By Musfika Mishi, Technology & Innovation, BloombergNEF

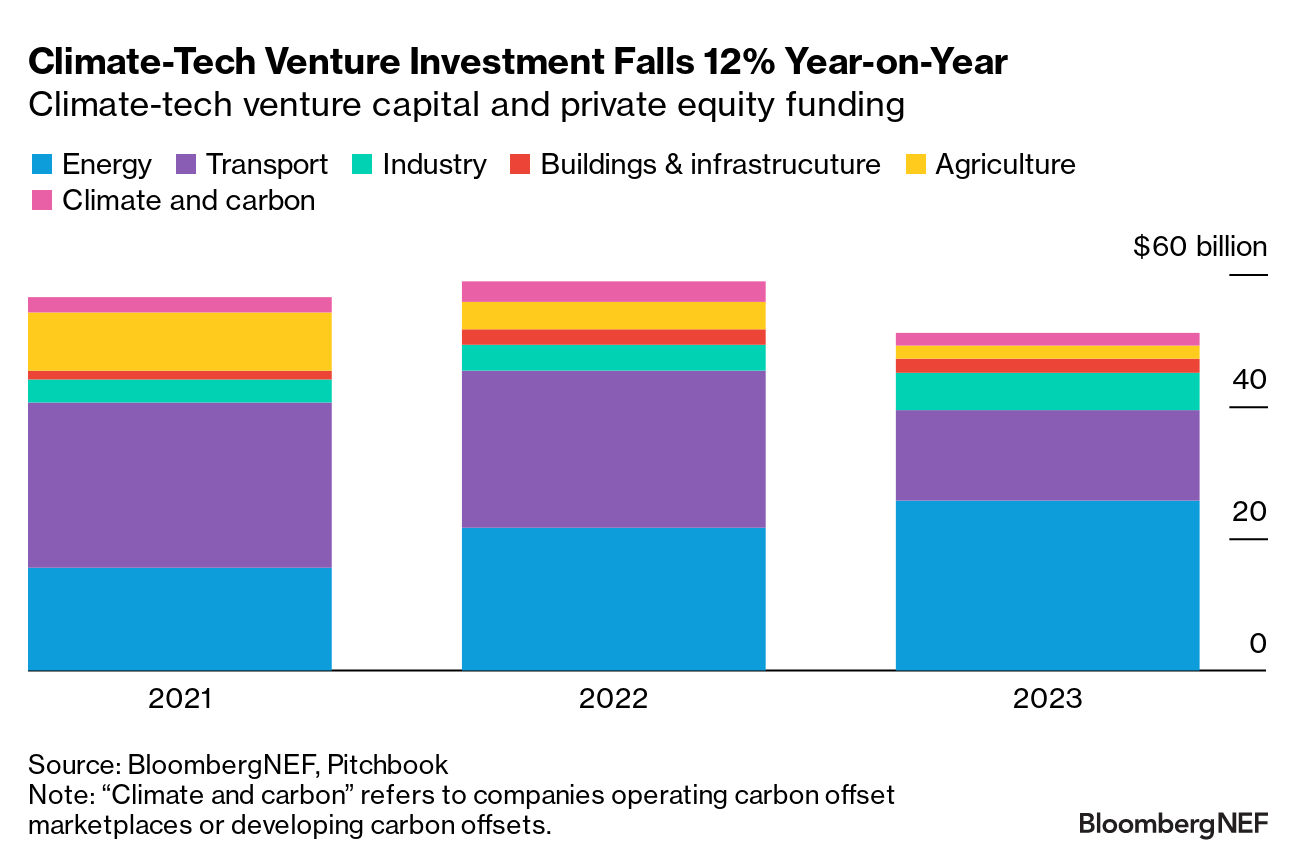

Climate-tech companies raised $51 billion in venture capital and private equity funding across more than a thousand deals tracked by BloombergNEF last year. Though this was 12% lower than 2022, the slide was a fraction of the 35% reported for all startups by Pitchbook. Most of the funding went to low-carbon energy and low-carbon transport companies.

The climate-tech sector had so far escaped the trend of declining venture capital since the pandemic – funding for climate-tech increased 4% in 2022 compared to 2021. However, high interest rates continue to impact market sentiment and rising costs forced many projects to shut down.

