By Hugh Bromley, Research Manager, Food, Agriculture and Nature, BloombergNEF

Agricultural carbon markets are underappreciated and underdeveloped but “carbon farming” might change that. The term covers a variety of methods aimed at sequestering atmospheric carbon in the soil and plants, or reducing farm greenhouse gas emissions. Together, these practices hold the potential to be a key source of offset supply for the voluntary carbon market.

BloombergNEF estimates that carbon farming could produce $13.7 billion of carbon credits annually by 2050, a mix of avoidance credits, created by better managing inputs such as fertilizers and fuel, as well as more highly valued removal credits, facilitated by soil carbon sequestration. That could help lower the sector’s 8.5% share of global greenhouse gas emissions, with a further 14.5% coming from land use change, primarily to feed the growing global population.

Agricultural carbon markets may also direct much-needed capital to small farms and countries with food security issues, making it a formidable source of carbon credit supply for buyers seeking projects with social and environmental “co-benefits”.

BNEF View

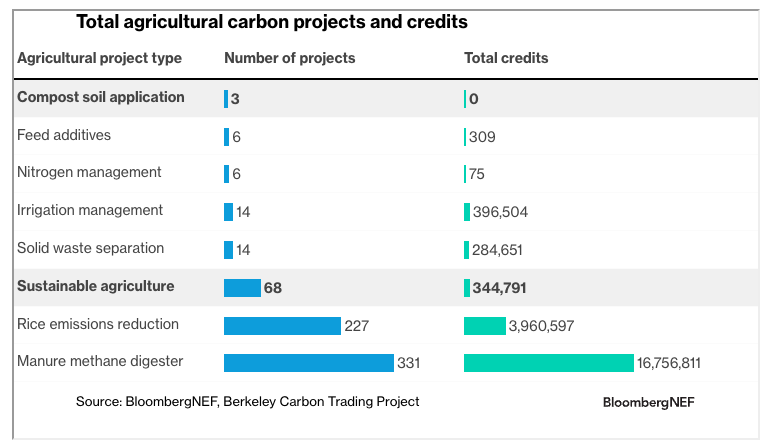

Agricultural carbon credits made up just over 1% of the 1.7 billion credits issued in the voluntary carbon market (VCM) as of 2022. These credits include both avoidance and removal credits. However, avoidance-based projects currently dominate. Only 344,800 of 22 million agriculture carbon credits were generated by projects that remove carbon and sequester it in soils.

Soil carbon is a solid form of carbon that is accumulated by plants and then stored in the soil. Soil carbon stocks have been greatly diminished by agricultural activity, releasing that carbon into the atmosphere as carbon dioxide. Soil carbon sequestration through sustainable farming practices could lock up 5 billion metric tons of CO2 equivalent per year until 2050, which is comparable to roughly 10% of annual emissions.

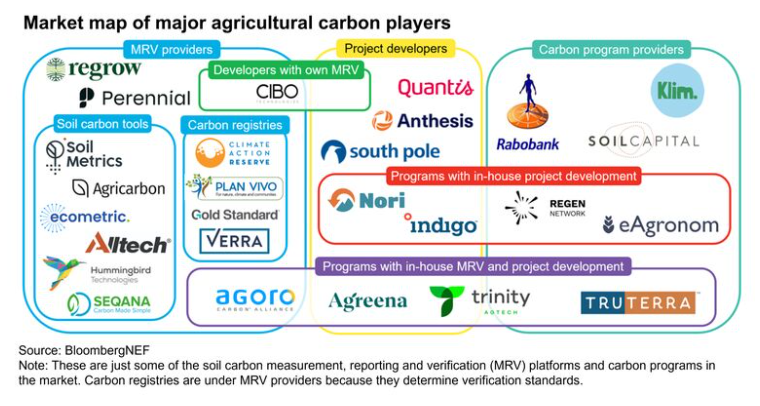

Although there is great potential for sequestration, it currently plays a minute role in carbon markets due to a lack of standards and regulation, as well as unreliable measurements. To produce robust carbon credits, soil carbon needs to be measured, reported to carbon registries, and verified by an independent third party. These three steps – measurement, reporting and verification – are collectively referred to as the “MRV” process. Agri-food giants and a consolidating field of startups are developing the technologies, tools and models needed to build confidence and scale in soil carbon sequestration.

Food and agriculture businesses such as Cargill Inc., Yara International ASA and Kellanova are turning to carbon programs to drive down the emissions footprint of their products. Insetting carbon is when a company reduces emissions using a carbon project within their supply chain and, as a result, no offset credit enters the VCM. Offsetting involves companies buying carbon credits that are not related to their supply chain to theoretically cancel out emissions caused by their operations.

BNEF clients can access related research here.