By Hugh Bromley, Sustainable Agriculture, BloombergNEF

Mismanaged interactions with nature have burnt billion-dollar holes in many corporate balance sheets. In collaboration with the Taskforce on Nature-related Financial Disclosures (TNFD), BNEF has examined 10 instances of companies suffering material financial losses from poorly handled interactions with nature.

The full series, When the Bee Stings: Counting the Cost of Nature-related Risks, is available here.

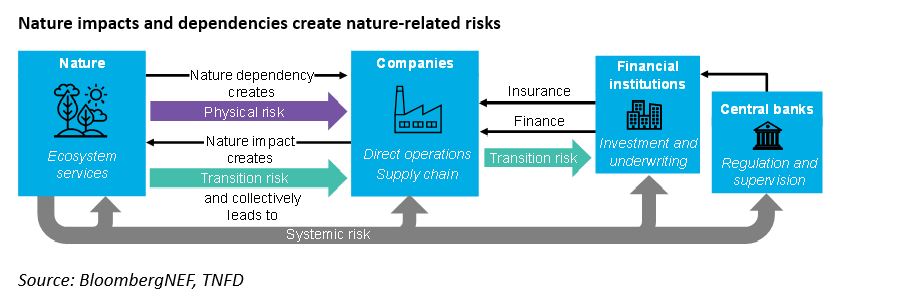

All sectors are exposed to nature risk, directly or indirectly, because economic activity relies on the stock of natural capital and the ecosystem services that flow from it. For example, forests provide wood for timber producers, growers depend upon insects and birds to pollinate crops, and an airport or nuclear power plant may depend on the erosion control and flood protection offered by mangrove swamps. Damage to ecosystems on which businesses depend can thus undermine operations. At the same time, business operations can impact nature, through the release of pollutants, extraction of resources and conversion of land.

The risks that companies face as a result of these nature-related dependencies and impacts fall into three categories: physical risk, transition risk and systemic risk.

Physical dependency and nature-related risks

Physical risks arise due to a decline in the state of nature disrupting the ecosystem services on which a firm’s operations depend. UK-based poultry producer Bernard Matthews suffered lost sales and brand damage after its lax biosecurity measures enabled avian influenza to enter its facilities, triggering the preventative culling of 159,000 turkeys. Consumer perception of Bernard Matthews nosedived in the aftermath of the outbreak. A survey conducted shortly after deemed Bernard Matthews Britain’s least trusted company, ranking last among 1,150 businesses. The company posted losses of £77 million ($159 million in 2007 nominal terms) in the 2007-08 financial year and was forced to lay off almost 150 workers.

EV giant Tesla also let physical nature dependencies manifest into operational interruptions and financial impacts. The construction of its flagship Berlin-Brandenburg gigafactory was delayed for months as environmental campaigners and local authorities investigated whether the area’s declining groundwater would be able to sustain the facility’s operations. The matter was laughed off by Tesla’s polarizing CEO; however, investors interpreted these delays as a threat to the company’s aggressive expansion plans, worsening falls in the firm’s share price and posing questions over the viability of its long-term operations in the region.

Transition risk stemming from impacts on nature

Transition risk arises through a company’s impacts on nature, manifesting as legal and policy risk in five of the cases analyzed by BNEF. Chemicals producer 3M, plastics manufacturer Formosa and mining major Freeport-McMoRan each released harmful materials into watercourses proximate to their operations, resulting in a range of outcomes including over $10 billion in legal liabilities, revocation of production permits and obstacles to planned equity transfers. Similarly, the world’s third-largest container shipping company, CMA CGM, received $165,000 in penalties from the US Environmental Protection Agency in August 2023 relating to various ballast water treatment infringements that could have potentially released invasive species to vulnerable marine ecosystems.

The predominance of water in these case studies is no surprise. Surface and groundwater are two of the most salient natural assets that companies depend on or impact through their operations.

Likewise, deforestation features prominently throughout nature-risk mitigation efforts across various sectors. Specialty oil and fats manufacturer AAK and the world’s largest meat producer, JBS, were impacted financially through market and reputational risk – further forms of transition risk – as a result of practices linked to deforestation. Despite AAK’s commitment to sustainable sourcing of palm oil, media reports tying its operations to a protected national park in Indonesia hit its share price, while ongoing criticism of JBS’ Amazonian practices has imperiled its long-planned listing in the US, jeopardizing up to $20 billion in unlocked value.

