By Bo Qin, Carbon, BloombergNEF

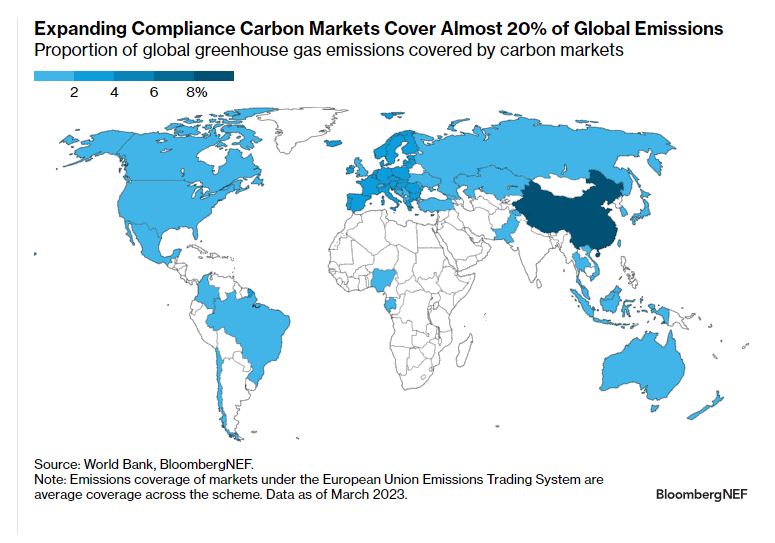

The odds of a UN-backed global offsets scheme emerging this year are slim to none, but all is not lost for carbon markets. Pricing emissions remains a popular decarbonization policy around the world and this sentiment will likely grow in 2024.

Both new carbon border tariffs and emissions trading programs are expected to enter the fray this year, as existing markets tighten supply and eye new sectors. As a result, BloombergNEF expects the prices of some carbon markets around the world to begin to converge.

New policy developments will likely see governments continue to try to capitalize on voluntary carbon market revenues. Meanwhile, newly established compliance programs also appear more lenient on the inclusion of offsets, bringing the spheres of compliance and voluntary carbon closer together.

These are the 10 key developments BNEF anticipates will play out this year:

- 1. Make-or-break year for new markets: The momentum for using market mechanisms to put a price on carbon has spurred many new programs in recent years and this will continue in 2024. In the West, the US state of Washington kicked off its cap-and-invest scheme last year and policymakers there could decide to link with the neighboring and more mature California-Quebec market. In the South, Mexico planned to transition from a pilot phase to a fully operational economy-wide emissions trading system. This year should finally see the details of this market emerge.

- 2. Finalizing reforms to steady prices: Alongside new markets gearing up, some existing markets are at long last set to finalize their reforms in 2024. California, for example, ratcheted up the ambition of its climate policy after lawmakers approved the 2022 Scoping Plan to lower emissions by 48% by 2030 versus 1990 levels, and by 85% by 2045. BNEF expects the decision on how this will be enacted within the carbon market to land in 2024. If the same target is adopted for the carbon market, the annual reduction in the program’s emissions cap will rise to over 11% in 2025, from 4% right now. This could see an average carbon price of between $40-43 per metric ton in 2024, rising to $43-48 per ton in 2025.

- 3. New sector to enjoy short-lived free ride: The shipping sector has now begun to pay for its emissions under the European Union’s carbon market. The move to include maritime emissions in the EU Emissions Trading System will see the market oversupplied in 2024-25, before shifting to a deficit of allowances from 2026 onwards. The earlier oversupply is designed to facilitate hedging for the sector, whereby allowances are pre-purchased to cover future obligations. However, combined with the previously mentioned additional allowances due to the REPowerEU plan, this adds to the oversupply of allowances this year.

- 4. Carbon tariffs spread beyond EU borders: This year has also kicked off with new red tape for European importers, specifically those procuring industrials metals, fertilizers, cement, electricity and hydrogen from outside the EU. More carbon tariffs are on the horizon. The UK confirmed its own carbon border adjustment mechanism on December 18. Over the coming year, it is expected to add details and – if a general election doesn’t get in the way – legislation towards implementing the scheme. Meanwhile, Canada and Australia could announce their own carbon tariffs in 2024.

- 5. European and US regulators to set criteria for offsets: After the COP28 climate summit in Dubai last year, the global carbon offset market, as laid out in the Article 6.4 mechanism of the Paris Agreement, drifted further from going live anytime soon. Still, advances on the standardization of offsets will likely be made through both governmental institutions like the European Securities and Markets Authority and Commodity Futures Trading Commission in the US, and private market organizations like the Science Based Targets initiative and Voluntary Carbon Markets Integrity Initiative.

- 6. Further waves of carbon nationalism: Carbon offsets are increasingly being recognized as a sovereign asset. ‘Carbon nationalism’ refers to the tendency of governments to assert control over the emissions reduction potential available within their national borders by limiting the participation of the private sector. Several governments have introduced policies relating to domestic carbon offset production and trade, ranging from additional taxes in Zimbabwe, stipulated benefit sharing in Papua New Guinea and at the more extreme end of the spectrum, full export restrictions in India. BNEF expects to see more policies introduced this year.

- 7. EU power sector emissions to marginally increase in 2024: Power sector emissions in the EU took a spectacular dive in 2023 off the back of increased renewable capacity additions, high wind output and some residual demand destruction. Renewables are still expected to have a solid year in 2024 but some recovery in demand and a return to more normal weather conditions will create a small opportunity for fossil-fuel-based generation to creep back into the mix.

- 8. Gas back in the money and the mix: Coal-fired power generation in the EU looks to be back out of the money in 2024, as the carbon price returns to the level needed to incentivize coal-to-gas switching. This will be compounded by coal plants coming offline, including Germany retiring 9 gigawatts of capacity in 2024.

- 9. No sign of snowman to boost US carbon demand: California had a record snow season last winter, prompting higher hydro generation to eat into demand for emission allowances. Some of the demand destruction from hydro was offset by a decline in power imports. This year, the ‘snow water equivalent’ – the amount of water contained in the snowpack – is much lower than previous years. That said, it is still too early to call the game for hydro in 2024. In addition, reservoir levels are also still above average as a result of the record 2023.

- 10. Investors await reform implementation: As the EU carbon price has ended its one-way price rally and faces increasing policy risks, investors are eying markets beyond the bloc’s ETS. Diversification into other carbon markets lowers policy and market-specific risks while still maintaining a focus on decarbonization. California, for example, provides an inflation hedge as it has a price floor pegged to inflation in its design.

BNEF clients can access the full report here.