By Sunny Park, BloombergNEF

Encouraging already green sectors like renewable energy to expand is just one piece of the puzzle in achieving net-zero emissions targets. Polluting industries must also be brought along for the ride and be able to secure the capital needed to drive their shift to a cleaner future.

This is where “transition finance” can come in – a term that has a rather nebulous definition within the financial community right now, but can be used to describe an asset class that funds technologies bridging the gap between current carbon-intensive practices and future carbon-free activities. China, in particular, could lean on this type of financing, as carbon-intensive sectors like steel and cement generate as much as 84% of the country’s emissions, according to the International Energy Agency.

The broader universe of sustainable finance is widely seen as a way to fund the energy transition, dominated by green bonds to date. While China is the global leader for green bond issuance, with nearly $56 billion sold in the first half of this year, this capital can only be raised for strictly green projects and activities (at least in theory). These debt instruments are therefore less open to the petrochemicals, cement, metals and mining, and other heavy industry sectors that contribute to 40% of the country’s GDP.

But China’s ambition to peak emissions before the end of the decade on the way to becoming carbon neutral ahead of 2060 will only be achieved if these polluting industries can enhance their energy efficiency and adopt low-carbon technologies and processes. With this in mind, the government, financial system and corporations are increasingly turning their attention to transition finance.

Ma Jun, the former chief economist at the People’s Bank of China, pointed to a possible boom to come for transition finance in China in an interview with Bloomberg News earlier this year. “The potential for transition finance is bigger, and transition finance activities will grow faster than traditional green finance,” he said.

China among the leaders in a small but growing market

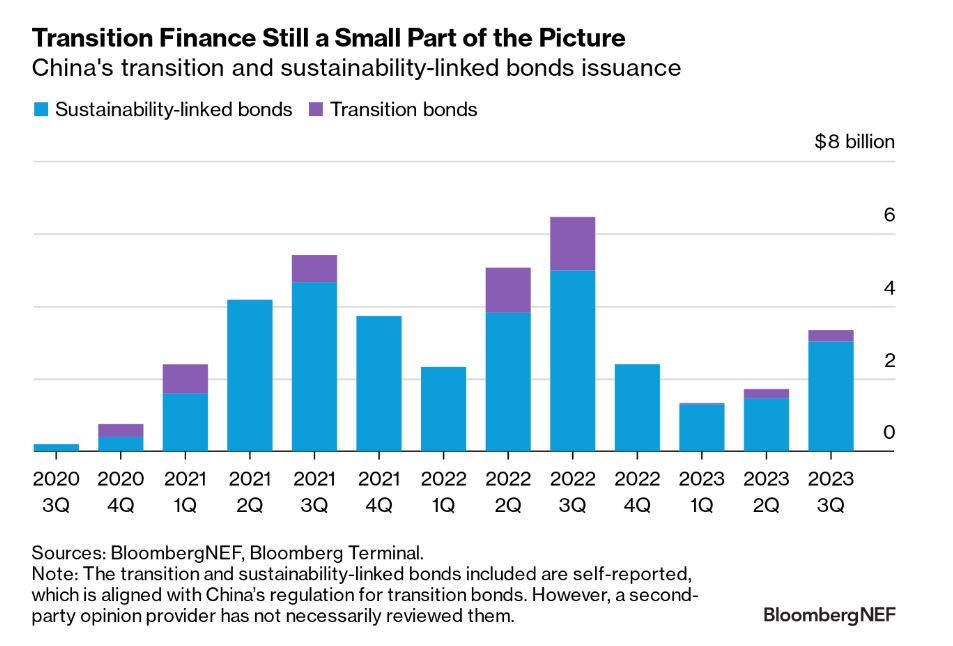

The world’s first transition bond was issued by Hong Kong power company Castle Peak back in 2017, to the tune of $500 million. Since then, the market has reached a high of $2.4 billion of annual issuance in 2021, although activity has been lumpy.

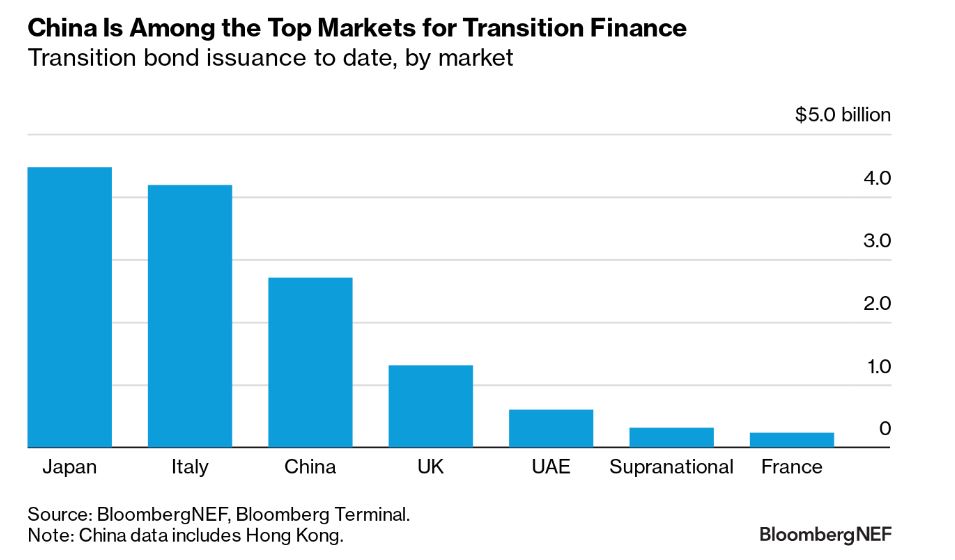

A small number of economies are taking the lead. Japanese institutions are out in front, accounting for a third of the $14 billion of transition bonds issued since 2019, with Italy and China close behind.