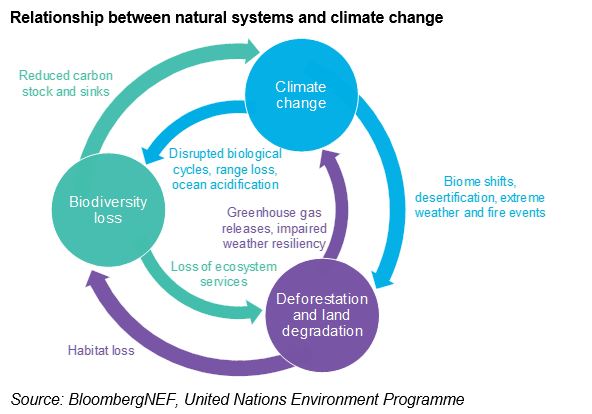

Nature loss and climate change are inextricably linked

While some events, such as heatwaves, may appear to be climate-related phenomena, they can also be seen as part of a larger breakdown in the operation of the biosphere. Temperature extremes precipitate droughts, floods, storms and various other meteorological phenomena, which in turn hinder ecosystem services. Shifts in land and ocean use, the primary drivers of nature loss, also contribute significantly to climate change, reducing the resiliency of the biosphere and exacerbating further impacts. Likewise, deforestation and habitat loss release stored carbon that amplifies temperature increases.

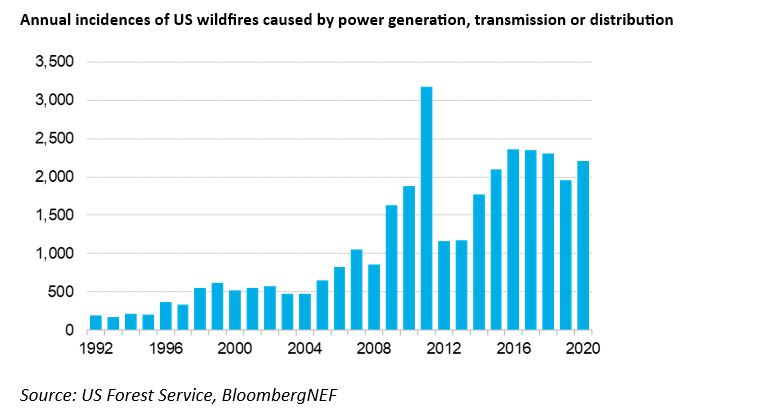

This overlap between nature and climate risk is highlighted by northern California’s electric utility PG&E. Its service territory covers approximately 70,000 square miles – almost twice the size of South Korea or Portugal – including some of the most forested areas of the state. Severe and prolonged drought – exacerbated by climate change – has made these natural settings more vulnerable to wildfire.

The utility was forced to file for Chapter 11 bankruptcy after a federal court found PG&E liable for damage caused by fires ignited when power lines were struck by branches in the drought-affected forest regions north of San Francisco that the utility had failed to properly trim and maintain. It later paid out billions of dollars in settlements and was required to invest heavily in upgraded transmission and distribution equipment, as well as monitoring systems.

Despite observing the financial collapse of PG&E, several other US utilities are facing legal and reputational loss related to wildfires. In June 2023, an Oregon jury found PacifiCorp liable for the 2020 wildfires in the state, while as of October 2023, Xcel Energy is engaged in court cases from insurance companies seeking to ascribe to it responsibility for wildfires in Colorado in 2021. Hawaiian Electric is being sued by Maui County and facing potential bankruptcy for its possible role in the 2023 Maui fires – among the deadliest wildfires in US history.

The cost to companies and the economy

The nature-related risks examined by BNEF highlight how the financial cost of mishandling can range from the relatively trivial, such as CMA CGM’s six-figure fines and public rebuke from the US EPA, to the more substantive $10 billion settlement agreed by 3M for its dumping of toxic chemicals into local water systems. Several of the cases saw risk manifest through share price declines, ranging from 3% intraday for Tesla, to over 90% for PG&E.

As nature’s already unprecedented decline continues to accelerate, nature risk is becoming more material to companies across all sectors. The Economic Case for Nature, prepared by The World Bank in 2021, predicts a 2.3% fall in global GDP – equivalent to $2.7 trillion – in 2030 under a partial ecosystem collapse scenario, relative to a baseline scenario with no change in the state of nature.

The full series When the Bee Stings: Counting the Cost of Nature-related Risks can be found here and in the TNFD Knowledge Hub. Further information on nature-related risks and their relationship to impacts, dependencies and opportunities can be found in the conceptual foundations section of the Recommendations of the TNFD. BloombergNEF clients can access further research on nature reporting, markets and finance here: web | terminal.