By Julia Attwood, Industrial Decarbonization, BloombergNEF

Producing the materials needed for the infrastructure and objects we use every day accounts for more than 20% of global emissions. These are some of the most difficult industries to decarbonize, as we have few ready options to replace the coal, gas and oil they typically use as fuel and feedstocks. Over the next six years hydrogen, carbon capture and electrification will need to be tested and scaled, as industrial emissions must drop dramatically from 2030. Applying new technologies will increase costs, but not astronomically. Many net-zero routes for steel, aluminum and petrochemicals incur cost premiums of around 50% or less, and some could deliver cost savings in the future. This is lower than reported premiums in other hard-to-abate sectors like sustainable aviation fuels and would have a minimal effect on most end-use products. Green premiums, carbon prices or subsidies will still be needed to level the playing field and ensure that new, clean capacity comes online as quickly as possible.

BloombergNEF’s newly published ‘2024 Levelized Cost of Net-Zero Materials’ report shows the cost of green steel, petrochemicals and aluminum in 2024, 2030 and 2050, for 12 regions globally. It is based on our proprietary levelized cost models for materials, where clients can change the inputs to the models to create their own scenarios. These are available to download for clients here: steel, chemicals and aluminum.

Steel has some of the most competitive green options

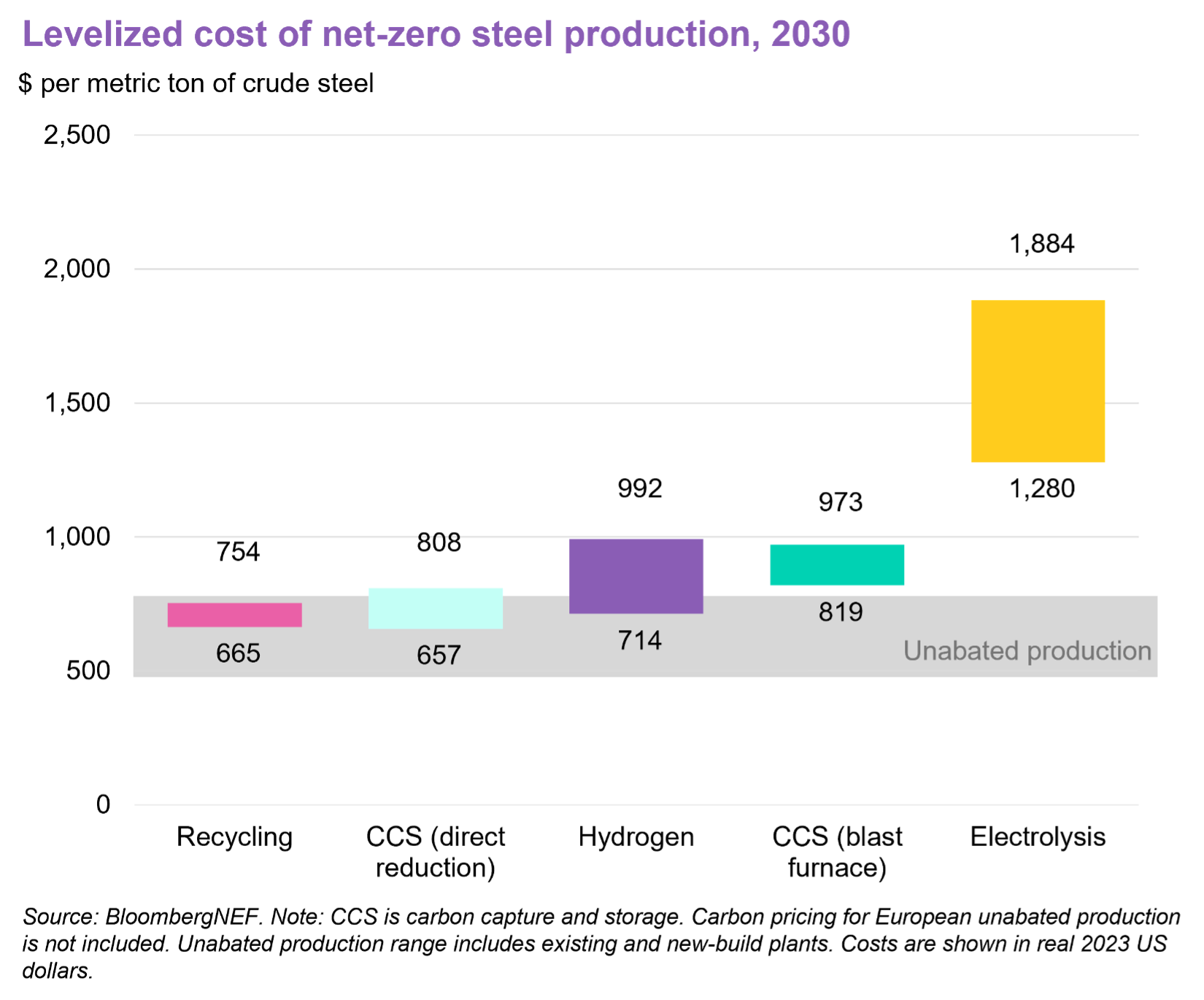

By 2030, falling clean fuel costs, carbon prices in Europe and subsidies in the US mean that some net-zero steel production can compete with the highest-cost unabated production. On average, green steel costs 66% more to produce than existing production routes in 2030, falling to 39% by 2050. Low-carbon production never outcompetes the cheapest existing plants but can become a competitive option compared to building a new coal-fired plant. Gas-fired direct reduction plants are already cheaper than coal plants and can be designed to use carbon capture at a lower cost than blast furnaces.

Local resources have a large influence on which production route is the most expensive. In China and South America, where hydrogen costs could be among the lowest in the world, building new hydrogen-based steel plants is cheaper than retrofitting carbon capture onto existing coal-fired blast furnaces by 2030. Conversely, where we expect hydrogen costs to be very high, such as in Japan, using carbon capture on existing