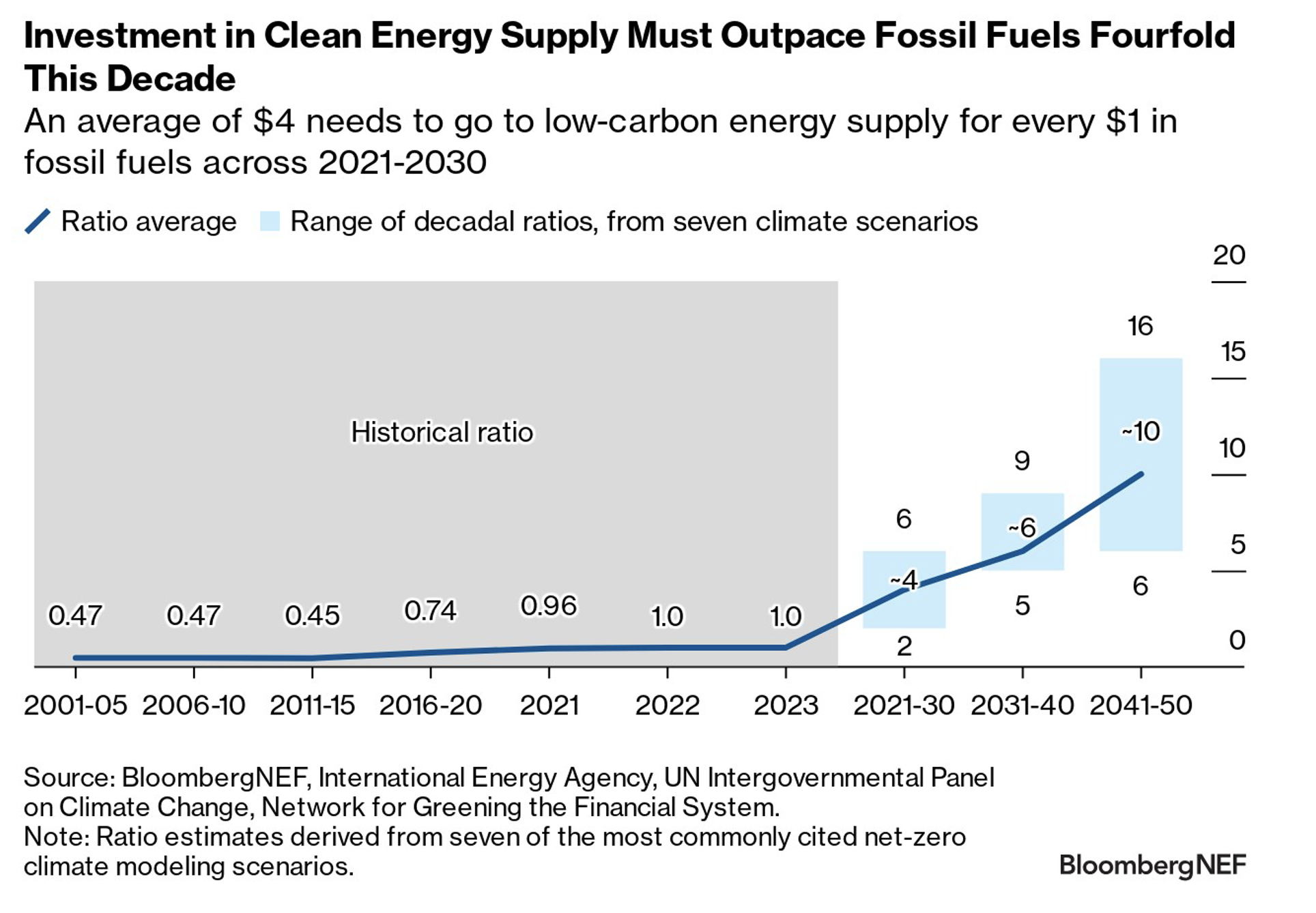

Getting on track to limit global warming to 1.5C hinges on investment in low-carbon energy supply averaging four times the capital directed towards fossil fuels this decade. That’s significantly higher than the 0.73-to-1 ratio of bank-facilitated financing at the last count in 2022.

The balance required in the real economy over the coming years – known as the Energy Supply Investment Ratio – is based on BloombergNEF analysis of commonly referenced climate scenarios from intergovernmental institutions such as the International Energy Agency. It’s seen reaching as high as 10-to-1 in the 2040s.

As the urgency to cut emissions grows, the pace at which the world can phase down its reliance on fossil fuels will be determined by the speed at which money flows to build out clean energy infrastructure to meet rising energy demand. Banks can both accelerate and profit from this transition by expanding their expertise and financing volumes with low-carbon energy companies, and tapering support for fossil fuels.

