By Jade Patterson, Renewable Fuels Associate, BloombergNEF

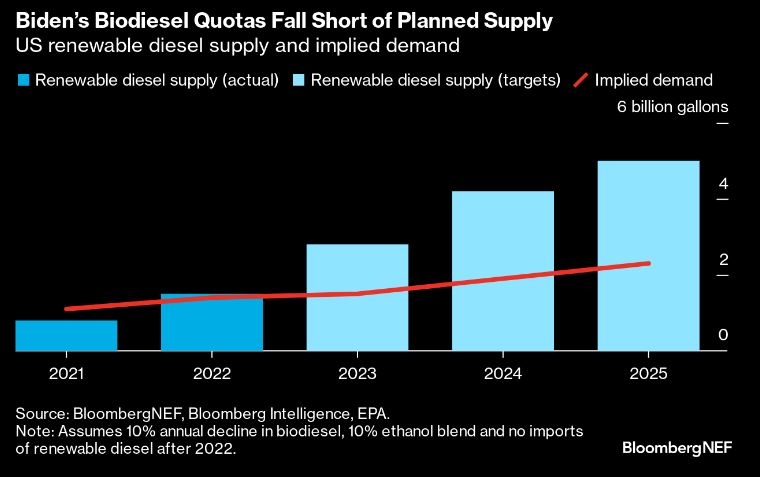

The Biden Administration has announced the amount of biofuel that must be blended into US road fuels for the next three years – and the quotas for renewable diesel fail to keep pace with growing supply.

Renewable diesel is one of the fastest-growing types of biofuels. Yet targets for the fuel were set drastically below the amount of capacity expected to come online by 2025. Oversupply will put downward pressure on biofuel incentives and force producers to find new markets, cancel projects or make new products.

The final rules set the total renewable volume obligation (RVO) at 22.33 billion gallons in 2025. Advanced biofuels, the category into which renewable diesel falls, is set to make up 7.33 billion gallons of that total. The mandates are part of the Renewable Fuels Standard (RFS) program, which provides billions of dollars of incentives to biofuel producers.

Based on existing advanced biofuel supply, BNEF expects 1.5 to 2.3 billion gallons of renewable diesel will be needed to meet the RVO from 2023 to 2025. Meanwhile, supply is set to reach 5 billion gallons by 2025, over twice the necessary amount.

Biofuel incentives, known as renewable identification numbers (RINs), are tradeable credits used to track compliance with the RFS and have become a balancing mechanism for renewable fuel margins. When taken into account with spot commodity prices and other government incentives, RINs make up 36% of profits for renewable diesel sold in California in 2023 so far.

BNEF Take

The new RVO set by the Biden Administration will reduce national support for biofuels blending. While new state policy incentives can provide some alternative sources of revenue, the declining federal incentive prices will squeeze margins for US renewable-fuels producers, such as Diamond Green Diesel, Phillips 66, and World Energy, a trend that will only be exacerbated as more capacity comes online.

Some of the costlier projects will struggle to make the economics work, likely resulting in an increasing number of project delays and cancellations. Producers with the ability to increase their yield of non-road-fuels products might be able to take advantage of new industries looking to decarbonize, which could accelerate the trend of projects shifting their attention – and output – toward things like sustainable aviation fuel.