By Antoine Vagneur-Jones and Stephanie Muro Padilla, Trade and Supply Chains, BloombergNEF

Today’s clean technology supply chains are dominated by China, but that may change if factory investments take off elsewhere. Policymakers across the world are wielding subsidies and engaging in outright protectionism in a bid to expand their countries’ manufacturing capabilities.

Attempts to make up the lost ground could foster more resilient supply chains and political support for decarbonization. However, the drive to localize marks a departure from the unfettered free trade of recent years. If successful, shifting to regions with costlier production will inflate the total cost of the energy transition.

BNEF View

Clean technology manufacturing is heavily concentrated in China – for everything from solar power to lithium-ion batteries. That won’t change overnight as China continues to host the overwhelming majority of newly commissioned factories. But the Inflation Reduction Act has catapulted the US to the fore of the race to localize clean tech, notably by extending generous subsidies to technology producers.

The US is not alone in wanting to onshore manufacturing. Plans to set up local clean-tech factories are afoot in geographies as different as the European Union, India, Mexico and Indonesia. Policy competition is emerging as, for instance, European battery makers petition the EU to match the production incentives now offered by the Biden administration.

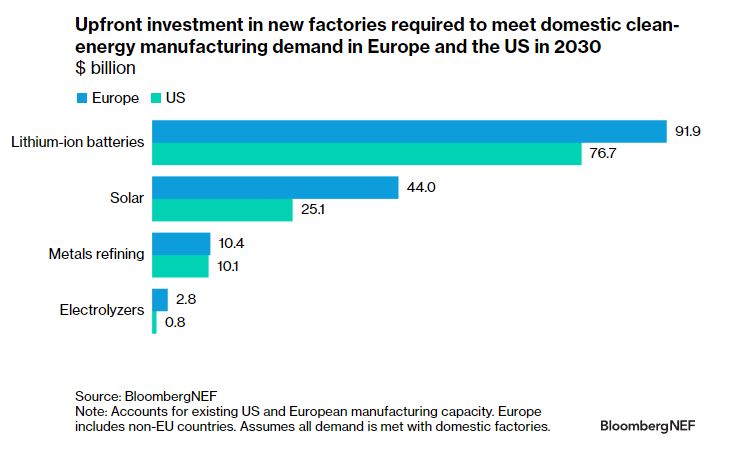

Trade flows will evolve as supply chains for highly traded products such as solar panels and batteries are recalibrated. But this reorganization won’t be cheap. Europe would need to invest an estimated $149 billion in manufacturing plants to meet 100% of its clean energy demand locally by 2030, according to BloombergNEF. The actual share will be significantly lower, but hints at the volume of investment required to make a difference.

Factory construction and operational costs vary considerably across regions, as does the availability of manufacturing equipment, input materials, skilled labor and government funding. Yet it’s not just about building factories. Replicating the vast, vertically integrated manufacturing ecosystems present within China will take determination and time.

Onshoring production would diversify value chains, strengthen political buy-in and create more local value. But it also involves replicating today’s lean, efficient global supply chains. Localizing in regions where production costs are high – the intention of policies like the Inflation Reduction Act – makes for more expensive clean energy equipment and projects, pushing up the energy transition’s total bill.