By Atin Jain, Senior Associate, Wind, BloombergNEF

The US offshore wind industry faces a perfect storm of rising costs, permitting delays and grid connection hurdles – all leading to low returns. Inflation and supply chain challenges have driven up capital expenditure, while financing costs have spiraled due to rising interest rates. Developers want to renegotiate their previously-agreed offtake deals which are no longer profitable while some are trying to cancel their contracts altogether.

Avangrid, the US subsidiary of Spanish electricity group Iberdrola, recently agreed to pay $48.9 million in fines to the state of Massachusetts to end its commitment to the under-development “Commonwealth Wind” offshore farm. BloombergNEF estimates the fines amount to less than 1% of the total project capital cost, which represents a bargain. The low penalties could encourage other firms to cancel their existing power purchase contracts.

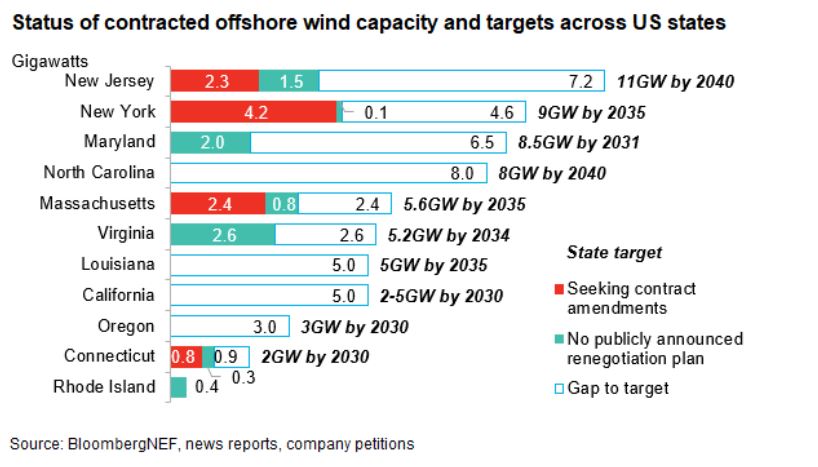

Commonwealth Wind is the first casualty of about 9.7 gigawatts of US offshore wind projects in the queue for renegotiation or cancellation of offtake agreements. This represents over half of the contracted pipeline across four states – New York, Massachusetts, New Jersey, and Connecticut. Other firms currently seeking revisions to power offtake agreements include Shell-Ocean Winds, BP-Equinor and Orsted-Eversource.

Danish developer, Orsted, lost a bid to provide offshore wind power to Rhode Island, whose main utility said rising costs made the proposal too expensive.

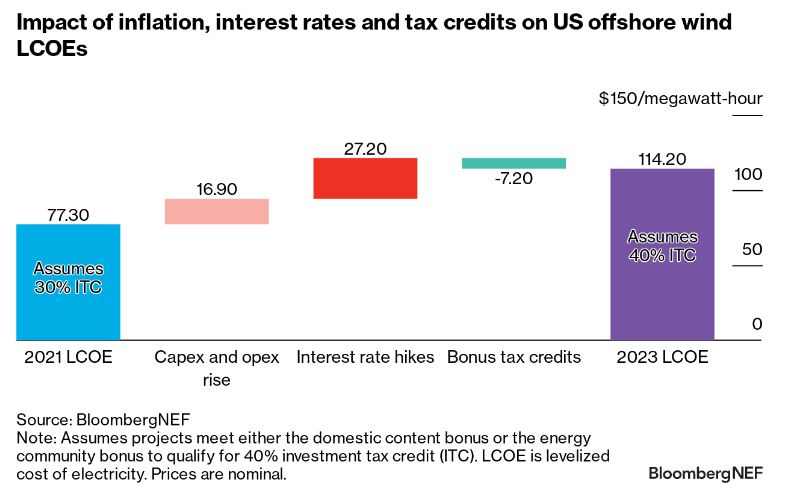

The levelized cost of electricity of a subsidized US offshore wind project has increased to $114.20 per megawatt-hour in 2023, up almost 50% from 2021 levels in nominal terms, according to BloombergNEF calculations.

