By Daisy Robinson, Renewable Fuels Specialist, BloombergNEF

The landscape for producing renewable fuels is shifting, with a flurry of projects recently canceled in more established markets replaced by plans for a more diverse set of locations and technologies.

This emerging market includes renewable diesel and sustainable aviation fuel, or SAF, with production still challenged by feedstock availability and high costs. Terminated capacity is more than offset by the new proposals.

Oil majors BP and Shell have both recently outlined plans to scale back large renewable fuel projects. In June, BP said it will not proceed with previously planned biofuel production units at its Cherry Point refinery in the US, and its Lingen plant in Germany. Then, in July, Shell paused construction of its 820,000 ton (roughly 278 million gallons) per year plant in Rotterdam, Netherlands, due to construction costs.

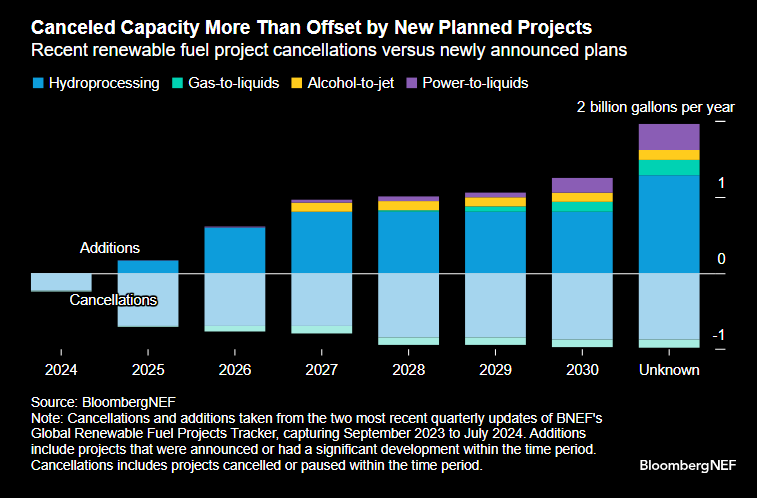

Several other firms have either abandoned, paused or reversed renewable fuel projects. Over the last two quarterly updates of BNEF’s Global Renewable Fuel Project Tracker — covering September 2023 to July 2024 — almost 1 billion gallons per year of nameplate capacity have been switched to ‘Paused/Abandoned’ status.

The vast majority of called off capacity is from projects using hydroprocessing. It’s the dominant technology for producing renewable diesel and SAF, but availability of sustainable, economic feedstock weighs heavily on project viability.

Meanwhile, new additions tracked by BNEF over the same period come to almost 2 billion gallons per year of capacity. Hydroprocessing still makes up the largest portion of additions. But roughly the same number of new power-to-liquids projects were announced as those with hydroprocessing, as facilities using the latter technology tend to be much larger as it is a more developed pathway. Power-to-liquids produces “e-fuels” produced from green hydrogen and captured carbon. These do not rely on biogenic feedstock, easing that challenge.

New projects are planned across a broader range of geographies, including China and Brazil, while cancellations are largely concentrated in the more established markets of the US and Europe.

Comparing cancellations to additions also indicates a strategic shift in product preference. While less than half of tracked cancellations aimed to produce SAF as part of their product slate, all new additions seek to produce the fuel. This is partially a function of technology: hydroprocessing units have a more diverse mix between renewable diesel and SAF, while newer technologies like power-to-liquids or alcohol-to-jet tend to be more focused on SAF.

The increasing distribution of planned capacity in terms of both geography and technology suggests project developers are thinking more critically about the placement and timing of projects, rather than abandoning renewable fuels altogether.