By Miquel Kishimoto Guardiola, Sustainable Finance Research, BloombergNEF

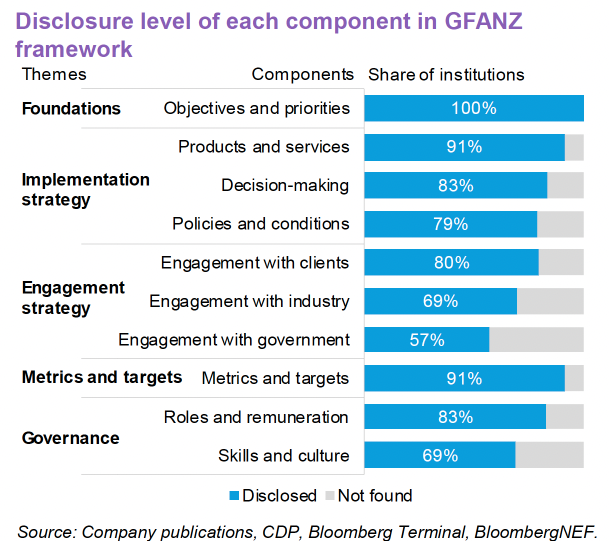

Leading financial institutions have started to take comprehensive steps to plan for a net-zero transition, and those efforts are gaining momentum. At least 42% of institutions in sector alliances under the Glasgow Financial Alliance for Net Zero (GFANZ) have disclosed all 10 components of the GFANZ transition plan framework.

Many of the goals and commitments aren’t detailed in a single place. This note delivers a review of disclosures across sources and compares them with a consistent framework. It reveals the full extent of transition planning disclosures and highlights areas needing further attention.

Download the summary report here.

- Some

77% of institutions have reported across the broader five themes

. This underscores the ambition of financials to embed net-zero principles in their activities.

- These themes enjoy structural similarities with conventional climate disclosures. They often bury in the details the forward-looking elements of transition planning.

- We have identified

12 additional elements that encapsulate the unique aspects of a transition plan

. Those include key transition financing strategies and portfolio emissions targets, which show an entity’s intention and approach. Disclosure levels averaged only 56% across these additional elements.

- The

number releasing stand-alone transition planning documents has tripled to 230 since the start of 2023

. We looked at documents with titles including the words “transition plans” or “net zero strategy”, among others.

- We also capture information from other dispersed sources such as company and alliance websites to obtain the

fullest possible picture of transition planning

.

- The analysis in this report covers a universe of

over 600 GFANZ sector alliance members

participating in the Net Zero Asset Managers initiative, Net-Zero Banking Alliance, Net-Zero Asset Owner Alliance and the Paris Aligned Asset Owners.

For institution-level results, BNEF clients can access the full report”Tracking Climate Transition Plans in the Financial Sector” here.