Recent policy support is raising optimism and investment prospects among Europe’s hydrogen (H2) developers, but generous US tax credits could hurt in the short run. So said many of the 23 representatives from Europe and Asia’s clean H2 industries at an October 4 BloombergNEF roundtable. Some 71% of attendees said they are more optimistic about clean H2 versus six months ago.

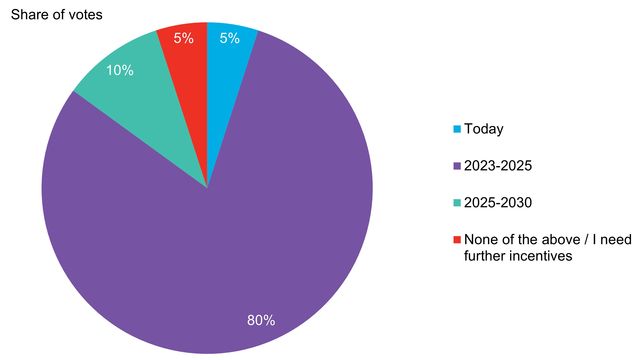

Attendees’ answers to the question “When would you take a FID on a 100MW+ electrolyzer?”

- Final investment decisions (FIDs) on large electrolyzers are 1-3 years away in Europe, said 80% of roundtable attendees as recent European Union (EU) subsidies have helped developers’ business cases. However, participants noted the need to find willing long-term buyers for clean H2, cumbersome renewable energy licensing rules and waiting to capture all available funding as the three main factors delaying their FIDs.

- Willingness to pay for a green product is essential to take a FID, according to attendees. E-fuels are emerging as one area where buyers are willing to pay a green premium, owing to EU mandates and voluntary targets. Car makers and wind turbine manufacturers are also buying products made with clean H2. But getting buyers to sign long-term contracts remains difficult as willingness to pay a green premium falls in the mid to long term, attendees said.

- Premiums for green products can be substantial. Aviation biofuel and biodiesel buyers pay 3.5-4.5 times the price of fossil fuels, according to one participant. Steel buyers are also willing to pay high premiums, although these can range from “virtually non-existent” to similar to those for biofuels, and can vary for different steel types. Truly green products are moving to value-based pricing models rather than pure commodity market pricing, noted a participant.

- Making the offtaker co-invest in the hydrogen-producing project helps producers secure long-term offtake contracts, noted a participant. Investing into a supply-side project can also make financing easier, reduce the premium offtakers pay and gives offtakers a better understanding of the premiums they should expect in the market, participants said.

- The US Inflation Reduction Act (IRA) will help Europe’s H2 sector in the long run, but it may hurt it in the short term, agreed participants. The short-term pain could involve project developers and equipment suppliers moving to the US, causing a supply crunch and slowing clean H2 developments in Europe. The long-term benefits include overall growth to the H2 industry, which will help build up supply chains, said attendees.

- The IRA is driving the removal of strict rules for green H2 in the EU, several attendees agreed. “It’s a wake-up call for Europe”, said one participant. Recent EU policy developments such as the setting up of the EU Hydrogen Bank and EU Parliament’s voting down of the temporal matching requirement for green H2 production are in part responses to the IRA, several participants agreed. However, European policy is more complex to navigate and lacks the simplicity of the US’s approach. European electrolyzer manufacturers could benefit from the IRA by expanding their business into the US – a trend BNEF noticed in our 2H 2022 Hydrogen Market Outlook.

- Infrastructure will be essential to connect supply and demand, attendees agreed, as investments in transport infrastructure will drive investments in hydrogen supply and demand by separating production from use. Most participants said H2 pipelines and ammonia ships are the most realistic way for Europe to meet its import goals.

- But avoiding H2 transport altogether could be the most economical option, said several attendees. Instead of moving H2 to existing industrial centers, it could be economical to move the industrial centers themselves. “Is it the best idea to bring green H2 into Europe, or is it better to relocate the value chain of steel?”, asked one attendee. Some participants said that shipping solid products, such as iron or steel, could be cheaper than shipping hydrogen.

- The industry is becoming more optimistic about the prospects for clean hydrogen. When asked “how optimistic are you about the prospects for clean hydrogen now compared to six months ago?”, 71% of attendees voted “more optimistic” or “much more optimistic”. The remaining 29% of attendees answered they feel the same as six months ago, and no attendees said they felt less or much less optimistic. This is a similar vote split to what BNEF observed in previous hydrogen roundtables in March 2022 and October 2021, indicating that optimism continues rising in the industry.