By Yiyi Zhou,

Clean Power Specialist, and Meredith Annex, Head of Clean Power Research,

BloombergNEF

Geothermal power is a firm, abundant energy source that has struggled for decades to break out of its niche status. It has recently regained interest globally, thanks to the advancement of next-generation geothermal technologies.

Over the past six months, BloombergNEF has seen an increasing number of utility-scale, commercial projects adopting next-generation geothermal technologies, and more countries are embracing geothermal technologies in pursuit of their net-zero targets.

What is next-generation geothermal technology?

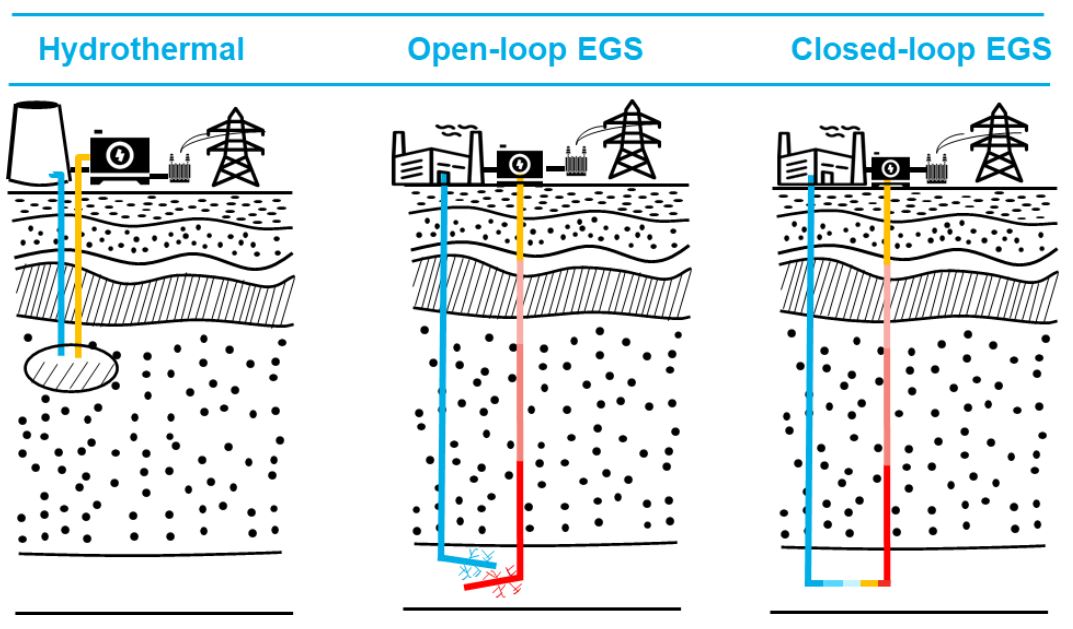

Geothermal power plants work by circulating water through hot rock beneath the earth’s surface. The development of geothermal power has historically been confined to hydrothermal sites – shallower resources with high temperatures, naturally occurring water and sufficient rock permeability. However, these resources are highly constrained and are most often located near volcanoes.

Next-generation geothermal technologies – like Enhanced Geothermal Systems (EGS) and Advanced Geothermal Systems (AGS) – aim to create conditions for geothermal energy in areas where natural exploitation was otherwise impossible. This has the potential to unlock geothermal energy for many countries.

Possible game changer

Next-generation geothermal technology has considerable advantages over other renewables.

