By Oliver Metcalfe, Head of Wind Research, BloombergNEF

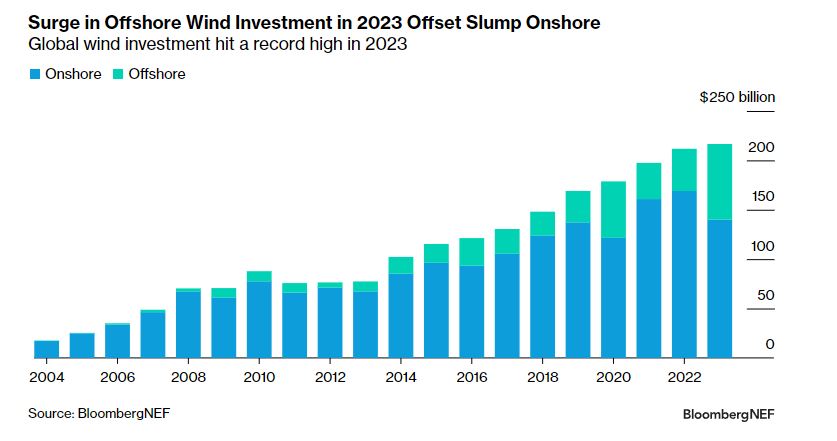

Offshore wind investment surged to a new high in 2023, according to BloombergNEF’s Renewable Energy Investment Tracker 1H 2024. The record comes despite rising costs and interest rates forcing some firms to delay or cancel projects last year.

Global offshore wind investment reached a record $76.7 billion, jumping 79%. This offset the 17% year-on-year decline from the onshore segment. China remained the largest offshore wind market, in spite of a down year, followed by the UK and the US.

The offshore wind industry had a tumultuous 2023. Some 6.9 gigawatts of projects in the US and the UK canceled their revenue contracts last year, as rising equipment and financing costs, permitting and grid connection hurdles, and supply chain delays slashed many developers’ expected project returns. Despite the turmoil, firms like Orsted, Iberdrola, Northland Power and Mitsui & Co were among those that reached final investment decisions on major projects in 2023.

BNEF predicts that governments will be willing to pay more for offshore wind and include more risk-sharing mechanisms in auction deals in 2024, while interest rates could also start to fall, decreasing the cost of borrowing. This could push more struggling projects to financial close in 2024.

A high-level summary of the Energy Transition Investment Trends 2024 report is available here.