By Helen Dewhurst, Corporate Sustainability Associate, BloombergNEF

The two new frameworks published by the International Sustainability Standards Board mark an important milestone in the quest for global consistency across corporate sustainability disclosures. Known as ‘IFRS S1’ and ‘IFRS S2’, they reflect a long-awaited response to demand from companies and investors to have a common language to report and value climate and social sustainability strategies.

The announcement on June 26 also validates an international shift in thinking away from sustainability merely being a moral imperative. It is now recognized as an entrenched business risk, considered equal in importance to financial reporting. The impact of these new frameworks on existing sustainability reporting standards will vary – some will continue to be used as a reference point, while others could see their utility progressively vanish as ISSB adoption ramps up.

Why were the ISSB standards needed?

The Trustees of the International Financial Reporting Standards (IFRS) Foundation formed the International Sustainability Standards Board, better known as ISSB, in November 2021 at the COP26 climate summit. The move was a response to strong market demand for a unifying sustainability reporting standard. The IFRS initiative is backed by the G-7, G-20, International Organization of Securities Commissions, Financial Stability Board, African finance ministers, and finance ministers and central bank governors from more than 40 jurisdictions. The ISSB is made up of 14 members, intended to represent the best available combination of technical expertise on reporting and geographical diversity. The board’s task was to address the conflicting reality of:

• Sustainability factors now being a mainstream part of investment decision-making. There is growing demand for companies to provide high-quality, globally comparable information on sustainability-related risks and opportunities.

• And the fragmented landscape of voluntary, sustainability-related guidance. This ‘alphabet soup’ of reporting frameworks, outlined in the gray box below, adds cost, complexity and risk to both companies and investors.

The global economy needs common reporting standards to reduce fragmentation and drive comparability in climate-related financial data. However, existing sustainability standards have overlapping core properties, leading to redundancy. They vary in complexity, popularity and investor appeal, with some standards focused on backward-looking data (such as environmental disclosure system CDP) and others taking a forward-looking approach (like the Task Force on Climate-related Financial Disclosures).

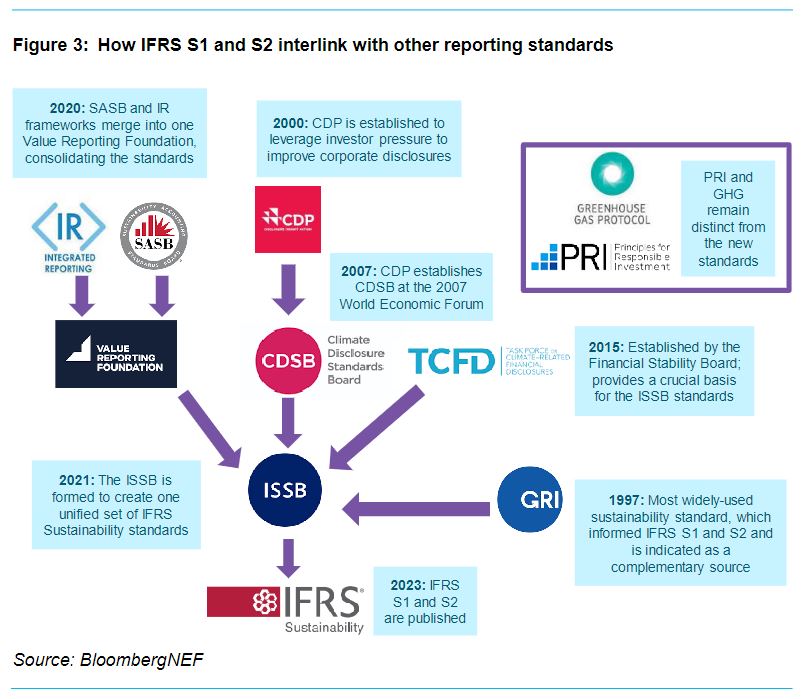

To a certain extent, the move towards a united sustainability reporting standard was already underway. In November 2020, the IFRS’ Integrated Reporting Framework and SASB Standards from the Sustainability Accounting Standards Board were brought together under one ‘Value Reporting Foundation’ umbrella.

