By Nathalie Limandibhratha, Associate, US Power and Helen Kou, Head of US Power, BloombergNEF

Texas is poised to become the leader in solar power capacity in the US by the end of the decade, as a tripling of installed capacity vaults it above California. But that record build could be eclipsed by the expected growth in power demand, driven by the electrification of oil and gas production, and rapid expansion of data centers.

Power consumption across the region operated by the Electric Reliability Council of Texas (better known as Ercot) is already breaking records due to heat waves and winter storms. The upward momentum is poised to continue, with peak demand projected to reach 118 gigawatts by 2030 in BloombergNEF’s base-case scenario, more than a third higher than today.

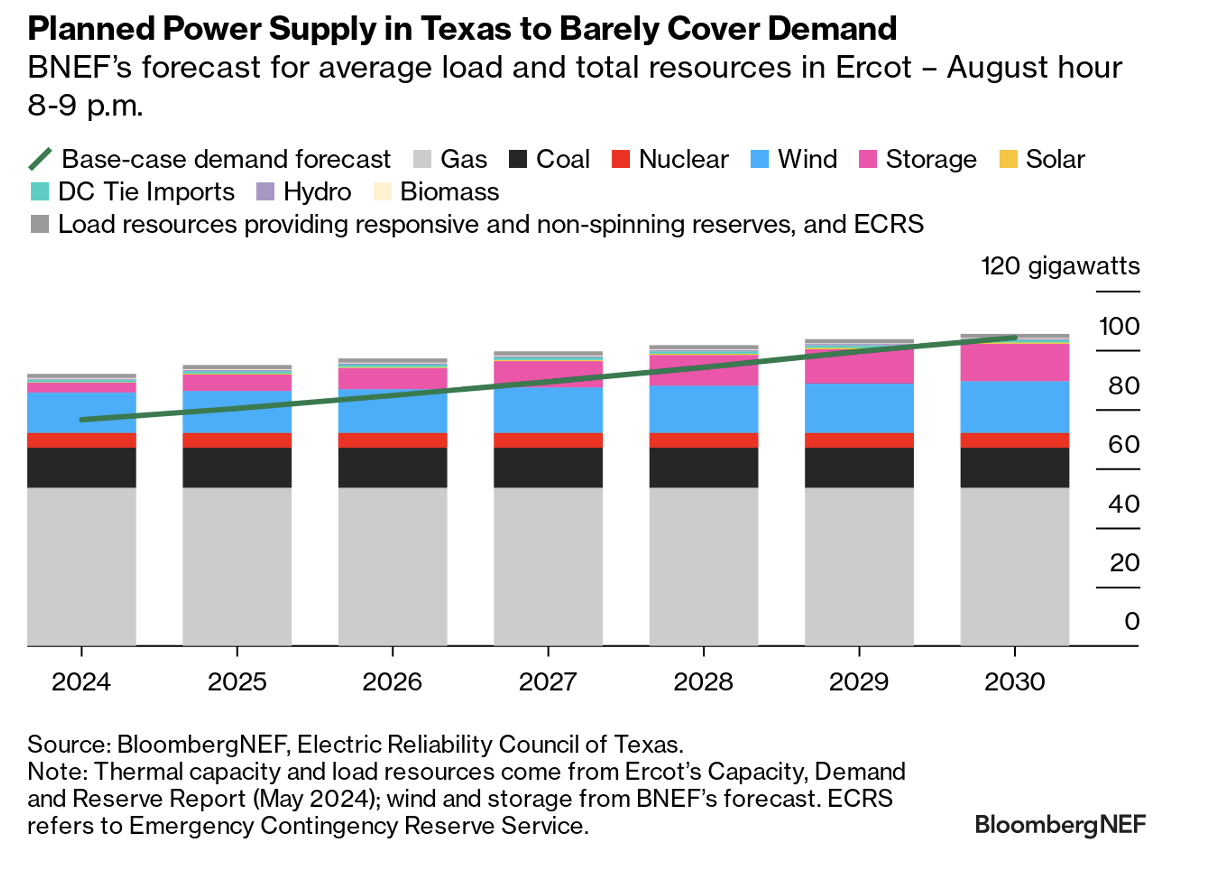

This load growth is on track to outstrip the rate at which new renewables plug into the grid. Ercot’s planned supply is barely enough to meet BNEF’s base-case demand forecast, especially during peak hours on summer days when solar fades.

