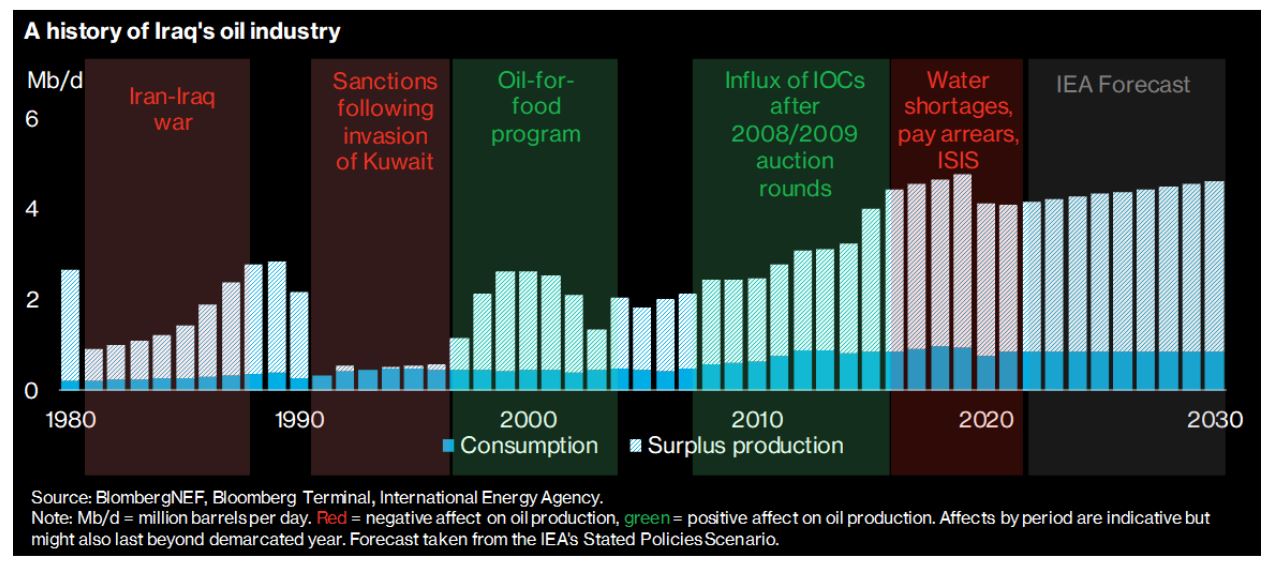

The first two decades of this century were turbulent for Iraq as it was plunged into the war that ended Saddam Hussein’s rule and years of extremist militant violence.

As conflict has ebbed, lives continue to be blighted by corruption and political instability. The period also convulsed the oil industry that’s the lifeline of the country’s economy — and the decades ahead are unlikely to provide much respite.

It looks likely that the country will remain stuck at a production range of 4-5 million barrels per day (b/d), disregarding persisting ambitions to add several million more to the mix.

Iraq first sought to rebuild with big auction rounds in 2008 and 2009, after which international oil companies (IOCs) were supposed to drive a revamp of the oil industry. But they have been leaving the country one after another since 2018 amid intensifying water shortages, continued political turmoil and payment arrears, leaving the sector in a precarious position.

As the next two decades likely form the last chance to add substantial volumes of oil supply to the global mix, Iraq might never see the oil heyday it had hoped for.