From a deals perspective, BNEF’s Climate-Tech VC/PE Investment Database shows a 15% decline in the number of deals completed in 2023 compared to 2022. For the same timeframe, Pitchbook reported a 27% decrease in deal count for the global market.

The overall market had 34% of investors abstain from dealmaking in 2023, as per Pitchbook. In contrast, within climate-tech, BNEF has tracked a 26% growth in the number of active investors, defined as those participating in two or more deals.

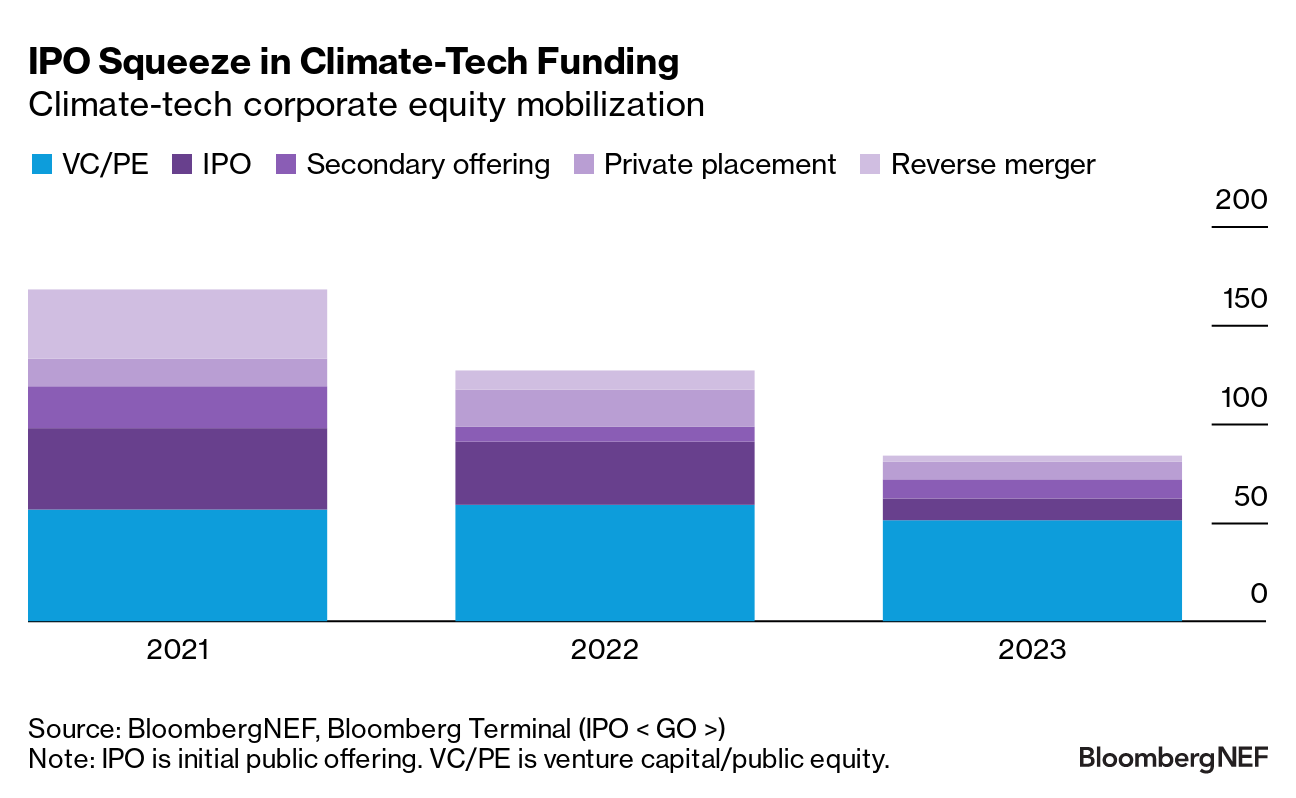

Irrespective of this strong performance, there is cause for concern for climate investors. Public markets – the route to exit for many startups – saw a much bigger decline in activity. Funding for initial public offerings slumped by 65% as many startups raised growth-stage equity to avoid undervaluation in the public market (Figure 2). Battery makers Northvolt and Envision AESC, as well as energy-services provider Redaptive, raised large rounds from VC/PE investors in anticipation of potential future public listings. Should interest rates continue to remain high for longer periods of time, investors may struggle to successfully exit their portfolios and return a profit.

