By Atin Jain, Energy Specialist, BloombergNEF and Meredith Annex, Head of Clean Power, BloombergNEF

The US is on track to see over 25% growth in annual clean energy installations this year, according to BloombergNEF’s 2H 2024 US Clean Energy Market Outlook. BNEF expects the US to hit an all-time high of 65 gigawatts of new solar, wind and energy storage additions this year despite persistent structural hurdles like permitting and grid connections. Annual clean energy installations are set to average 102GW over the next 11 years – quadruple the 26GW averaged over the past 11 years – in BNEF’s base case view.

BNEF sees over 950 gigawatts of new solar and wind additions to the US power grid over 2024-2035 under its base case forecast. An additional 231 gigawatts/925 gigawatt-hours of energy storage capacity is expected to be added during the same period. Competitive economics for renewables compared to gas-fired electricity, growing corporate and utility procurement targets and strong policy support are some of the fundamental drivers that anchor this growth.

The 2H 2024 US Clean Energy Market Outlook includes 34.2 gigawatts (direct current) utility-scale solar deployment in 2024 under its base case view, 6% more than was expected in the 1H 2024 version of the report. This implies a 28% increase over 2023 utility-scale solar additions. Texas and the Southeast compete for the top position, expecting 8GW each of new large-scale solar capacity. The energy storage sector continues to grow in BNEF’s outlook, with new additions in 2024 set to exceed 10 gigawatts for the first time. Two markets, California and Texas, dominate those additions. In contrast, BNEF forecasts only 6.9 gigawatts of onshore wind to come online in 2024. Longer turbine delivery lead times, shortages of transformers and other electrical equipment, and high interest rates have slowed execution timelines and delayed projects, hampering wind build this year and extending into next.

Uncertainty around the elections, however, poses some risk to the US’s long-term renewable energy growth. Former President Donald Trump and his Republican Party have vowed to repeal the Inflation Reduction Act (IRA) – the Biden administration’s flagship climate legislation – along with the all-important tax credit subsidies for clean energy developers and manufacturers.

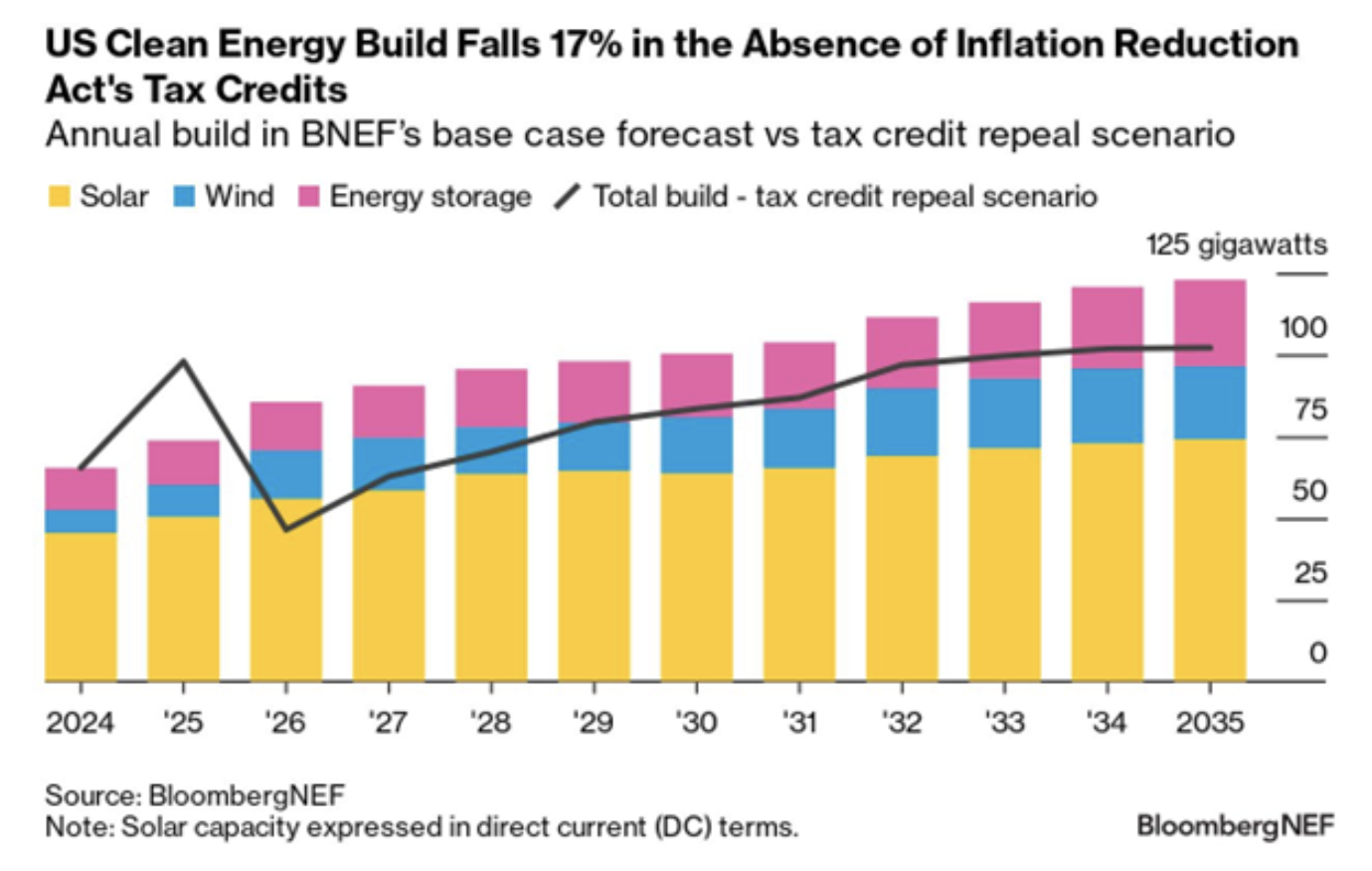

While BNEF views a complete repeal of the IRA tax credits as unlikely, such an outcome would have an impact on solar, wind and energy storage build. A scenario in which the IRA tax credits are immediately removed, but where projects that start construction by 2025 are grandfathered in through a provision known as safe-harboring, could result in a 17% drop in cumulative wind, solar and energy storage capacity additions over 2025-2035 based on BNEF analysis. Wind, in particular, would be impacted the most. This worst-case, but unlikely, scenario would see 927GW of total wind, solar and energy storage build over 2025-2035, compared to 1,118GW in BNEF’s base case forecast for the same period.

A total repeal of the IRA’s tax credits would not entirely stymy the US’s clean power momentum. After an initial rush to benefit from safe-harboring, and a drop once the repeal takes effect, BNEF’s scenario sees annual additions of wind, solar and energy storage return to 2024 levels by 2028 thanks to competitive economics and continued demand for offtake agreements.

Even beyond the IRA tax credits, the next US administration will make other decisions that affect the US clean energy industry. The parties differ in their stance on import tariffs for wind, solar and storage equipment – with the Republican party more likely to impose tougher restrictions. This could disrupt trade-exposed sectors like solar once developers have used up stockpiled imports. Other power sector issues like clean firm resources and permitting have bipartisan support, but an election resulting in a split Congress could make further progress on these issues difficult.

BNEF clients can access the full report here.