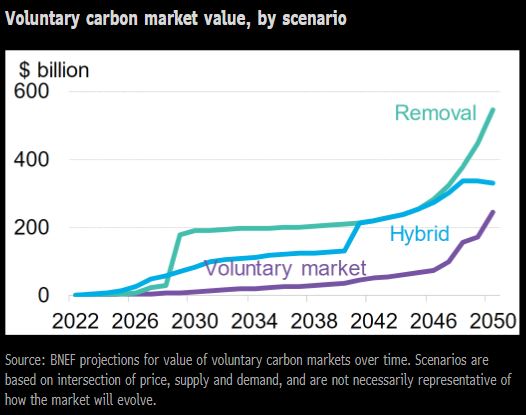

A natural side effect of growing net-zero commitments is a higher aggregate dependence on voluntary carbon offsets. The trading volume of voluntary offsets grew 300% last year on the Expansiv platform alone. By 2050, carbon offsets can become a homogenized commodity market with an estimated value of $245-$546 billion, according to BloombergNEF.

While demand will naturally boom, work is needed to ensure that the supply of quality offsets can keep pace. At the BNEF Summit in New York, expert panelists identified technology innovation and standards development as key focus areas for the development of the offsets market.

On the operational front, integrity standards are key to unlocking trust and market liquidity. Currently, it is difficult to gauge the quality of offsets and this limits both the volume and speed of transactions. Several industry groups are developing frameworks for evaluating the quality of new offsets being offered.

On the technology side, there is consensus that removal offsets must play a key role in the future, but the technology is still immature and requires more time and capital. In the meantime, panelists agreed that corporations should take advantage of already-mature avoidance offsets wherever possible. Rather than setting avoidance- or removal-only strategies, they recommended a more pragmatic approach of using avoidance offsets now, and thereby helping fund the development of removal offsets for the future.