This article first appeared on the BNEF mobile app and the Bloomberg Terminal.

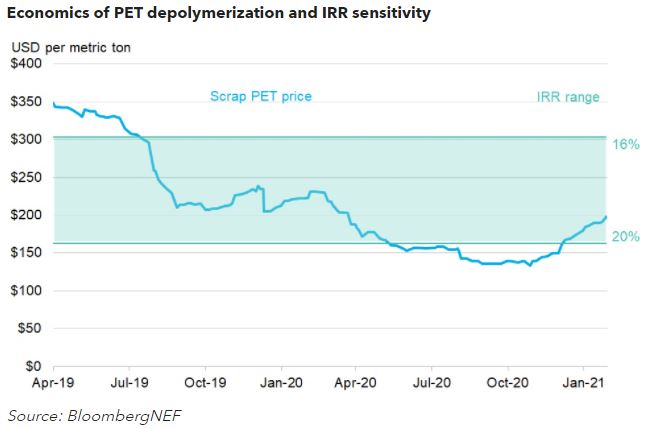

- Scrap prices have fallen over 60% to $133/metric ton

- IRR range remains 16-20% for PET depolymerization projects

Falling scrap PET prices have made recycling increasingly attractive in the U.S., according to BNEF analysis.

Over the past two years, scrap PET prices have fallen from a high of $350 to as low as $133 per metric ton in November 2020. This has kept the internal rate of return for PET depolymerization projects in the 16% to 20% range.

PET depolymerization is a new recycling process in which a chemical reaction breaks up waste PET – a plastic commonly used in beverage bottles – into its base units, which are then rejoined. Unlike mechanical recycling, depolymerization can produce virgin-quality material from heavily-contaminated PET waste, making it less sensitive to feedstock costs.

In the long run, rising scrap prices would increase feedstock costs for all technologies. However, it would give an edge to depolymerization as it would be able to process lower-quality, cheaper scrap compared to mechanical recycling.

Indorama Ventures, Danone, Coca-Cola and Pepsi have all invested in PET depolymerization technologies.

BNEF Shorts are research excerpts available only on the BNEF mobile app and the Bloomberg Terminal, highlighting key findings from our reports. If you would like to learn more about our services, please contact us.