Increases in capex and opex have added $16.90/MWh to the LCOE. The higher cost of capital, thanks to interest rate hikes, has increased levelized costs by another $27.20/MWh, assuming project owners continue to expect to make a 5-percentage-point premium over their cost of debt. In practice, some developers may settle for lower overall returns. A 40% investment tax credit benefit in the Inflation Reduction Act helps to offset a minor share of these cost increases.

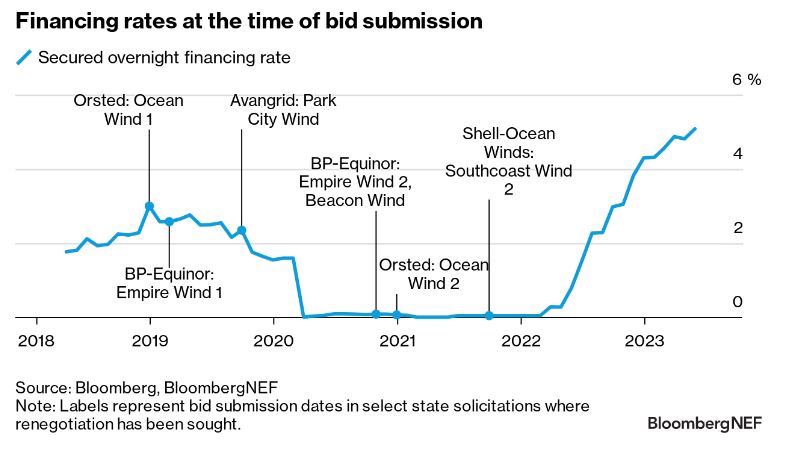

The secured overnight financing rate (SOFR) – a base rate for loans – stood at 5.05% in mid-July 2023, significantly higher than the near-zero levels during 2020-21 when many of these projects secured offtake contracts. The high interest rate environment is not expected to ease, causing further pessimism among developers. The US Federal Reserve increased the interest rates to a 22-year high in July and signaled that borrowing costs may further increase by the end of this year.

A surge in cost of materials, labor, and logistics has increased total project costs for most developers. For example, the US Consumer Price Index (CPI) averaged 1.8% before the Covid-19 pandemic in 2019 – when New York state awarded offtake contracts to BP-Equinor’s and Orsted-Eversource’s projects in its first solicitation, and Massachusetts utilities signed power purchase agreements with Shell-Ocean Winds. Although inflation rate has come down from its peak in 2022, the CPI stood at 3% at the end of June 2023, significantly higher than when most of these projects were awarded.

Inflation can erode the value of a developer’s revenue over time, making it more difficult to finance and build projects. The current offtake agreements are not adjusted for inflation and many developers are asking regulators to include inflation adjustment mechanisms in the contracts. These can help mitigate some risks to the developers by adjusting the offtake price to reflect changes in the inflation rate and improve project economics.

Several US states face a growing risk of missing their offshore wind goals. New York state has a target to add 9GW of cumulative offshore wind capacity by 2035 and has contracted 4.3GW of projects in its two solicitations so far. Developers of 95% of the contracted capacity are now trying to renegotiate their contracts, putting the projects at risk of delays. In Massachusetts, developers of 75% of contracted capacity are looking to renegotiate or cancel their offtake deals. In Connecticut, 73% of the contracted pipeline is at risk and in New Jersey, which is targeting 11GW by 2040, 60% of its contracted pipeline is at risk of delays.

The US is not the only place where the offshore wind industry faces cost-related headwinds. In the UK, Swedish utility Vattenfall has stopped development on its 1.4GW Norfolk Boreas offshore wind project, citing the high interest rates and cost inflation as key factors in its decision to suspend activities at the site.

The renegotiation efforts mean ambitious goals by state governments and the Biden administration to achieve 30GW of offshore wind capacity by 2030 are drifting further away. BloombergNEF cut its cumulative 2030 forecast by 11% due to delays resulting from contract renegotiations and now forecasts the US to reach 23.1GW of cumulative offshore wind capacity by 2030.

Contract revision requests put state regulators in a difficult position. They realize the projects are crucial for them to reach their longer-term installation targets, but officials awarded the contracts in competitive processes. Renegotiation could set a risky precedent. Companies that lost out originally could argue that they were unfairly punished for better contingency planning in their bids.

BNEF clients can view the full report here.