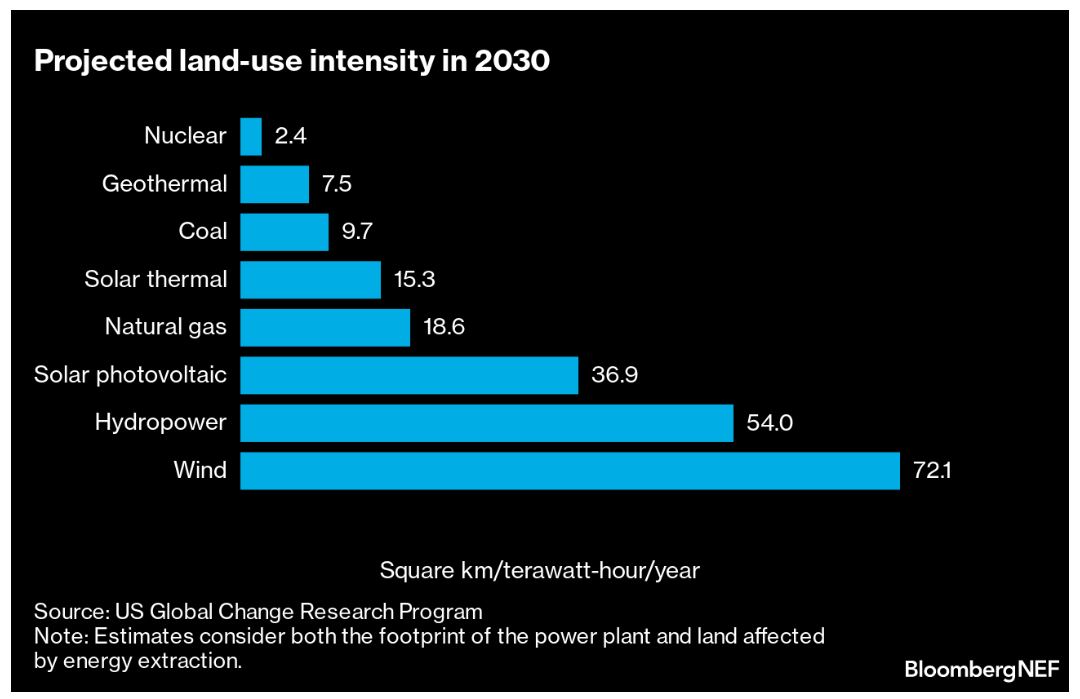

First, it offers significant resource potential with minimal land use requirements. The US Department of Energy found that next-generation geothermal energy could provide up to 120 gigawatts of firm capacity in the US by 2050. The Massachusetts Institute of Technology suggests that geothermal energy could meet the global total energy demand twice over. Geothermal energy has the lowest land-use intensity of all renewable energy technologies, according to a US government report.

Second, it can provide dispatchable, flexible electricity which is not dependent on the weather. The next-generation geothermal plants can ramp generation up and down over a few minutes and can run for as long as necessary to ensure the reliability of the grid, thanks to advanced well flow control and power system setups.

From hype to reality: testing various technologies

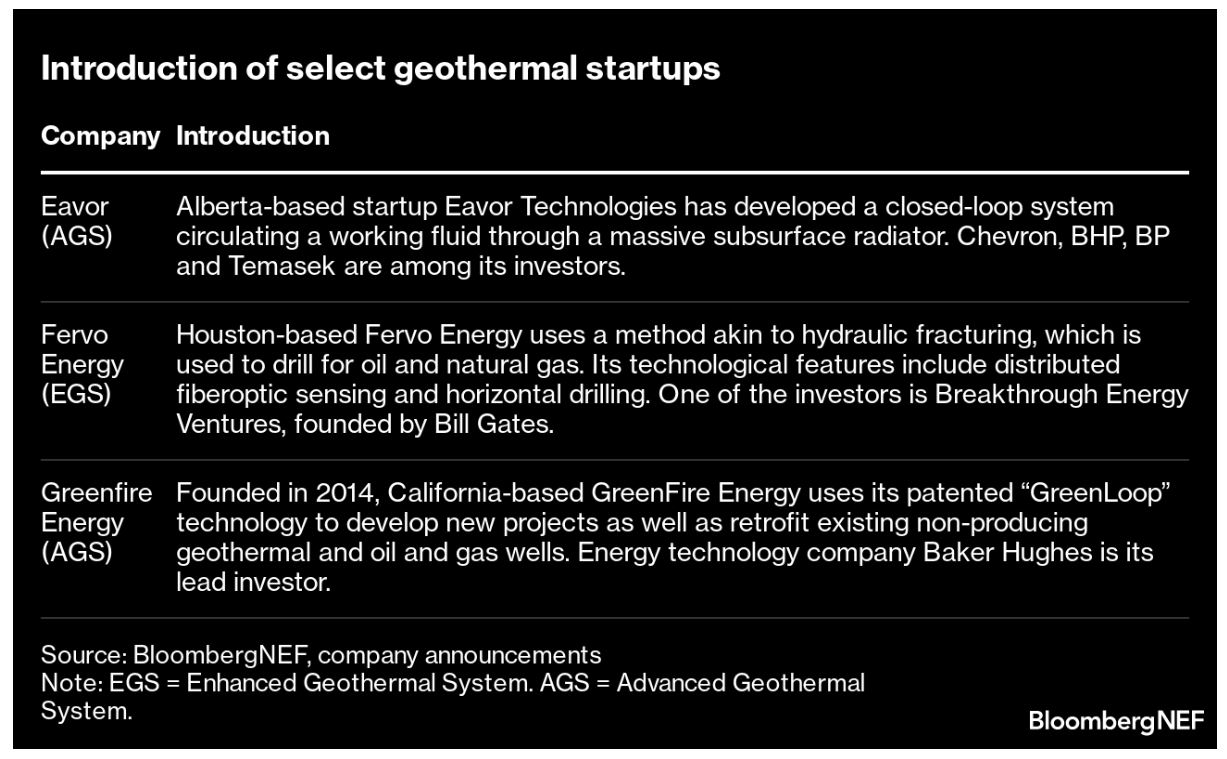

A variety of technologies are under development. Their approaches differ, but the goal is common – to unlock the vast potential of geothermal resources. There are a few high-profile players.

