By Evelina Stoikou, Energy Storage, BloombergNEF

Competition among automakers, battery manufacturers and stationary storage providers is driving the pursuit of batteries with lower cost, improved performance and without materials that are difficult or expensive to source. BloombergNEF expects a variety of companies to bring battery breakthroughs to the market throughout this decade.

A new set of cathode, anode and electrolyte technologies are set to deliver the next generation of batteries.

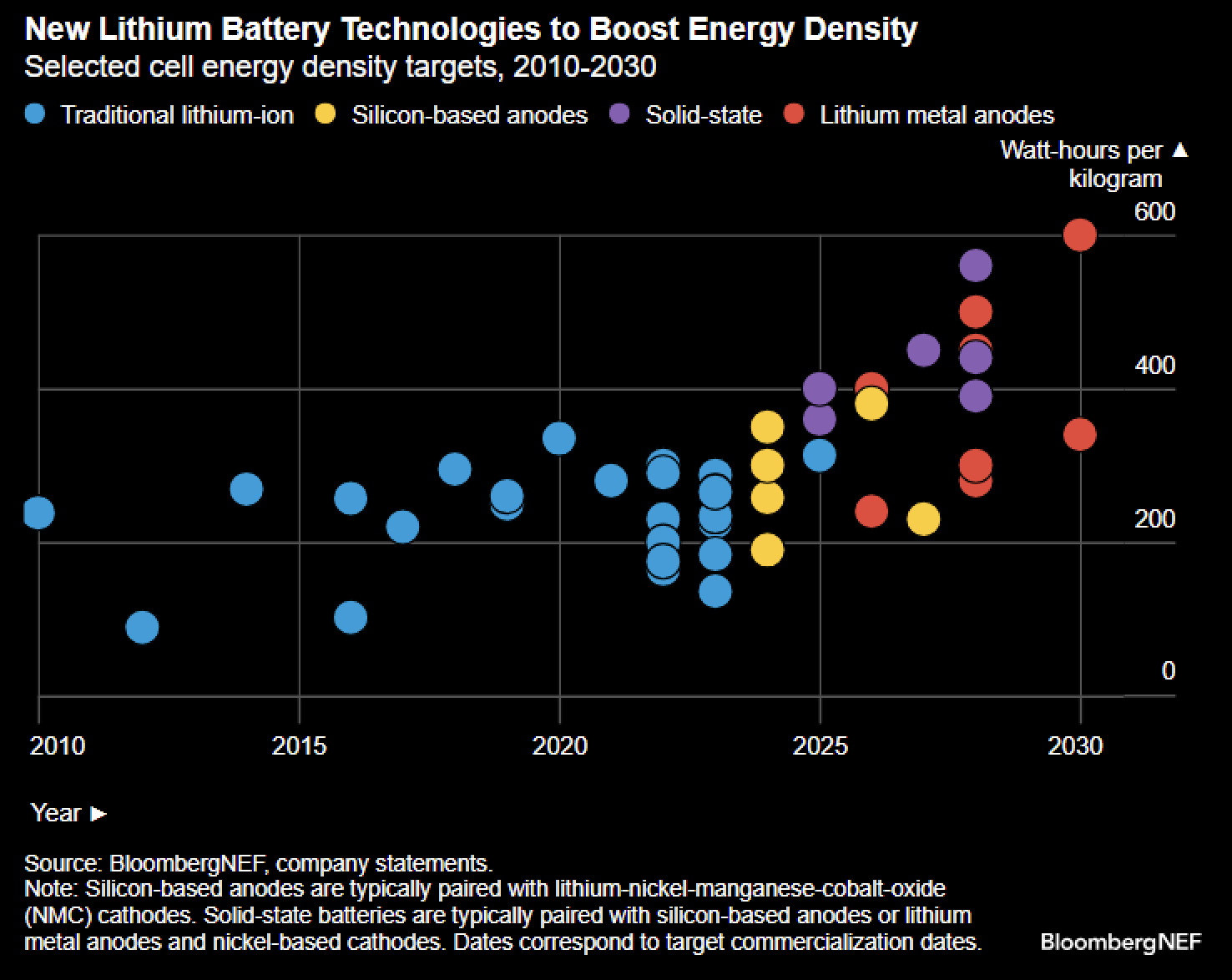

Lithium-ion batteries became the standard across most sectors due to their good performance, high energy density and long cycle life as well as their robust supply chain. Their energy density – indicating how much energy can be stored per unit of mass or volume – is one of the most important performance metrics given its potential to increase driving range in electric vehicles.