The reserve margin – the ratio of total supply capacity to demand – is expected to drop from 20% in 2023 to just 1% by the end of the decade. To meet the forecast demand, new gas plants or batteries paired with renewables must come online. Beyond peak hours, BNEF sees annual gas- and coal-fired generation increasing to meet the load growth.

Did someone say data centers?

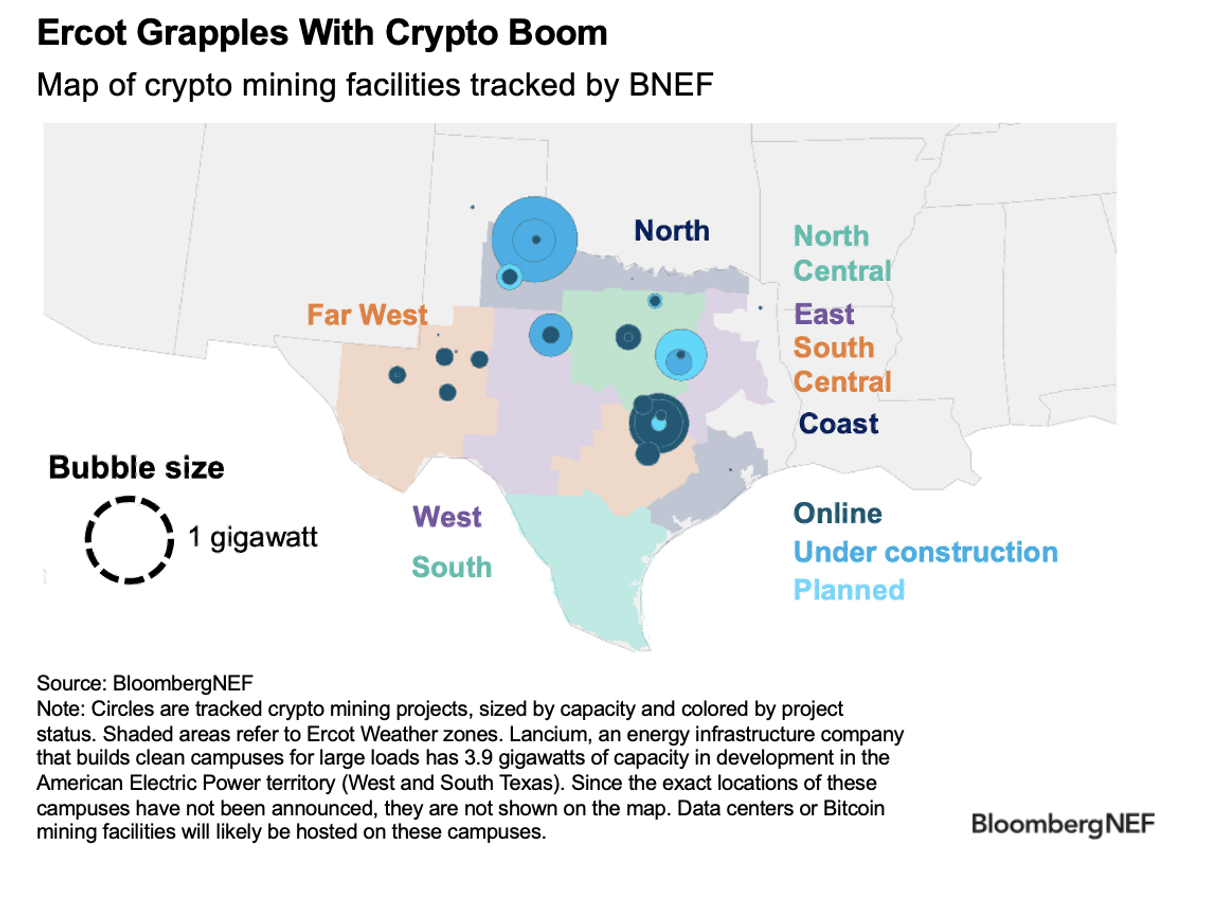

Texas faces a critical challenge in meeting the electricity needs of its rapidly expanding industries. Residential demand is set to take a backseat to booming new around-the-clock load from industrials, driven by the electrification of oil and gas production in the Permian Basin, and a data center boom to power crypto mining and artificial intelligence.

Flexible cryptocurrency mines, a niche type of data center, add even more complexity to the grid. While Bitcoin mines are estimated to make up just 16% of demand by 2030 in BNEF’s outlook, the impact on power prices could be significant, potentially doubling prices depending on their breakeven price.

