By Kyle Harrison

Head of Sustainability Research

BloombergNEF

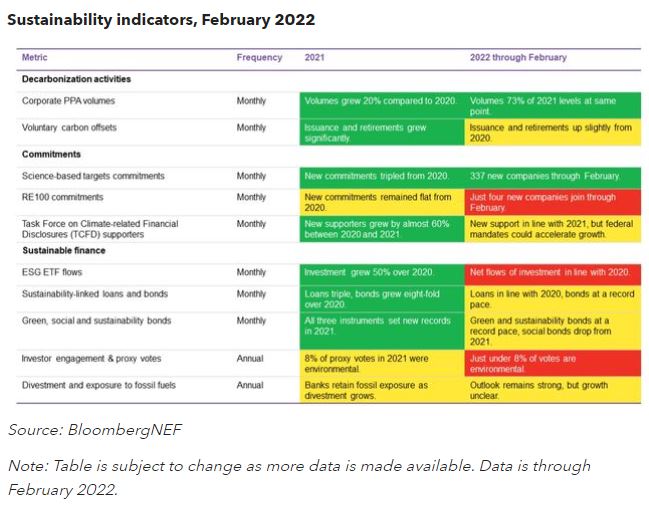

Corporate sustainability has gone mainstream, with thousands of companies setting ambitious targets each year, raising hundreds of billions of dollars in sustainable debt and making major investments in decarbonization activities. As sustainability continues its ascent, BloombergNEF is tracking key indicators to quantify the growth.

- Through February, nearly $77 billion of green bonds have been issued, up from almost $61 billion at the same point in 2021. The largest tranches came from Bank of China with $4.8 billion and China Development Bank with $2.4 billion.

Clients can access the full ‘Sustainability Indicators: Looking Back, Moving Forward’ report on the Terminal or on web.

- The number of TCFD supporters is expected to grow in the coming years as federal-level mandates around the standard come into place. TCFD is largely voluntary today, but the U.K. and Brazil plan on making it mandatory starting from 2023. Several countries in the European Union, including France and Germany, require TCFD reporting under certain circumstances and mandatory TCFD reporting is being considered in the U.S., Canada and South Africa. All of this will add to the growing number of supporters, of which there are 161 in 2022 through February.

- Through February, seven early meetings saw 12 proxy votes filed, of which two relate to environmental issues. These include an approved vote at Costco’s annual general meeting (AGM) to adopt emissions reduction targets and one vote not approved at Tyson Foods’ AGM to report on sustainable packaging. The remaining 27 proxy votes filed are pending until future meetings, with one relating to the environment.