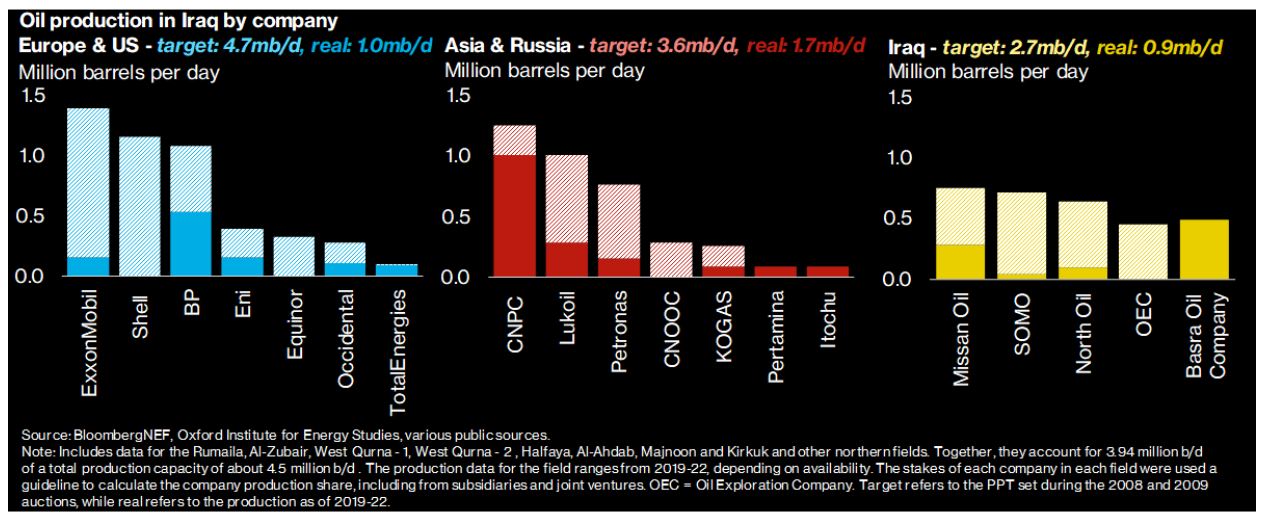

IOCs are on the retreat, giving way to Chinese and local companies

Iraq’s oil industry started to recover after the bidding rounds in 2008 and 2009. A total production plateau target (PPT) volume of 11.6 million b/d was set for all the fields that were auctioned successfully – albeit with an unspecified timeframe.

European and US majors such as ExxonMobil, BP and Shell were slated to be at the vanguard of this production push. Shell took a 45% stake in Majnoon, ExxonMobil a 60% stake in West Qurna – 1, and BP a 38% stake in Rumaila. Those three fields together had a gross production target of close to 7 million b/d.

As of 2022, Shell has divested its entire share in Majnoon – that had been stuck at a capacity of about 240,000 b/d – while ExxonMobil cut its stake in the West-Qurna 1 field to 22.7% in early 2023. Only BP remains a sizeable operator in the country via its Basra Energy Company Limited joint venture with CNPC, which owns a majority stake in the Rumaila oil field.

But BP’s contract for its Rumaila field operations expires in 2034. As the firm seeks to reduce its fossil fuel production by 25% by 2030 compared to 2019, and Iraq remains a high-risk environment, it is highly likely that BP will also abandon this stake early in the next decade – or even sooner.

With many of Iraq’s fields having been in operation for more than half a century and producing with a relatively low recovery factor of about 30%, upping their output requires extensive expertise. It is unclear whether the Asian and Iraqi companies that have been replacing the IOCs can bring this to the table.

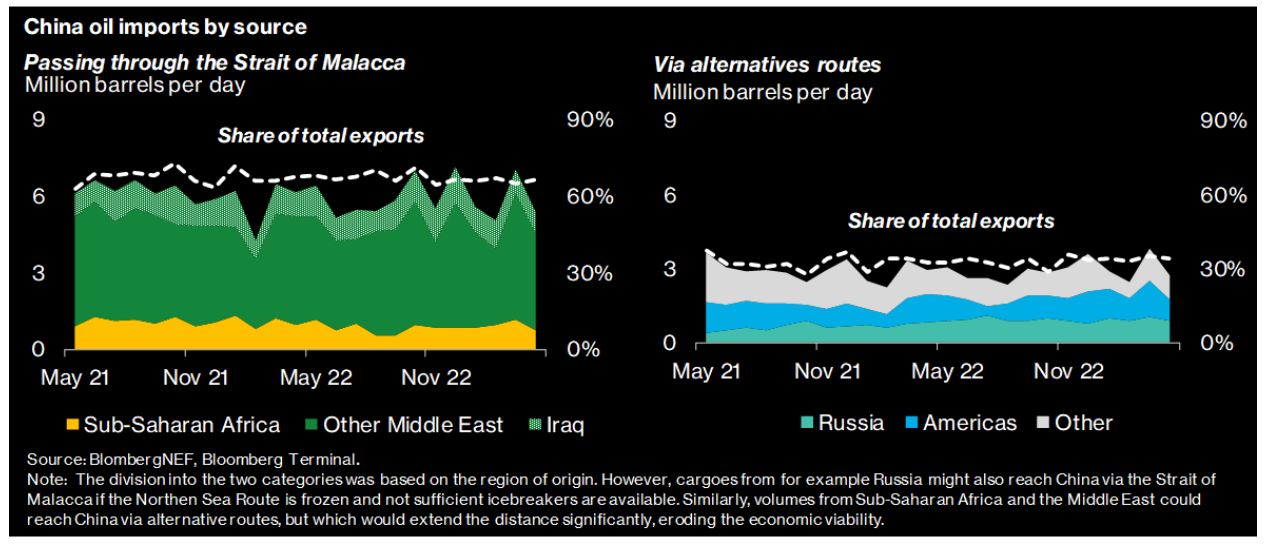

How much is China willing to pitch in?

China’s CNPC in particular has been taking up an ever-increasing chunk of Iraq’s projects, now accounting for more than 20% of the country’s output. But amid mounting geopolitical tensions, Beijing is likely to seize on any chance to diversify its supplies of oil away from the Strait of Malacca – via which the country still receives more than 70% of its oil imports.