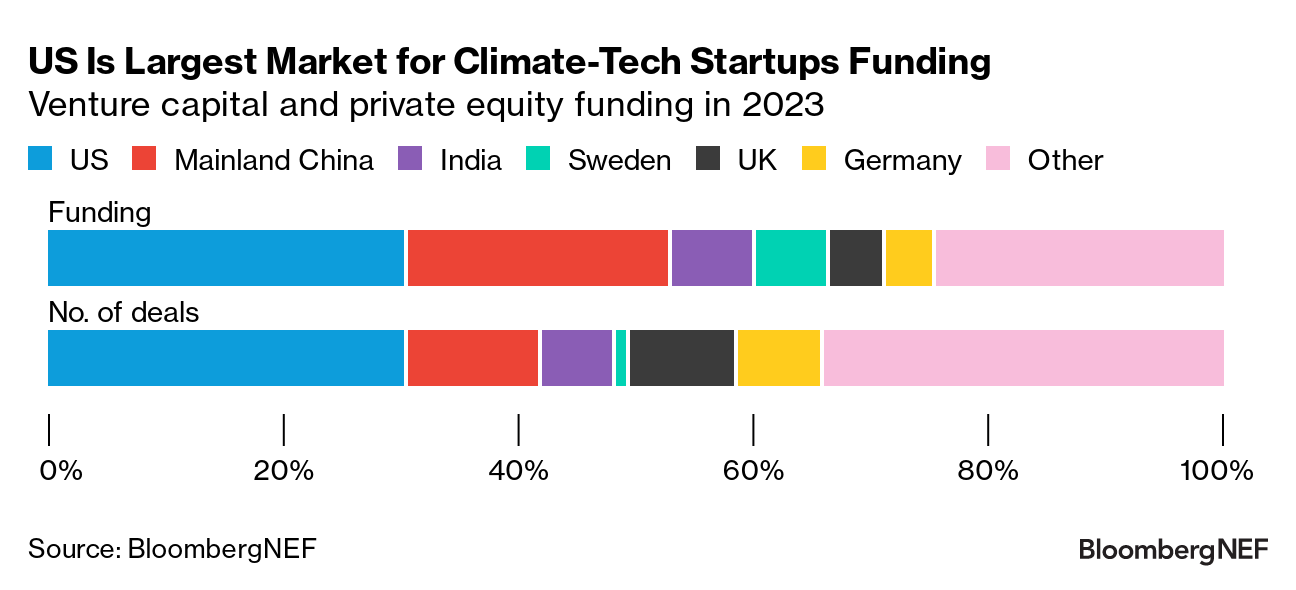

US is best-funded climate-tech startup market for third year running

Regionally, the US continued to be the largest market for climate-tech in 2023, which marked one year since the passage of Biden’s Inflation Reduction Act or IRA (Figure 3). A total of $14.6 billion was allocated to startups in the region – almost $3 billion more than the second largest market of Mainland China. Some 300 deals were completed by American clean-tech companies, more than double that of the next largest market. Among the largest raises during the year were by energy developer Plus Power ($1.8 billion) and battery recycler Redwood Materials ($1 billion).

In China, there was strong activity seen in clean-energy-equipment and electric-vehicle manufacturers. The $11.7 billion mobilized was 23% lower compared to 2022, likely driven by a perceived oversupply of clean-tech manufacturing capacity in the region. This overcapacity comes at the exact moment the US and EU are pivoting towards onshoring their clean energy supply chains.

Startups headquartered in the EU raised $10.8 billion across all sectors, coming in third place overall. Sweden and Germany led, accounting for over half of the total funding. Sweden is home to low-carbon steelmaker H2 Green Steel and battery manufacturer NorthVolt, which together raised $3.6 billion across three deals. In January 2024, the EU approved almost $1 billion in German aid to Northvolt, highlighting the desire of European governments to grow a stronger clean-tech manufacturing base onshore.