There are various advantages and disadvantages of reporting according to each standard, so companies often end up using a combination of them all (Figure 1). This leads to double reporting, unnecessary additional costs, and reduced validity and comparability for users.

What’s included in the new ISSB standards?

The ISSB’s remit is to simplify the global sustainability disclosure landscape, while building on the expertise and best practice associated with existing market-leading frameworks and standards. The creation of the ISSB standards involved combining guidelines from the Value Reporting Foundation, which merged IR and SASB, with recommendations from TCFD and CDSB (Figure 3). The initial drafts underwent an extensive consultation process, with more than 1,400 comment letters and survey responses received, and 400 outreach events held with over 30,000 stakeholders involved.

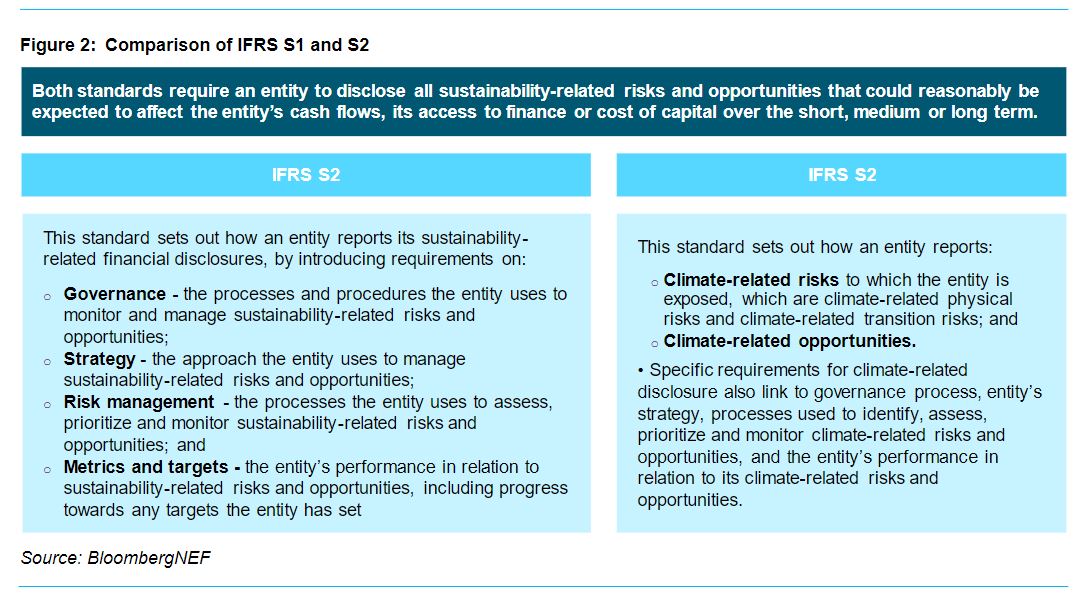

The result is made up of two documents: General Requirements for Disclosure of Sustainability-related Financial Information, known as IFRS S1, and Climate-related Disclosures, called IFRS S2 (Figure 2). Together, these provide a global baseline for companies to disclose decision- useful, climate-related financial information, which is what the financial community requires. IFRS S1 focuses on the disclosure of sustainability-related risks and opportunities that could financially impact a company. It defines financial materiality, in line with existing IFRS accounting standards, and provides guidance on reporting across an entity’s entire value chain, with the notable exception of investments and acquisitions. Of the two standards, this one is closer to the GRI guidance (which is listed as a complementary source), although TCFD remains the most important inspiration for both.

While IFRS S1 focuses on sustainability more broadly, IFRS S2 concentrates on disclosure of climate-related risks and opportunities (Figure 2). Entities are required to use climate-related scenario analysis to assess these risks and opportunities, including the disclosure of climate-related targets that have been validated by a third party. Emissions intensity disclosure is not required, but location-based Scope 2 emissions from grid electricity do need to be communicated and Scope 3 emissions across the value chain should be reported unless a company meets relief measure criteria, such as inconsistencies in reporting from suppliers.