For the past few years, these startups have been busy carrying out pilot projects to test the feasibility and efficacy of their technologies. Since the start of the year, Eavor Technologies has commissioned its Eavor-Deep project in New Mexico, while Fervo Energy embarked on an experiment at its geothermal power plant in Nevada in January 2023. Eavor claimed that its New Mexico project, alongside an earlier demonstration in Alberta, had successfully met all the predetermined technical objectives and paved the way to commercialization. Meanwhile, Fervo’s results suggest its geothermal system may store energy for hours or even days and deliver it back over similar periods, effectively acting as a giant and very long-lasting battery.

BNEF expects to see more tests and pilot projects thanks to rapidly expanding funding and investments from governments and investors. For instance, the US DOE announced in February 2023 that it would contribute up to $74 million for as many as seven pilot projects.

On the brink of commercial use

The success of demonstration projects has triggered early-stage commercialization.

Eavor’s first commercial-scale project in Germany will produce energy by 2024 and reach full capacity in 2026. Besides this project, Eavor has obtained up to €1 billion in funding from Deep Energy Capital, an independent renewable energy investment firm, to build another five geothermal projects in North America and Europe.

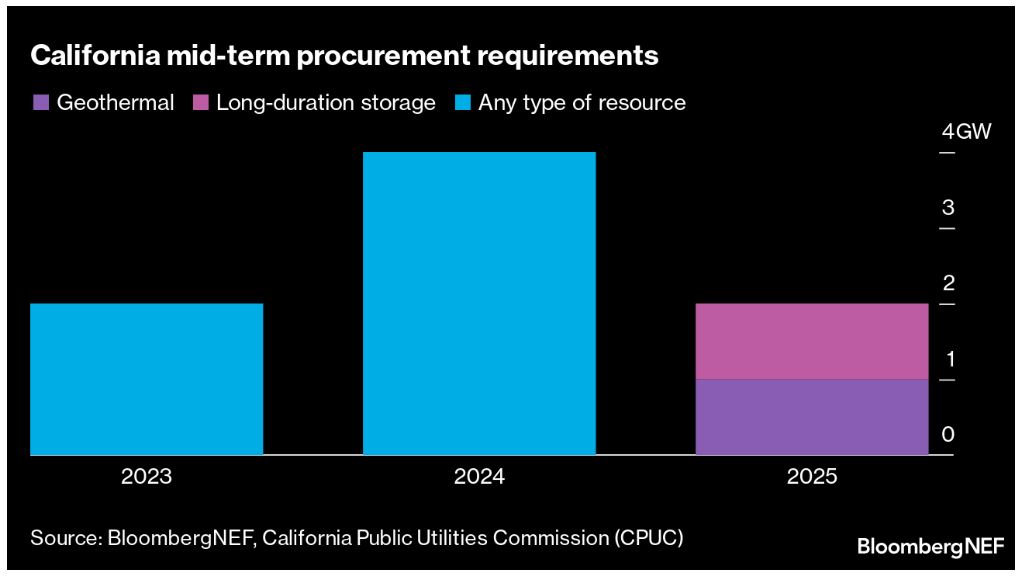

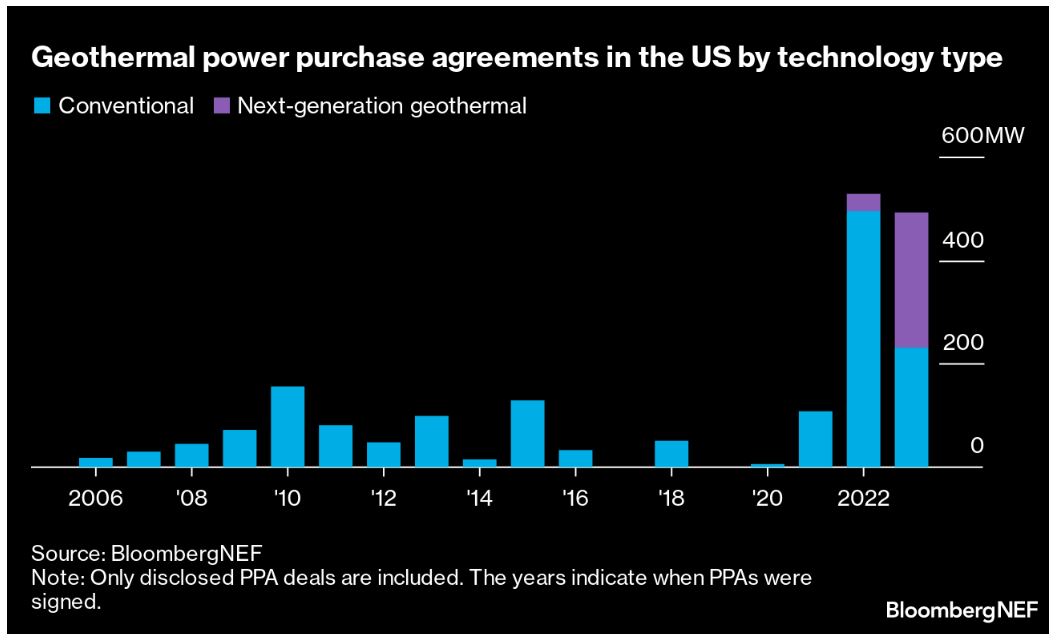

In the US, there has been a flurry of next-generation geothermal power purchase agreements or PPAs since mid-2022, with California signing most of them. In 2021, the state called for local load-serving entities to procure at least 1GW of geothermal resources and 1GW of long-duration storage (defined as providing eight hours of storage or more) between 2023 and 2026. The goal is to ensure sufficient resource adequacy.

The percentage of renewable PPAs that use geothermal is still quite low – less than 3% in 2022 in the US. However, the increase in geothermal PPAs and the transition to next-generation geothermal technologies marks a new phase in the commercialization of geothermal energy.

Corporate energy buyers are also looking into next-generation technologies as potential enablers for their 24/7 carbon-free energy commitments. Alphabet Inc.’s Google, for instance, is working with Fervo Energy to develop a 5MW EGS plant to power its data center in Nevada. This is the world’s first corporate agreement to develop geothermal. As part of the deal, Google will also partner with Fervo to develop artificial intelligence and machine learning that could boost the productivity and flexibility of next-generation geothermal technologies.

Widening international interest

Geothermal is also experiencing a renaissance in interest outside the US. Markets, especially those rich in hydrothermal geothermal resources, are turning to geothermal as a fossil fuel alternative to improve energy security, address geopolitical vulnerability and to cut carbon emissions.