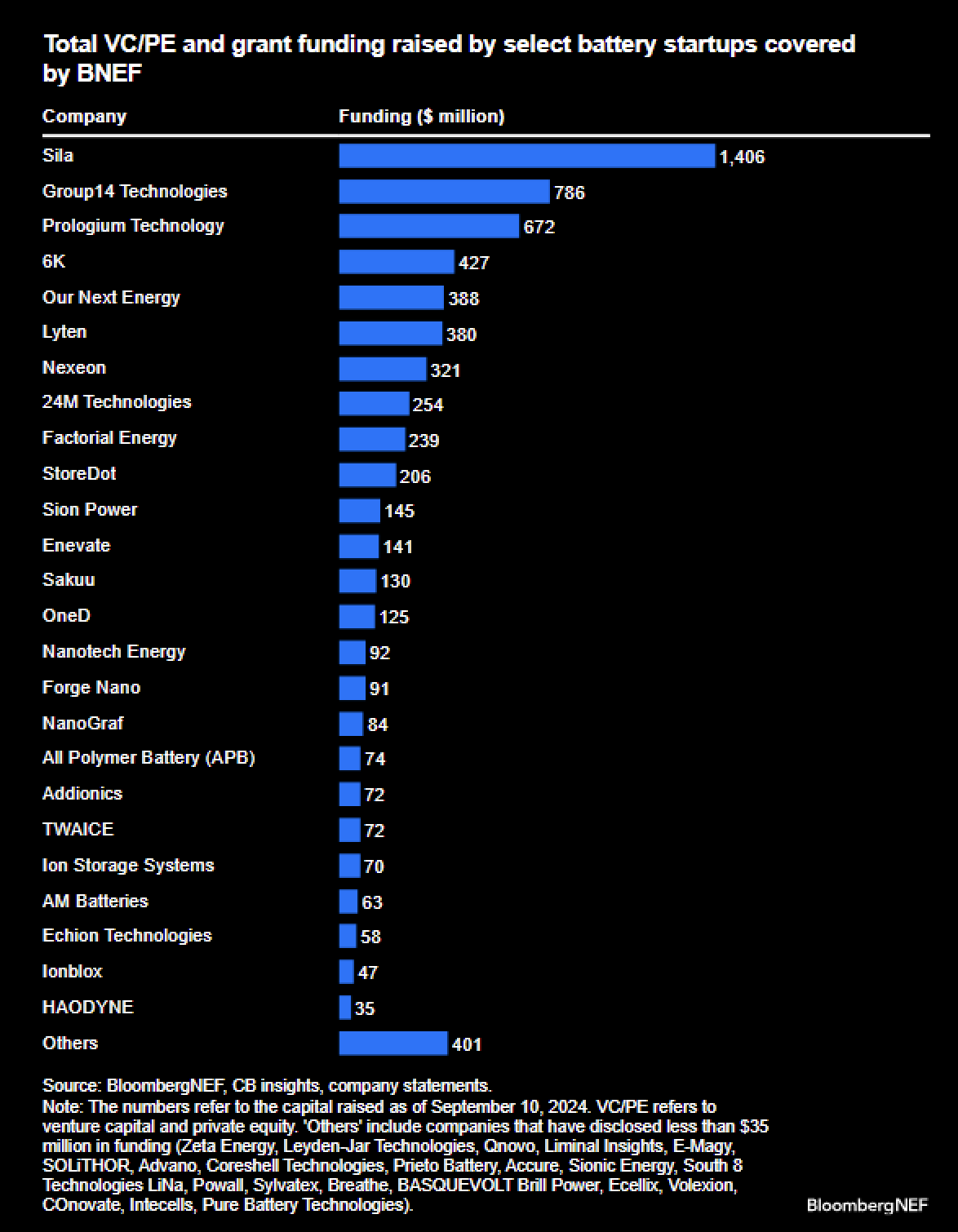

Advancements in cathode technology have historically contributed to the improvements in energy density. However, the current generation of cathodes are close to their theoretical energy density limit. Companies working on silicon-based anodes, lithium metal anodes and solid-state electrolytes are attracting the most funding, as these technologies come with significant potential to improve battery performance and energy density.

BNEF has covered 61 battery startups with activities across anode, cathode, electrolyte, software, manufacturing process, cell and pack design, coating and additives. The private companies profiled in our work have raised a combined $6.9 billion as of September 2024, in the form of private equity, venture capital and grant funding. And this is just a small subset of all the companies active in this space.

New battery technology breakthroughs typically involve new components or materials, new manufacturing processes and new raw material supply chains. All require significant investment, manufacturing expertise and time. Only a small number of new technologies make it past the pilot production stage, as proving the performance of the technology at a large production scale is significantly more complex than in a small-scale prototype.

The success of new technologies will be determined by how quickly they can be scaled and integrated into current manufacturing processes. While solid-state batteries are beginning to increase production this decade, mass production for low-cost vehicles is unlikely so soon. Meanwhile, innovations such as silicon-based anodes and dry electrode coating are making progress, with large automakers working toward their adoption. New technologies will likely be implemented for high performance applications first — like aviation and the military — followed by mass-market EVs, which are more sensitive to cost.