Impact on other sustainability standards

The big question is whether these new standards will live up to their task of becoming the go-to voluntary reporting framework. The inaugural standards from the ISSB don’t explicitly absorb or swallow up any existing standards, but since its work was based heavily on three existing frameworks – the Value Reporting Foundation (in turn made up of SASB and IR), CDSB and TCFD – these are all likely to be viewed as complementary and may become redundant to an extent given their significant overlap (Figure 3). They will continue to be used as a reference in the interim if nothing else – the TCFD is even included as a source of guidance in IFRS S1, for example.

In practice, previous company filings that based reporting on these frameworks will be in good shape to transition to the requirements laid out in IFRS S1 and S2. As shown in Table 1, the IFRS guidance around governance is layered on top of existing TCFD guidance, so TCFD supporters will be well prepared to build on this with ISSB. Similarly, the IFRS S1 and S2 definition of materiality is aligned with the one used in IFRS Accounting Standards. The IFRS S1 and S2 guidance does distinguish that materiality judgements for sustainability-related financial disclosure differ from those for financial statements, particularly on time horizon, or financial implication of interactions throughout their value chain.

Four reporting frameworks that remain relatively distinct from the guidance in IFRS S1 and S2 include the PRI, GRI, GHG and CDP (Figure 1). This group of standards does not focus on ‘double materiality’, or sustainability issues that have a material impact on a company’s financial performance. We expect each of these frameworks will retain a distinct purpose – remaining less ‘cannibalized’ – and will continue to be used by companies for the following reasons:

• PRI: As this is more of an investing philosophy (with only six principles), rather than practically applicable guidance, this will likely continue to have a role outside of ISSB. Existing signatories of these principles are responsible for over $100 trillion in assets worldwide and include some of the world’s largest and most influential investors. It is therefore a powerful network in its own right, which continues to have utility for its core following.

• GRI: As the oldest of the sustainability reporting standards (having first been introduced in 1997), these are the most widely used globally. We therefore expect a fair amount of inertia from smaller companies with fewer resources that may be resistant to change – at least in the

short term – as it involves switching to a new reporting structure. The GRI is also listed as a complementary source to the new ISSB guidance.

• GHG Protocol: This will continue to be useful as it very specifically covers one area of reporting: carbon accounting. The guidance and tools that the GHG Protocol provides will still be essential for companies to calculate the metrics required in IFRS S1 and S2.

• CDP: As data is collected in a standardized questionnaire, it has always appealed to investors for its quantitative nature. There is also an element of competition that CDP fosters through the company disclosure process. Being on the CDP ‘A list’ can be worthy of a press release, so companies are incentivized to provide a submission.

For target-setting groups like the Science Based Targets initiative, the ISSB’s announcement will likely complement its work, rather than swallow it up. You can’t manage what you can’t measure, so improved disclosure is the first step for companies setting new targets or improving existing ones.

To what extent and when will this impact reporting in reality?

The most important implication of the ISSB standards is that they build on the principle of double materiality, familiarized by VRF, the Climate Disclosure Standards Board (CDSB) and TCFD. This approach to reporting forces organizations to frame their thinking around sustainability, in terms of risks and opportunities that must be managed as carefully as their financial health. Companies that report in this way are more likely to put climate and social risk at the core of their business strategy. This even comes down to the cyclicality of this reporting, which should align perfectly with a company’s other financial reports.

IFRS S1 and S2 are effective for annual reporting periods beginning on or after January 1, 2024, meaning investors will theoretically begin to see information in 2025 based on companies applying the standards for their 2024 reporting cycle. A firm must apply the standards together, although there is no additional requirement to prepare its financial statements according to IFRS accounting standards (unless this is already the case).

Although all public and private companies can apply IFRS S1 and S2 (as with all other sustainability disclosures), the ISSB does not have the right to mandate their application – this decision sits with jurisdictional authorities. So, the ISSB now has its work cut out to support effective implementation and has created a Transition Implementation Group to do this. It is consulting on future priorities, with comments open until September 1, 2023.