By Maia Godemer, Green and Sustainable Finance, BloombergNEF

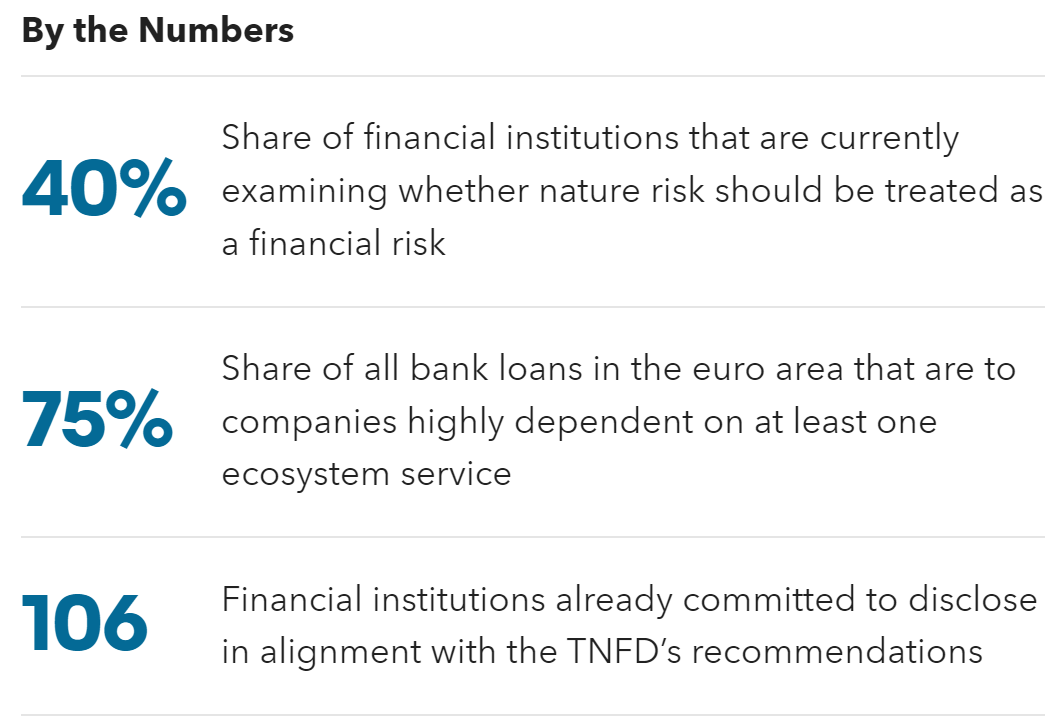

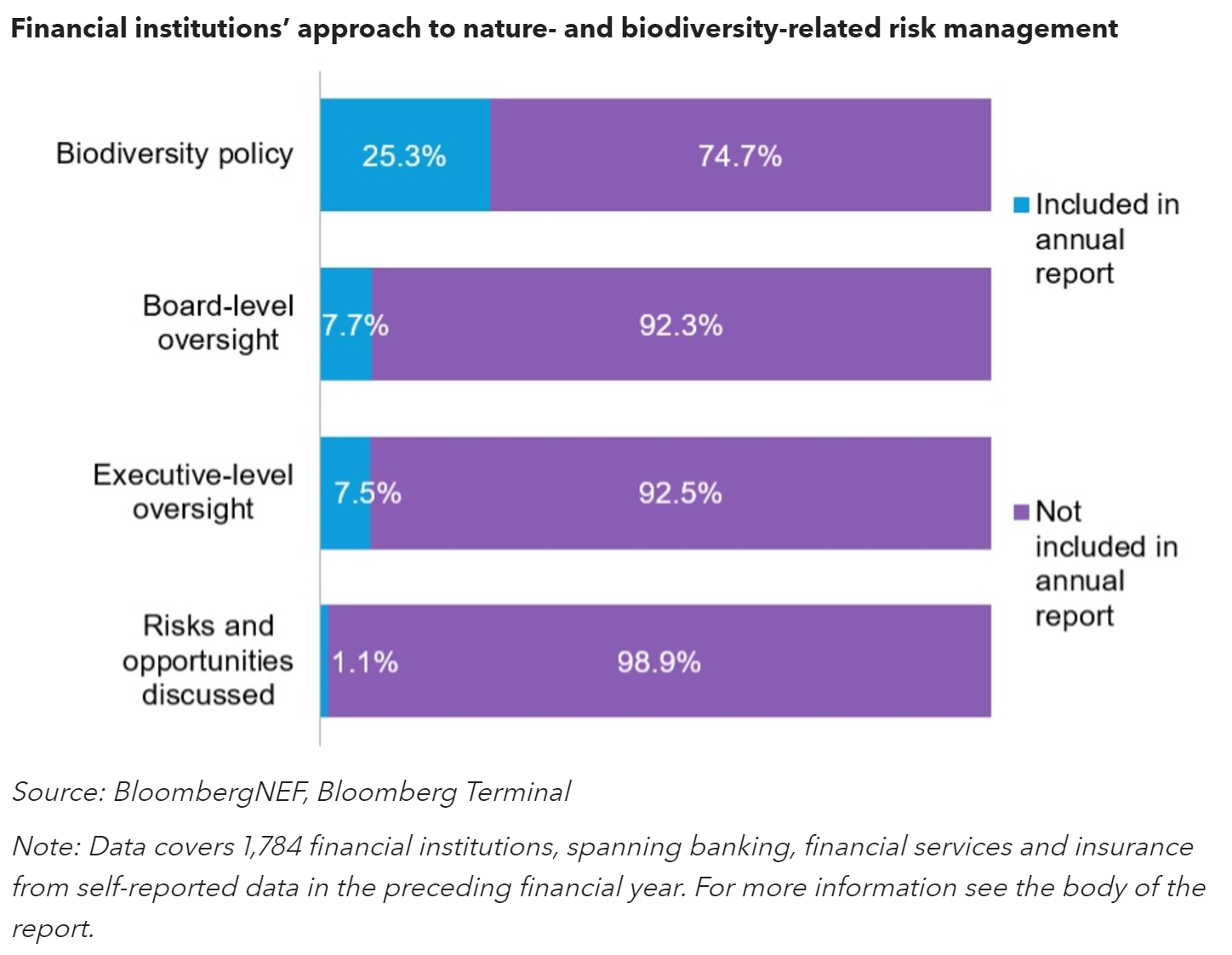

Financial institutions are inadequately prepared to assess and manage nature-related risk, with just 1% discussing the potential threats and opportunities in company filings. This is despite growing awareness of how ecosystems underpin economic value generation and the environmental harm caused by many business operations, with some G-20 countries rolling out voluntary guidance on nature or imposing mandatory regulation. As policymakers incorporate broader environmental considerations into legislation, banks and investors will be compelled to better understand how to manage nature-related risks in their portfolios and processes.

- With global biodiversity declining faster than at any point in human history, both physical and transition nature-related risks have become more material to financial institutions’ investing strategies.

- An April 2024 survey by the Global Association of Risk Professionals (GARP) found that the majority of financial institutions lack sophistication in their approach to managing nature-related risk, far behind the equivalent strategic engagement with climate. The same report notes that only 17% of banks and asset managers are using metrics, targets or limits to assess drivers of nature-related risks, while 75% of the same entities are yet to identify nature-related risks or opportunities.

BNEF clients can access the full report here.