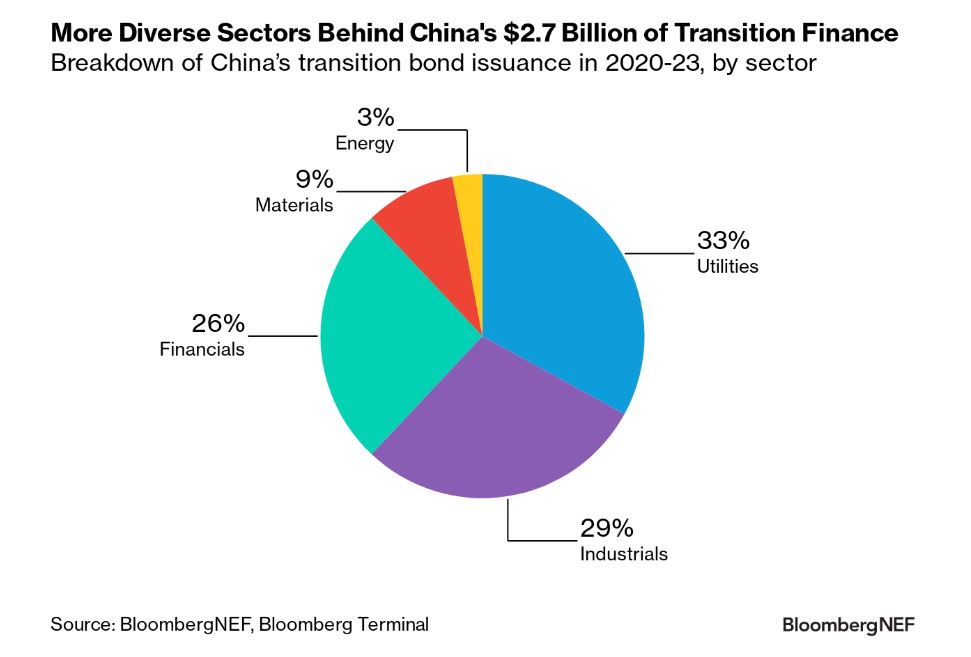

Globally, transition finance is predominantly raised by utilities, with a primary focus on integrating cleaner energy into the grid. While these types of companies are also the most prominent issuers in China, a broader spectrum of sectors are involved there, most notably financials and industrials. Additionally, state-owned enterprises and provincial governments dominate these transactions, including the likes of Wuxi Huaguang Environment & Energy Group, Huaneng Power International, and Shandong Iron and Steel Group.

The market is still nascent, however, in both China and elsewhere around the world. Issuance of more established sustainability-linked bonds far exceeds that of bonds explicitly labelled “transition”. Transition finance deals have totaled just 1 % of global sustainable debt issuance so far in 2023. Sustainability-linked instruments are part of transition finance too, as they put environmental or social targets on the issuer, rather than confine the use of capital to certain activities.

The challenge of “transition-washing”

Many investors remain cautious about this newer debt instrument due to concerns about the specificity and ambition of issuers’ targets, and the intended use of proceeds – a dilemma known as “transition-washing”. Transition finance, by virtue of its broad scope, can be less stringent in defining what projects and activities fit the bill, which could compromise the environmental integrity of these bonds.

Transition finance extends beyond a label that characterizes an activity or company at a given moment. It should help an organization align with the goals of the Paris Agreement and national emissions targets, and drive the adoption of innovative technologies. This hinges on a robust and transparent system of data reporting around issuers’ climate transition strategies, governance and progress on their emissions profiles.

To achieve this, governments should encourage heavy emitters to set ambitious transition targets, publish plans with science-based measurements, and report progress regularly. This approach empowers stakeholders and communities to assess outcomes, promotes responsible corporate behavior and allows investors to provide capital with confidence.

There are frameworks designed to set some boundaries. The International Capital Market Association developed a Climate Transition Finance Handbook recommending issuers of transition finance should have science-based climate targets and be transparent about their investment program, among other criteria. Meanwhile, in China, the central bank has taken the lead on researching and outlining the basic principles of transition finance, a crucial step to prevent transition-washing.

According to the Climate Bonds Initiative, the People’s Bank of China plans to introduce sector-specific transition finance standards initially covering steel, thermal power, construction materials, and agriculture. These could be expanded to other sectors, encouraging more capital to flow into decarbonizing industry.

Learn more about transition finance

The role of transition finance in China will be discussed at the BNEF Summit Shanghai, due to take place across November 27-28, 2023. For more analysis of developments and the market outlook for transition and sustainable finance, BNEF clients can read:

2H 2023 Sustainable Finance Market Outlook

The Climate Transition Finance Handbook from ICMA: Review

Decoding the Illegible Transition Finance Lexicon