blast furnaces is the lower cost option. For steel recycling, scrap prices, rather than electricity prices, determine the cost. Regions with well-developed scrap supply chains can produce cheap green recycled steel today. Electrolysis is an early-stage technology that will take time to scale and will still be expensive in 2030. Only regions with low-cost firm clean power will be able to use it competitively.

Subsidies can make green petrochemicals competitive in the US

Decarbonizing petrochemicals is complex, with many combinations of low-carbon feedstocks and cracking technologies available. For feedstocks, fossil-based naphtha from oil can continue to be used, if carbon capture is used to abate the refining emissions. Bio-based naphtha made from used cooking oil or oil seed crops is a drop-in substitute for fossil feedstocks, but is more expensive and limited in supply. Plastic waste that has been chemically recycled back into naphtha is the highest cost feedstock option. These feedstocks then need to be cracked to produce the ethylene, propylene and aromatics used to make plastic. This can be done in new, electrically powered crackers or rotodynamic reactors running on clean power, or in crackers running on blue hydrogen or using carbon capture to abate its emissions. Bio-naphtha is a carbon sink and can be used in an unabated cracker to offset its emissions.

Green petrochemicals would be, on average, 45% more costly to produce in 2030. However, subsidies from the US Inflation Reduction Act can make petrochemicals abated with carbon capture cheaper than unabated production. US costs represent the low end of the ranges above. Costs vary significantly between feedstocks. Using fossil naphtha, with its production abated by carbon capture is always the lowest-cost option and the most scalable, so long as CO2 transport and storage is available. Both bio-based and recycled naphtha are reliant on waste products with highly distributed supply chains. This makes them expensive and difficult to produce at scale. We expect both to be blended into naphtha crackers, but rarely used to provide 100% of the feedstock.

Electrifying crackers is a popular option in Europe, where there are several pilot projects testing both technologies. They have the added advantage of being more efficient, both in terms of energy and feedstock use. In North America, where there are existing CO2 pipelines and storage sites, petrochemicals producers have focused on carbon capture and blue hydrogen. These plants allow faster deployment of net-zero production with mature technologies.

