REPORT

Net Zero Hinges on Emerging Markets Outside China More Than Doubling Annual Energy Investment

By Victoria Cuming, Head of Global Policy, BloombergNEF

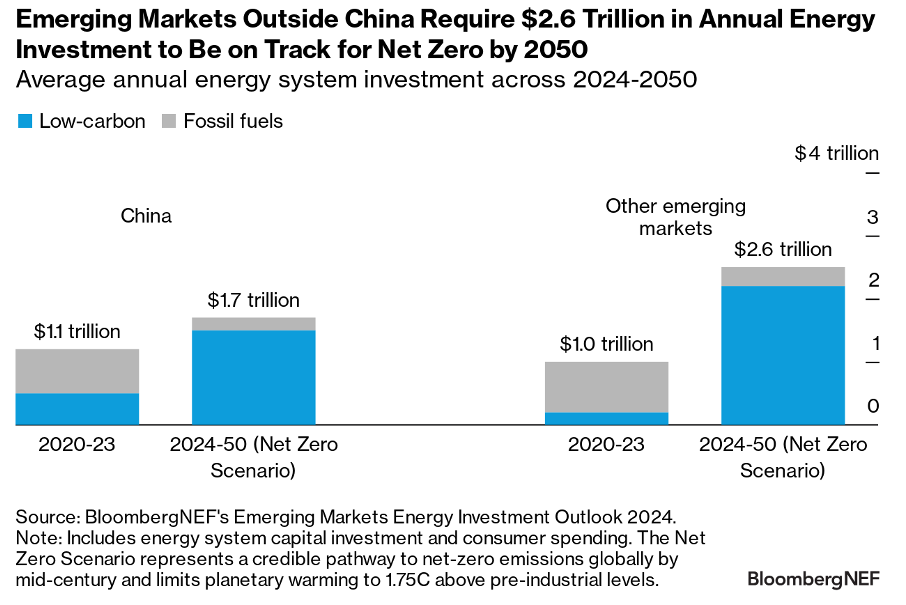

Emerging markets outside China need to more than double their annual energy transition investment to be on track for net-zero emissions by 2050.

BloombergNEF estimates these low- and middle-income economies require $69 trillion across the coming decades, spread across everything from solar and wind power to electric vehicles. That works out to $2.6 trillion per year, on average, between now and mid-century.

It’s a significant step up from the $1 trillion per year average seen since 2020, but only 10% higher than what could be spent if economics alone drive the evolution of the energy system and there is no new policy support.

Bringing China into the picture, BNEF sees the country needing $1.7 trillion of annual energy investment to 2050 in a net-zero pathway, around a 50% jump versus the past four years. This Net Zero Scenario represents a credible pathway to net-zero emissions globally by mid-century and limits planetary warming to 1.75C above pre-industrial levels.

Under a net-zero pathway, low-carbon technologies flip the balance and draw a much larger share of investment than fossil fuels across all emerging markets. Green solutions account for 89% of China’s total across 2024-2050, up from 23% in the last four years. The other emerging economies reach a similar share over the coming decades, but surge from just 5% historically as these markets have been slower at ramping up their energy transition investment.

Under a net-zero pathway, low-carbon technologies flip the balance and draw a much larger share of investment than fossil fuels across all emerging markets. Green solutions account for 89% of China’s total across 2024-2050, up from 23% in the last four years. The other emerging economies reach a similar share over the coming decades, but surge from just 5% historically as these markets have been slower at ramping up their energy transition investment.

