At the beginning of each year, we pause to reflect on what has happened in our industry and gather our thoughts on what to expect in the coming 12 months. These 10 trends highlight what we think will be some of the most noteworthy developments in energy storage in 2023.

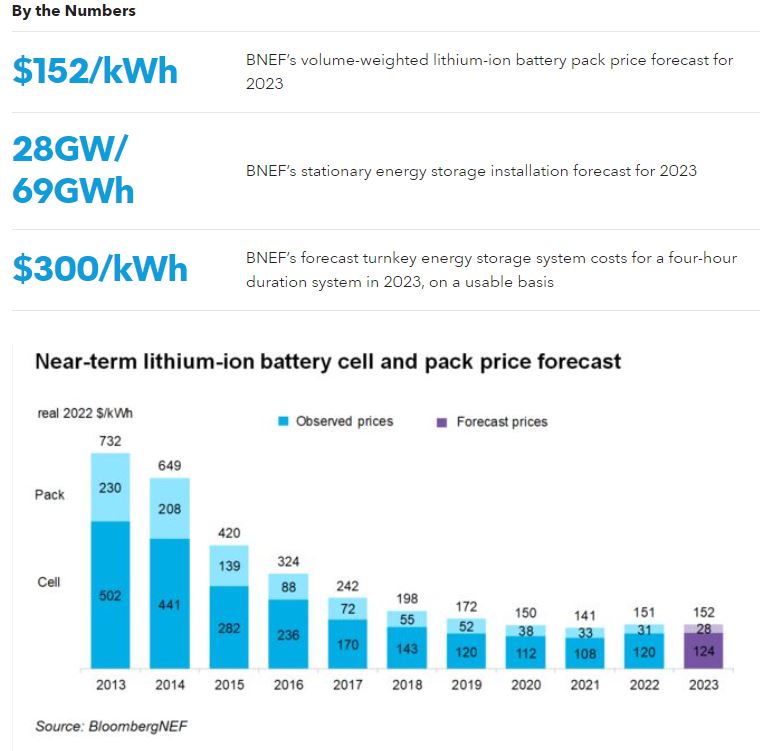

- Lithium-ion battery pack prices remain elevated, averaging $152/kWh. In 2022, volume-weighted price of lithium-ion battery packs across all sectors averaged $151 per kilowatt-hour (kWh), a 7% rise from 2021 and the first time BNEF recorded an increase in price. Now, BNEF expects the volume-weighted average battery pack price to rise to $152/kWh in 2023. Lithium and nickel prices will also remain high in the coming year, given the uncertainty surrounding China’s reopening post-Covid Zero policy and the continued disruption to metal supply chains caused by Russia’s war in Ukraine.

- Volatility in supply, demand and prices continues, although lithium prices may start easing with new supply. In the second half of 2022, battery metals were buffeted by events around the world: Russia’s war in Ukraine intensified, China’s battle with Covid wouldn’t go away, inflationary pressures built and fears of recession grew. Yet a rally in metals prices persisted throughout most of the year, and the long-term outlook is bullish (despite signs that a short slowdown in metals demand may be imminent). While we’ll be watching all battery metals in 2023, we focus here on lithium, given its price throughout the second half of 2022.

- Announcements from a large battery maker and a two- or three-wheeler manufacturer give sodium-ion batteries a boost. Sodium-ion batteries, still in their infancy, are beginning to scale up. An alternative to lithium-ion batteries, sodium-ion battery technology offers could alleviate battery-market pressures — and potentially push down costs — as soon as 2026. For 2023, we speculate that at least one major battery manufacturer will come out with a significant sodium-ion battery product roadmap announcement. In addition, we think that two major energy storage system (ESS) products will be launched and that at least one large-scale two- or three-wheeled-vehicle company will announce a vehicle model powered by sodium-ion batteries.

- Solid-state batteries progress, with new announcements potentially adding more than 40GWh. Solid-state batteries have become the most promising technology for pushing cell-level energy density up to 500 watt-hours per kilogram and driving battery prices down in the second half of the decade. Several leading battery manufacturers, like LG Energy Solution, CATL and SK, as well as startups like Solid Power, Prologium and Quantumscape, have laid out clear roadmaps to commercialize solid-state batteries within this decade.

- US Inflation Reduction Act guidance is released, leading to more than $80 billion in new investments for the battery supply chain. The Inflation Reduction Act (IRA) was signed into law by US President Joe Biden on August 16, 2022, injecting at least $369 billion into the country’s clean energy economy. With a good chunk of cash going to the power sector and electric vehicles, the law represents the largest effort yet to strengthen the battery supply chain in the US. Under the ‘Advanced Manufacturing Production Credit’ and ‘Clean Vehicle Credit’ sections, the law introduced a variety of credits to support the domestic supply chain, from raw materials to battery cells, modules, electric vehicles (EVs) and energy storage.

- A weakened battery position forces the EU to rethink incentives. As the North American battery supply chain enjoys an IRA boost, European battery players will likely pressure the EU to offer new incentives, too. BNEF will be watching for the EU’s response, which may include new subsidy schemes for domestic manufacturing and ‘buy European’ requirements for local content. Facing waning enthusiasm for local battery-making, Europe will be under pressure to loosen state aid rules (EU competition rules that restrict subsidy spending at a country level rather than through the EU), ease permitting and potentially allocate additional EU funds toward the battery supply chain.

- As policies regulating raw material origination take hold in the EU and US, the Chinese battery supply chain devises creative workarounds. Chinese companies will be closely watching the rollout of IRA guidance, with a special eye to the regulation of critical minerals and battery components — and the definition of ‘foreign entities of concern.’ Ford and CATL are rumored to be considering building a battery manufacturing plant in Michigan, US, in a complex arrangement that would allow the facility to reap tax benefits while respecting the terms of the law. (Ford would own the facility while CATL would operate it.) Such creative workarounds will become increasingly likely among Chinese companies, especially among those that are interested in expanding into the US.

- Energy storage system costs stay above $300/kWh for a turnkey four-hour duration system. In 2022, rising raw material and component prices led to the first increase in energy storage system costs since BNEF started its ESS cost survey in 2017. Costs are expected to remain high in 2023 before dropping in 2024.

- The energy storage system market doubles, despite higher costs. The global energy storage market will continue to grow despite higher energy storage costs, adding roughly 28GW/69GWh of energy storage by the end of 2023. In gigawatt-hour terms, the market will almost double relative to 2022 installations. (In October 2022, BNEF estimated 16GW/35GWh would be installed by the end of the year.)

- Pumped hydro makes a comeback, attracting more investment than other long-duration storage technologies. Despite long lead times, BNEF is taking a stance that investors and policymakers will be banking on pumped hydro energy storage in 2023. We speculate that this may lead to more committed investments towards pumped hydro than for other long-duration energy storage technologies this year.