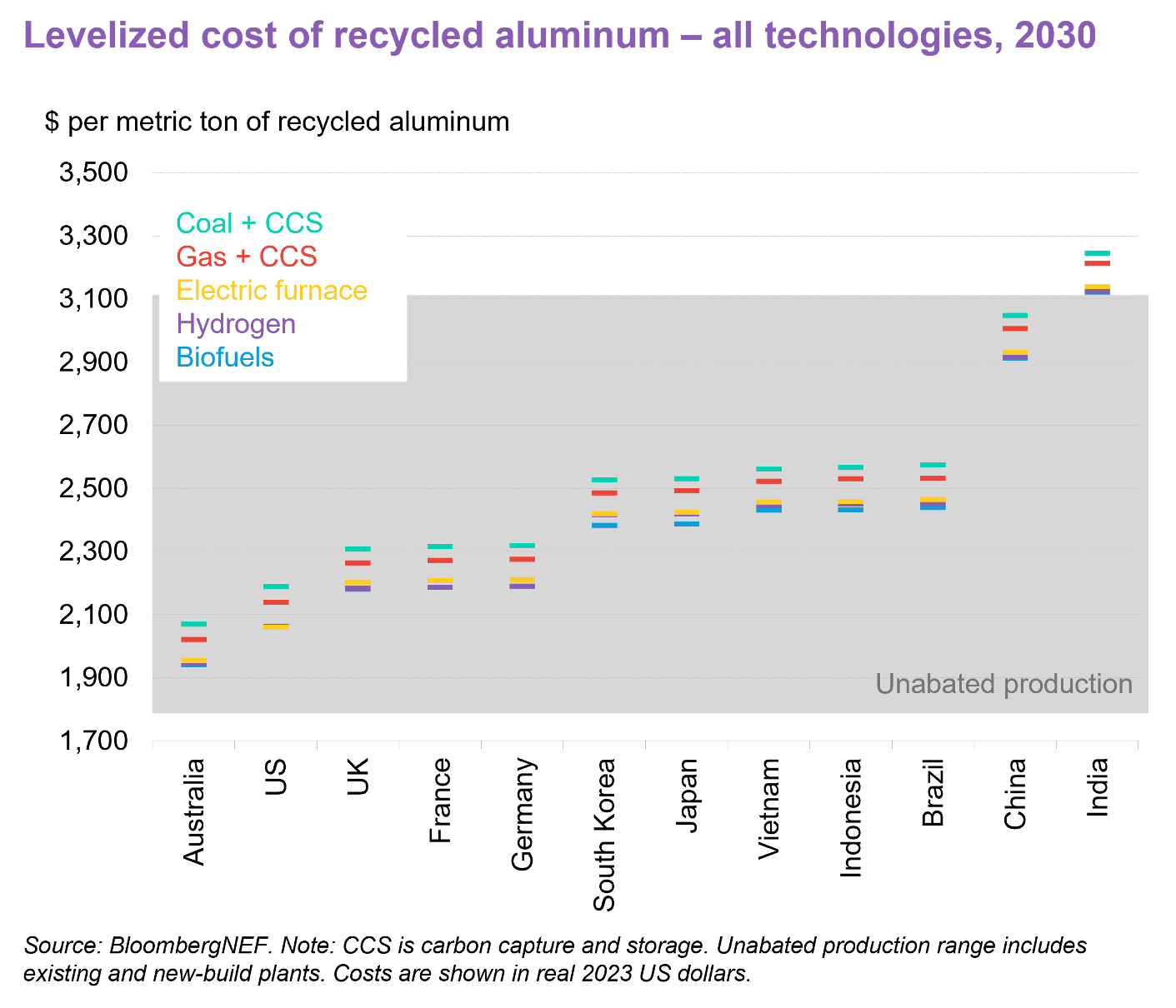

Recycled aluminum offers a green product at a small premium

The cost of net-zero recycled aluminum changes very little between 2024 and 2050. Most of the cost declines over this time happen in clean fuels, but it is scrap prices that dictate the cost of recycled aluminum. The aluminum scrap market is mature and we expect little change in scrap costs in real terms. However, there is a huge range in scrap prices between regions, from Australia at the low end, where a lack of any domestic aluminum recycling means there is no demand for scrap, to India, where large amounts of aluminum scrap are imported from other countries. This difference in scrap price creates a large unabated production cost range.

Recycled aluminum already has a much lower carbon footprint than making new aluminum. It can be fully decarbonized by switching gas or coal for biofuels or hydrogen, using an electric furnace, or applying carbon capture to fossil-based plants. Biofuels, hydrogen and electrification compete for the lowest costs, but on average, decarbonizing aluminum recycling only incurs a very small cost premium, below 10%. Many countries are beginning to see their scrap reserves as strategic and are considering export bans in order to take advantage of this relatively low-cost, near-term option for decarbonization.

BNEF clients can read the full report here.