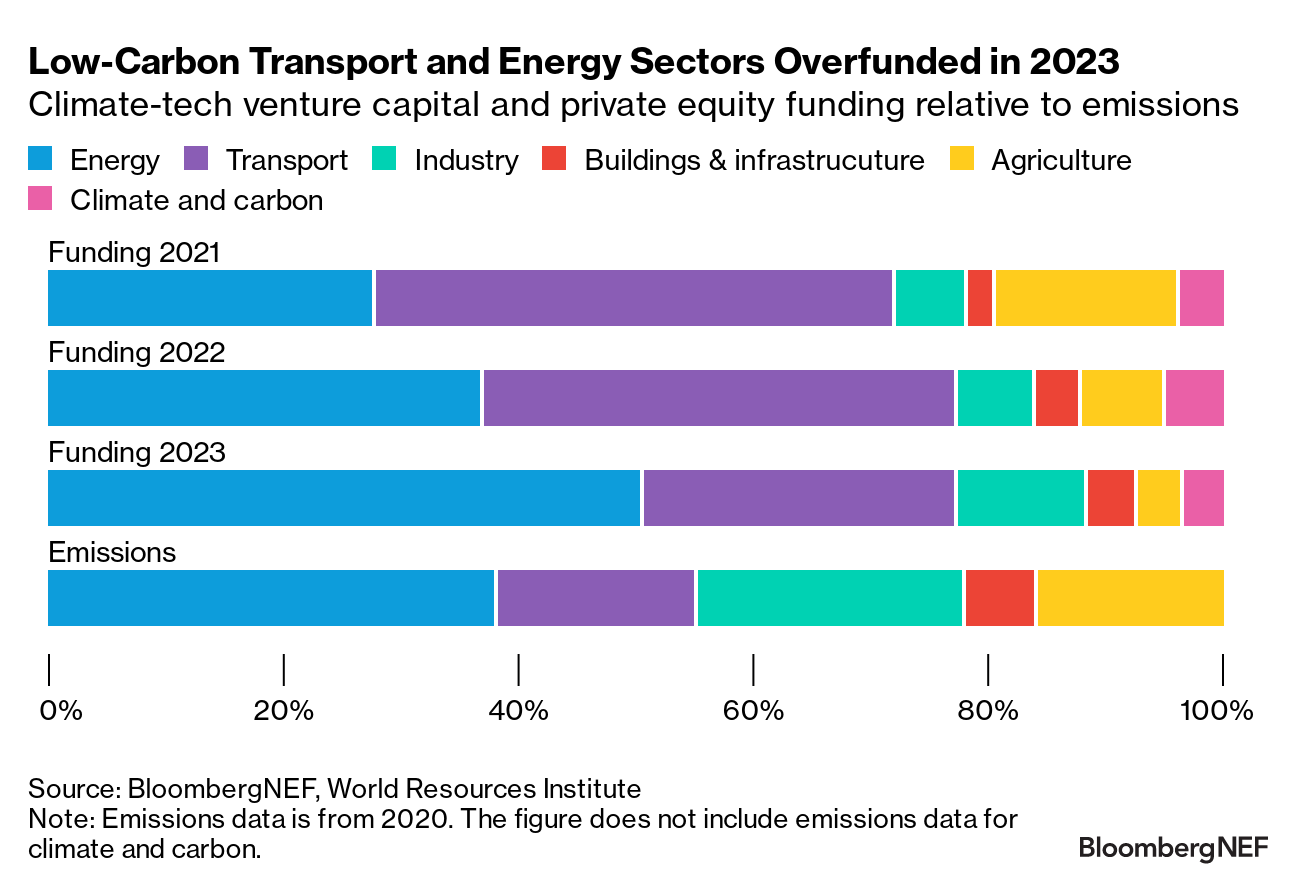

Low-carbon transport is consistently overfunded relative to global emissions

The transport sector accounted for 17% of global emissions in 2020 based on data from World Resources Institute. However, low-carbon transport startups raked in upwards of 27% of climate-tech VC/PE funding in 2023. This is much lower than previous years though. The oversubscription could be attributed to numerous causes: the cost competitiveness of battery-electric vehicles and the value of the global auto market chief among them. Low-carbon energy startups, which includes solar, wind and storage equipment makers, accounted for 50% of funding in 2023, marking the first year the sector was overfunded relative to its 38% contribution to emissions.

On the flip side, low-carbon industry, buildings and agriculture are constantly underfunded relative to their contributions to emissions. In 2023, industrial decarbonization funding increased slightly with several low-carbon steel making companies raising 9-figure deals. Funding for these sectors needs to double to match emissions. Agriculture only received a quarter of the funding needed this past year, following two years of decreases. Low-carbon buildings received 4% of funding in 2023 despite making up 6% of emissions, up from 2% of funding in 2021. Undersubscription in these sectors can be attributed to the lack of economically competitive low-carbon solutions.