lowest global weighted-average prices, at $130/kWh and $95/kWh, respectively. This is the first year that BNEF’s analysis found LFP average cell prices falling below $100/kWh. On average, LFP cells were 32% cheaper than lithium nickel manganese cobalt oxide (NMC) cells in 2023.

Miners and metals traders surveyed expect prices for key battery metals like lithium, nickel and cobalt to ease further in 2024. Given this, BNEF expects average battery pack prices to drop again next year, reaching $133/kWh (in real 2023 dollars). Technological innovation and manufacturing improvement should drive further declines in battery pack prices in the coming years, to $113/kWh in 2025 and $80/kWh in 2030.

Yayoi Sekine, head of energy storage at BNEF, said: “Battery prices have been on a rollercoaster over the past two years. Large markets like the US and Europe are building up their local cell manufacturing and we’re keenly watching how production incentives and tightening regulations on critical minerals will impact battery prices. These localization efforts will add a layer of complexity to how battery prices shape up regionally in coming years.”

Localization of battery manufacturing in regions such as the US and Europe could exert upward pressure on battery pack prices as the local industries scale up. Battery manufacturing in the US and Europe have higher costs due to higher energy, equipment, land and labor costs compared to Asia, where most batteries are currently produced. Local policies such as the $45/kWh production tax credit for cells and packs under the Inflation Reduction Act in the US could offset part of the cost, although the IRA’s impact on pricing is not yet clear.

Continued investment in R&D, manufacturing process improvements, and capacity expansion across the supply chain will help improve battery technology and reduce costs over the next decade. BloombergNEF expects next-generation technologies, such as silicon and lithium metal anodes, solid-state electrolytes, new cathode material, and new cell manufacturing processes to play an important role in enabling further price reductions.

Contact

Oktavia Catsaros

BloombergNEF

+1 212 617 9209

ocatsaros@bloomberg.net

About Bloomberg

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration. For more information, visit Bloomberg.com/company or request a demo.