Targets require leading companies to cut equivalent of quarter of today’s global GHG emissions by 2050

New York, September 24, 2021 – Through August, 111 of the Climate Action100+ 167 “focus companies” have set a net-zero or equivalent target, pledging to fully reduce and/or offset their emissions at a level equivalent to what they emit annually, according to new analysis from research company BloombergNEF (BNEF). These focus companies have been deemed the world’s heaviest emitting, accounting for over 80% of global industrial greenhouse gas emissions.

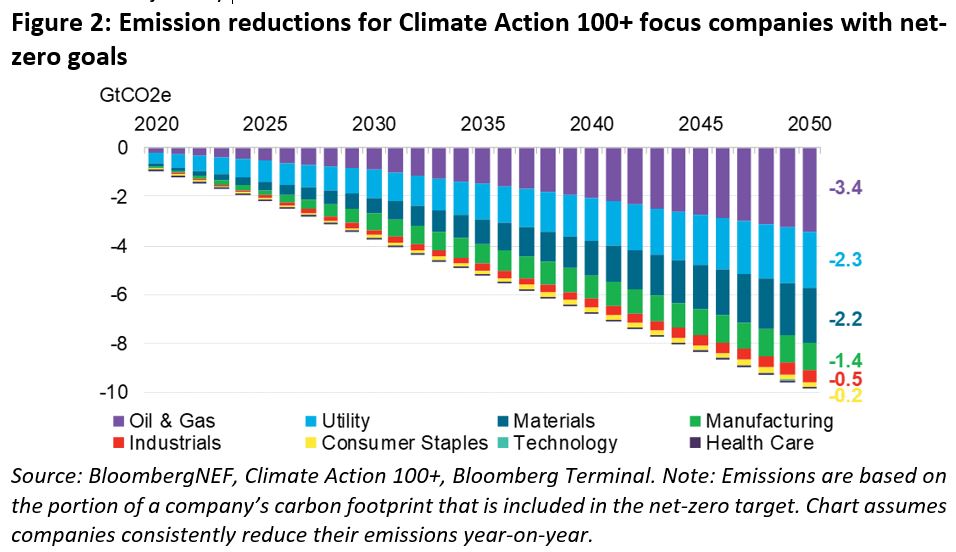

BNEF estimates that in 2030, the net-zero targets set by these 111 focus companies will reduce greenhouse gas emissions by 3.7 billion metric tons of carbon dioxide equivalent (GtCO2e) annually. This increases to 9.8 billion metric tons by 2050 – just short of China’s current annual emissions and equivalent to over a quarter of global greenhouse gas house emissions today.

Kyle Harrison, head of sustainability research at BNEF, said: “As more net-zero targets are set by corporations, the conversation will change from one focused on quantity to one around quality. Companies will be under the microscope for the path they take to achieving net zero emissions. The winners will be the ones that will – and already do – address their entire value chain, focus on tangible emission reductions and turn a net zero strategy into a new business opportunity.”

The oil and gas sector will represent over a third, or 3.4GtCO2e, of these planned emission reductions, more than any other sector. European oil majors like Shell, Total and BP have pledged to achieve net-zero emissions by 2050 and have already made some progress as they diversify their business into low-carbon activities.

Alongside investor pressure, these targets have also been influenced by decarbonization targets set by the oil majors’ major customers. Airlines like Delta, American and Qantas, as well as petrochemicals companies like BASF and Dow – all of which are sources of large oil demand – have set net-zero targets of their own and are also Climate Action 100+ focus companies. Utilities (2.3GtCO2e), materials companies (2.2GtCO2e) and manufacturing (1.4GtCO2e) are the next largest sectors set to reduce their emissions. Utilities in particular have cut their emissions in recent years as they’ve integrated more clean energy into their generation portfolios.

Just as interesting are the heavy emitters that are yet to set a net-zero goal. U.S. oil and gas companies like ExxonMobil, Chevron and Kinder Morgan are lagging far behind their peers in Europe, with no net-zero targets announced to date. Despite a push within the automotive sector to decarbonize, Fiat Chrysler, SAIC Motor Corp. and Suzuki Motor Corp. are target-less. NextEra Energy and Korea Electric Power Corp. are notable laggards in the utility sector.

All of these trends, as well as assessments of the quality of net-zero targets, can be found in BloombergNEF’s Corporate Net-Zero Assessment Tool. The tool looks at 500 of the world’s largest and heaviest-emitting companies, evaluating the quality of net-zero targets based on 13 different metrics. This allows investors to holistically assess the long-term climate ambitions of their portfolio companies and provides corporations with an ideal benchmarking tool as they go on their net-zero journey.

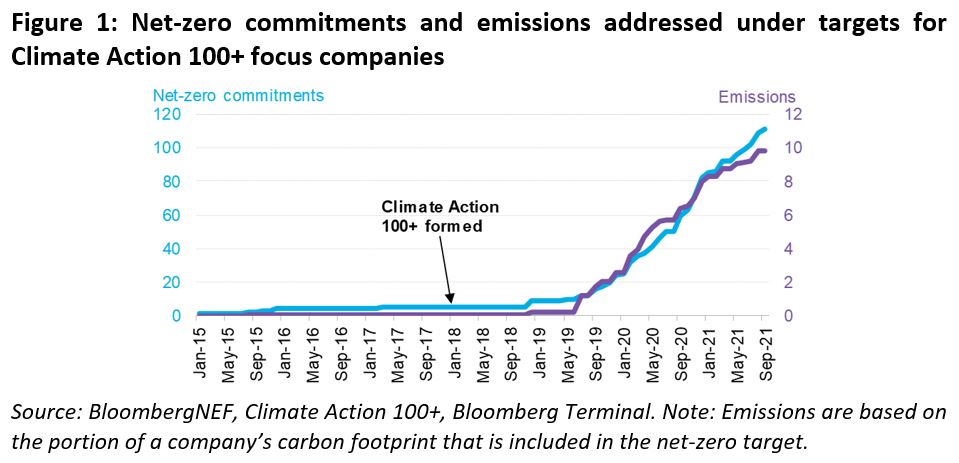

Investor pressure is a huge driver in the corporate race to net zero. Just five of the Climate Action 100+ 167 focus companies had set a net-zero target prior to January 2018 when the initiative was launched and began engaging with heavy-emitting companies. The remaining 106 targets have been set since, showcasing recent uptake. The Climate Action 100+ consists of over 600 investors that are working with their portfolio companies to cut emissions and improve climate reporting. They are specifically taking aim at the 167 focus companies.

The Corporate Net-Zero Assessment Tool is available to BNEF subscribers at BNEF <GO> on the Terminal or via the following link on the web.

Contact

Veronika Henze

BloombergNEF

+1-646-324-1596

vhenze@bloomberg.net