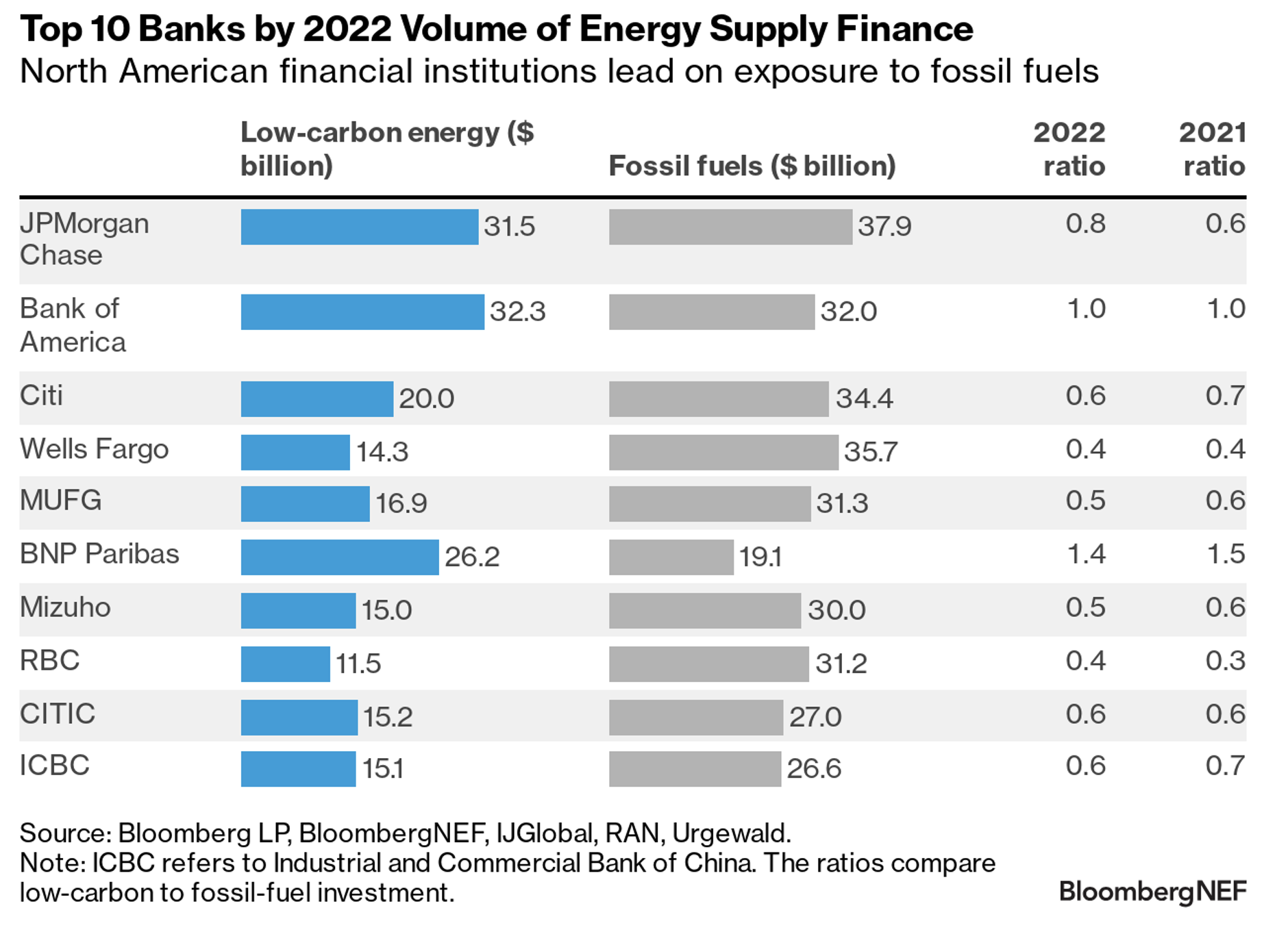

But this must be done alongside benchmarking their business activity against the real economy, their peers and the near-term outlooks to 2030 of credible climate scenarios. Having facilitated $0.73 toward low-carbon energy supply for every $1 directed to fossil fuels in 2022, this was short of the 1-to-1 ratio of investment seen in the real economy.

The Energy Supply Banking Ratio often varies between institutions based on their existing client base, regional emphasis and business to date. North American banks, for example, have an average ratio of 0.6-to-1, reflecting the region’s large oil and gas production footprint. Banks in energy-importing Europe, by contrast, finance on average 1.8 times as much low-carbon energy supply as fossil fuels.

Ratio lens gains traction in climate finance disclosure

While the Energy Supply Banking Ratio developed by BNEF was once one of the few estimates of this metric, several banks, including Citigroup Inc., JPMorgan Chase & Co. and Royal Bank of Canada, have now committed to disclose their own ratios of low-carbon to fossil-fuel financing activities.

Publishing this metric will help investors gauge the climate progress of banks in their portfolios. It can also be used as an internal strategy tool as banks chase the opportunities created by the energy transition.

Individual institutions may choose different methodologies when calculating and disclosing their energy supply ratios to best reflect their unique business models. BNEF’s Energy Supply Banking Ratios Implementation Guide helps banks frame the choices they make as they design this ratio. It will also assist investors and other stakeholders in parsing the forthcoming bank disclosures and understanding discrepancies between these figures and those BNEF publishes.

Download BNEF’s Energy Supply Banking Ratios Implementation Guide.