Quack, quack Texas

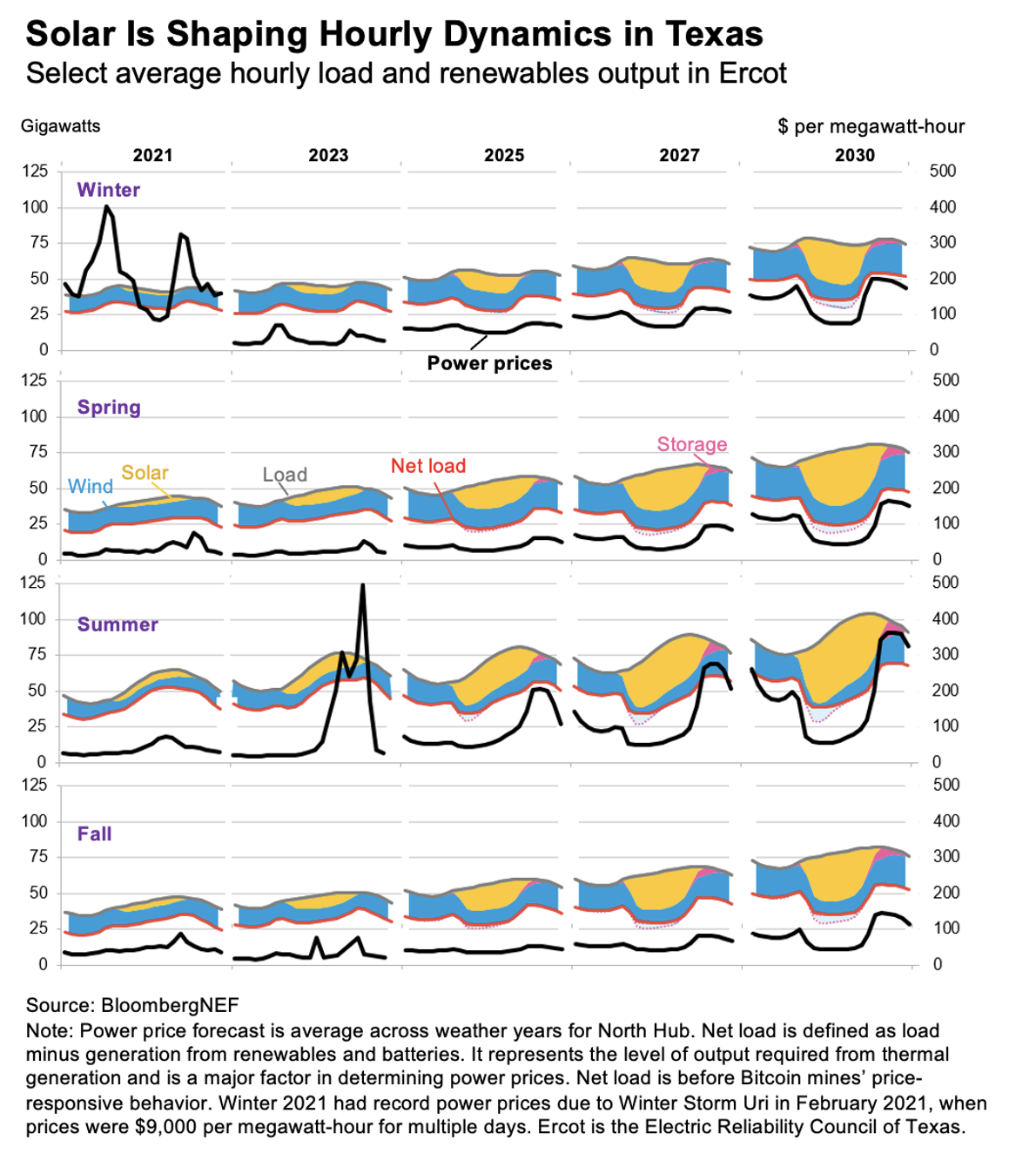

Ercot is on course to become the top US market for solar by the end of the decade, with installed capacity expected to triple. As wind and battery storage additions lag, solar will increasingly shape Ercot’s hourly power prices.

Prices will be consistently crushed at midday and peak when the sun sets. The shape of Ercot’s net load, which reflects the hourly difference in demand and renewables, will soon start to resemble California’s signature “duck curve”.

The solar-driven depression, coupled with industrial load’s around-the-clock profile, will result in on-peak prices between 6 a.m. to 10 p.m. becoming cheaper than off-peak prices in 2026. Wind will have the strongest merchant revenues of clean power, thanks to their strong night capacity factors soon being in sync with premium off peak prices.

BNEF clients can access the full report here.