By Luxi Hong, Head of Downstream Oil and Chemicals, BloombergNEF

Listed international oil companies (IOCs) are under the spotlight as the oil and gas industry faces mounting public and investor pressure to decarbonize. In response, IOCs have engaged in investing and divesting to position themselves for the energy transition.

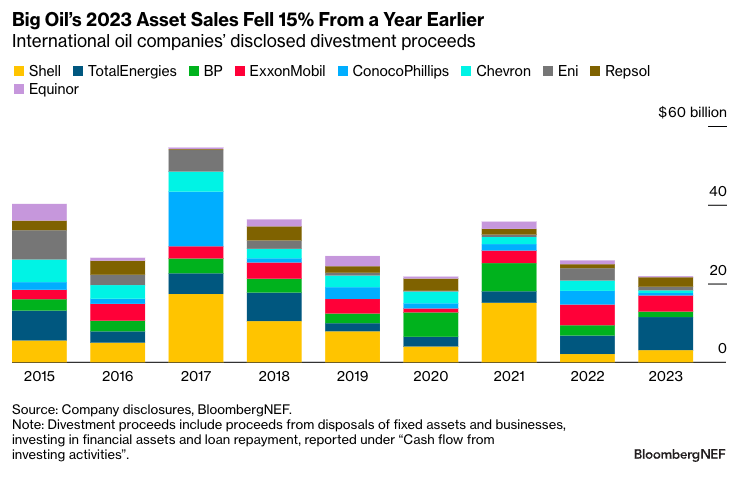

Nine of the world’s largest IOCs have sold a total of $290 billion worth of assets from 2015 to 2023, with upstream oil assets accounting for half of the divestment deals. In 2023, the IOCs’ divestment proceeds fell 15% from a year earlier, while their capital allocation for the upstream segment has grown steadily. This creates greater uncertainty in the oil majors’ energy transition, as IOCs seek to strike a balance between providing returns to investors and their efforts to decarbonize.

- Shell led asset sales from 2015 to 2023 with $71 billion of divestment proceeds. This is nearly double that of TotalEnergies, the second-most active.

- Total asset disposal value fell 15% in 2023 from a year earlier to $22 billion, likely due to the elevated oil and gas prices in 2022.

- IOCs are selling more in home markets, namely in Europe and North America. Assets in these regions often incur higher costs than elsewhere, or face more pressure by regulators, investors and customers to address climate-related risks.

- By trimming high-carbon oil assets and increasing investment in low-carbon businesses, IOCs can ‘green’ their portfolio and grow a more sustainable business. This trend is particularly prominent among European IOCs.

- However, the IOCs’ capital allocation to low-carbon segments slowed down in 2023, while the upstream segment’s share of capital expenditure grew for the first time since 2017. This signals a recalibration of oil majors’ transition strategies.

- A new trend has emerged since 2021 with the acceleration of renewables-related divestments. BloombergNEF identified three motives for such sales: the adoption of a farm-down approach to boost project returns, exiting business lines due to portfolio restructuring, and forming partnerships to strengthen renewable business models.

- About 70% of assets were acquired by oil industry players, often smaller or lesser-known producers compared to the IOCs. Although selling off high-carbon assets may help IOCs achieve their decarbonization goals, transferring these responsibilities to buyers with less climate ambition will not help curb oil and gas sector emissions.

BNEF clients can access the full report here.