EVs dominate demand-side spending

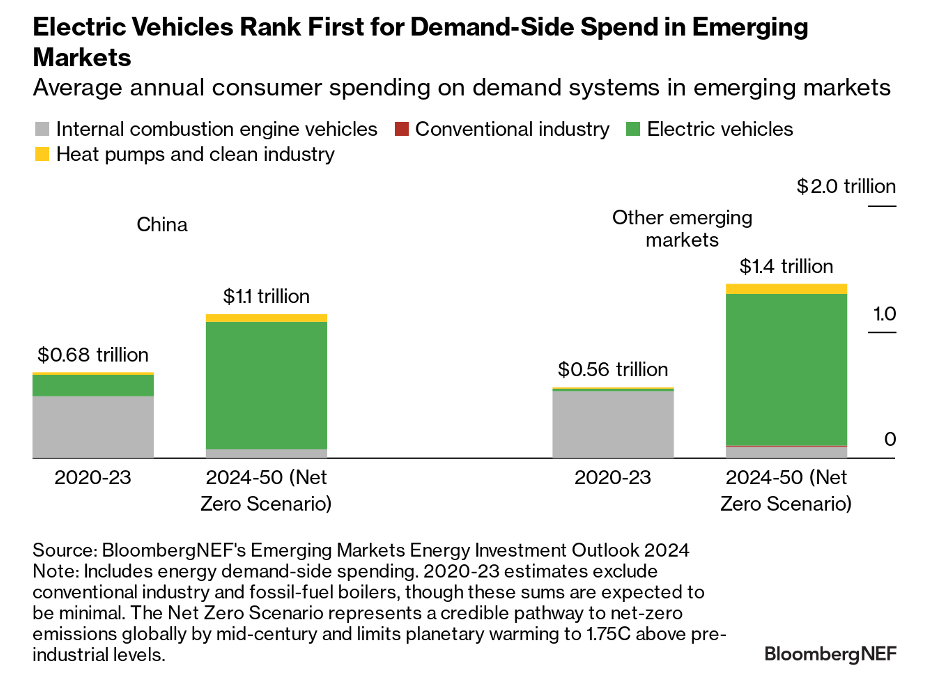

Reaching net zero hinges on a transformation of the road transport fleet, with all geographies needing to rapidly phase out sales of gasoline and diesel cars, and accelerate the switch to electric vehicles.

The Net Zero Scenario sees low- and middle-income economies outside China spending $1.4 trillion per year on energy demand systems like cars and heat pumps to 2050. This is a substantial uplift from historical levels of $0.6 trillion per year, partly due to economic and population growth, as well as rising road vehicle adoption.

However, the future demand-side investment is 10% less than the annual average envisaged in BNEF’s economics-driven base case. This is because a net-zero pathway requires a faster transition to EVs, which are increasingly cheaper than vehicles with an internal combustion engine. This reduces overall average spending on road transport.

By contrast, demand-side spending is higher for China in the Net Zero Scenario than the base case, mirroring a number of high-income economies. This reflects the fact that some conventional vehicles will need to be scrapped before the end of their operational lifetimes, to expedite the decarbonization of existing fleets.

Renewables and grids in focus on the supply side

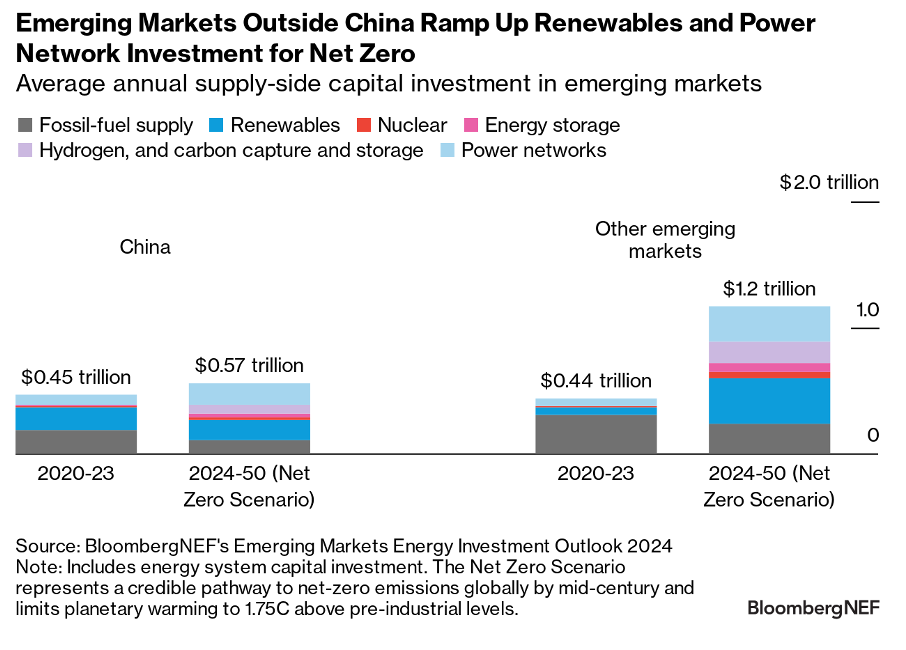

Emerging markets outside China will need to meet rising power demand on the back of economic and population growth, and expanding energy access. These economies invest $1.2 trillion per year, on average, in the supply side of the energy system in the Net Zero Scenario.

There is a notable scale-up in the amount of capital deployed in renewables and the electricity grid, with the $0.6 trillion annual average to 2050 being five times higher than historical levels.

China sees less change between the past and future on the supply side. It has already begun to ramp up its energy transition investment and its power demand is not poised to increase significantly in the coming decade. Nonetheless, the country still needs to direct more investment to low-carbon solutions to be on track for net zero. This comes to around $0.6 trillion, on average, between now and mid-century, with half of this going toward renewables and power networks.

Both China and the other emerging markets see almost zero supply-side investment in fossil-fuel processes and power without carbon capture and storage from this year under a net-zero pathway. A small sum goes to gas peaker plants, which provide flexibility to the electricity mix. Investment in fossil-fuel supply is still needed in other sectors, especially those that are technologically more difficult and costly to decarbonize.

Access the full report here.