Japan, for instance, sees geothermal as a clean baseload power source that can help the country reach its net-zero target by 2050. The government has set an ambitious target to install 1.5GW of geothermal power by 2030. However, the current project pipeline and exploration activities may not be able to support this goal.

Taiwan also identifies geothermal as a critical energy resource to achieve net-zero carbon emissions by 2050. The market, one of the few that offer geothermal feed-in tariffs, commissioned its first megawatt-level conventional geothermal plant in November 2021. In January 2023, Taiwan’s state-owned petroleum company, CPC Corp., signed a memorandum of understanding with GreenFire Energy to co-develop enhanced geothermal projects.

In Latin America, a region with strong geothermal potential and rapidly growing green energy demand, Eavor has partnered with Getech, a geothermal energy and green hydrogen company, to locate multiple closed-loop geothermal projects for development in January 2023.

Costs, scalability and enabling regulatory frameworks

The recent advancements in enhanced geothermal technologies and growing interest from governments and investors show promise for their wide adoption. However, some issues remain to be addressed.

One major issue is affordability. Geothermal power development is expensive and capital-intensive. The cost of developing next-generation technologies is even higher. A next-generation geothermal project in 2022 would require more than $8.7 million/MW in capital expenditure, compared with $1.8 million/MW for onshore wind and $1.1 million/MW for solar plants. Capital expenditures rise as temperature and depth increase.

The financing costs are also higher as investors require a greater expected return on riskier projects. A geothermal project has a roughly 15% weighted average cost of capital at the pre-drilling stage, compared with 5% for wind and solar projects.

The industry hopes to drive down the costs through economies of scale, cheaper and more robust drilling technologies, and better exploration techniques. The US DOE’s EarthShots Initiative seeks to cut the cost of next-generation geothermal power by 90% to $45/MWh by 2035 – an extremely ambitious goal in BloombergNEF’s opinion.

Scalability is another issue. The latest development has proved the technical feasibility of developing next-generation geothermal projects on a small scale. The effectiveness, ability and safety of doing this on larger scales is still up for debate. The commercial projects to be developed in the coming years could provide more insights.

Last but not least, enabling regulatory frameworks and social acceptance would be needed to shorten the project approval timeline, lower financing barriers and foster investments. Ongoing studies like probabilistic modeling of the seismic risk caused by geothermal power plants would also be beneficial.

To grow as a global solution, new investors and players must be brought into the next-generation geothermal market to shorten the learning curve and drive down the costs. The recent progress in terms of PPAs and new utility-scale projects is positive for the industry, but government support to reduce permitting and other regulatory impediments will be key.