With Russia having lost most of its access to European markets due to the EU’s boycott of its crude oil from December 2022, China is presented with an appealing opportunity to curtail its reliance on Middle Eastern flows that have to pass through vulnerable chokepoints.

While Russia’s Northern Sea only remains navigable for a select number of vessels, having access to the oil produced in West Siberia could provide a viable alternative for China to reduce its dependency on the Middle East – especially with Russian grade being of a similar gravity to many Middle Eastern grades.

Meanwhile, Saudi Arabia has committed itself to up its supply to China by some 700,000b/d via deals concluded in March 2023. As China’s oil demand is improbable to increase by more than 2 million b/d before peaking in the decade ahead, CNPC might lack incentives to further up its stakes in Iraq.

Water is essential, yet scarce

Water has been a major roadblock to an uptick in oil output, being essential to maintain reservoir pressure as Iraq’s fields are less suited to using gas.

The availability of freshwater in Iraq is becoming tighter, with salt levels reaching new heights while droughts are occurring with increasing frequency and intensity as global temperatures rise.

The Common Seawater Supply Project (CSSP) was meant to form the cornerstone of water supply to the Iraqi oil industry, more than doubling available water for oil production of close to 5 million b/d. But the project has been on hold ever since its inception in 2011, with initial operator ExxonMobil exiting in 2018.

Now, TotalEnergies is considering a deal to pick up the pieces of the CSSP. But while preliminary agreements have already been signed in September 2021, the project remains on hold.

Political turmoil plays its part

The political realm remains equally problematic. About 10% of Iraq’s oil is produced in the northern region controlled by the Kurdistan Regional Government (KRG) and is further at risk of supply disruption. Disputes between the KRG and the federal government in Baghdad have been flaring up since a referendum called for independence for the semi-autonomous Kurdish region in late 2017.

These tensions led to 400,000b/d of exports from northern Iraq to Turkey being halted in late March 2023, following an international tribunal that stated that oil from the Kurdish region should not be exported without Baghdad’s approval. Smaller IOCs operating in the region have consequently also warned that they might consider divesting amid lingering uncertainties.

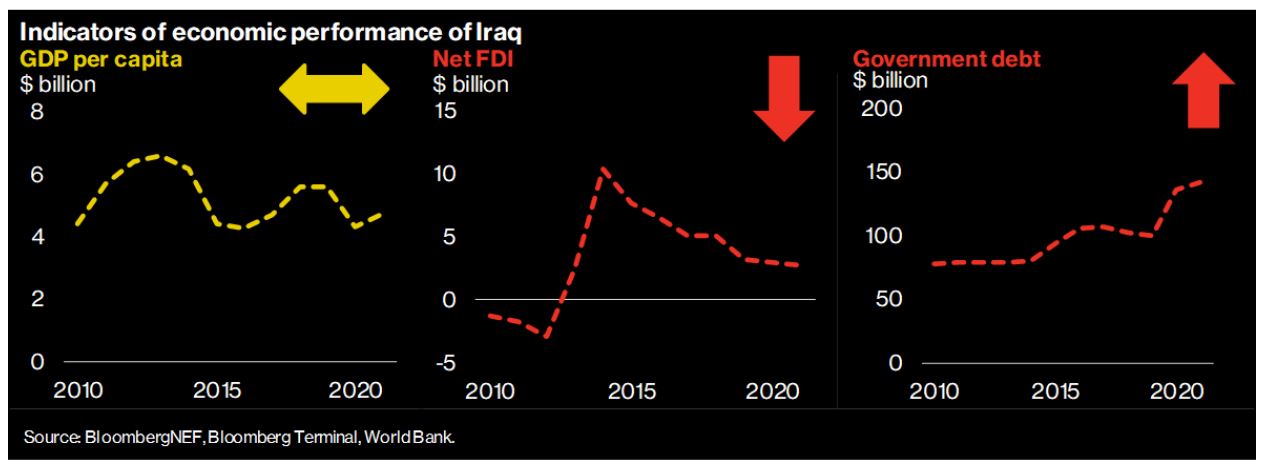

A rocky path ahead for Iraq

The future looks tough. The CSSP will become more important in not only upping oil production but also maintaining it, as droughts increase in frequency and severity. Aging reserves and fleeing IOCs add to the difficulties in maintaining oil output at Iraq’s current fields.

A track record of massively missing set production targets in the past under less arduous circumstances further suggests that the upcoming decade will bring little relief. Meanwhile, the country’s debt grows, while foreign investment has fallen steadily over the past decade.

A rising population and a lack of diversification in the economy will further pressure the government’s treasury, in turn complicating payments to the companies left operating in the country.

In short, any major supply gaps in the decade ahead are unlikely to be filled by Iraq.