Gas power plants in China are facing negative profit margins under current gas and power prices. BloombergNEF assesses that gas power projects under development are likely to be delayed or even canceled if expected profit margins remain low.

Gas power plants are struggling to remain profitable

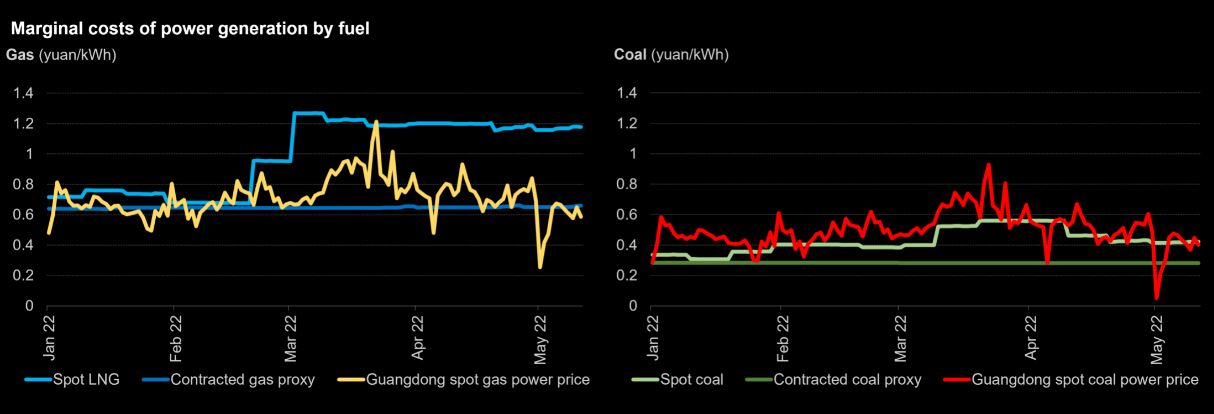

Persistent high gas price levels are eroding profit margins of operational gas power plants in China. Marginal generation cost of gas power plants consuming contracted pipeline gas remain around 0.65 yuan ($0.10) per kilowatt hour, according to BNEF estimates. For plants burning liquefied natural gas, marginal cost of generation surged to more than 1 yuan/kWh ($0.15/kWh) after March.

It is getting increasingly harder to cover the marginal cost of generation given current power prices. For example in Guangdong, a province with 30% of China’s installed gas power capacity, spot power tariffs paid to gas power plants in May have dipped below 0.6 yuan/kWh ($0.09/kWh). This figure is 52% below the marginal cost of plants supplied with spot LNG and 14% lower than those supplied with contracted gas.

Coal power plants appear to have better economics than gas plants. Their marginal generation cost is lower — around 0.5 yuan/kWh ($0.07/kWh)for assets burning spot coal and 0.3 yuan/kWh ($0.04/kWh) for those using contracted coal. Spot coal power prices in Guangdong appear to be slightly higher than the marginal generation cost of plants burning spot coal.

Projects under development could be delayed or canceled

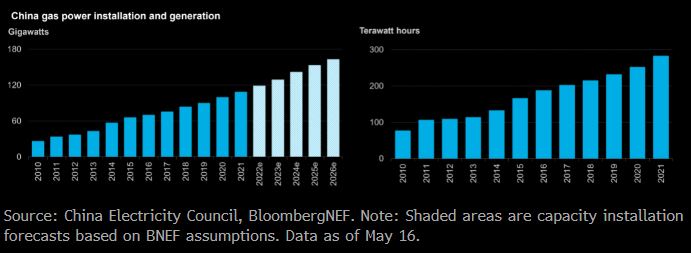

As of May, China has 109 gigawatts of installed gas power capacity. With a strong government push to reduce air pollution and carbon emissions, around 67 gigawatts of gas power projects are in development, 23 gigawatts of which are under construction and 44 gigawatts are in the planning stage. However, developers are considering delaying or even canceling such projects due to difficulties in procuring affordable gas and limited contracted gas supply.

For example, in Guangdong province, the benchmark tariff for gas power is 0.655 yuan/kWh for large plants. This means gas price should not be higher than $14 per million British thermal units, assuming a dollar-yuan exchange rate of 6.7. Current Japan-Korea marker futures indicate JKM prices will fall below $14/MMBtu only in 2025 (as of May 16).

The State-Owned Assets Supervision and Administration Commission imposes harsh financial penalties on operational gas power projects incurring losses. Therefore, state-owned utilities are even more cautious regarding future gas power project deployment.