By Bo Qin, Carbon, BloombergNEF

US markets are leading a global carbon price rally, helping drive dollars to both investors in the technology and the carbon market. The price of emission allowances in Washington and California sailed past Europe and New Zealand this summer.

North American carbon prices have typically lagged many of their global peers, but the West Coast is changing that narrative. Washington state’s carbon price rallied 74% this year to an all-time high of $73.05 per ton last week. California reached a record of $37.49 per ton in July, a 24% increase since the beginning of the year.

Coastal states are building the carbon markets momentum in the US. In addition to the new markets in Washington and Oregon, New York state is in the process of developing its own program. The advantage of having a compliance carbon allowance market is that it gives the emitters a price signal to abate without dictating who should and how. The cheapest abatement option would be used first, leading to cost-efficiency. It also allows faster abaters to earn extra cash by selling surplus allowances back to the market.

Together with other state and federal policies, like the Inflation Reduction Act (IRA), a compliance carbon market can help to scale up new clean technologies including hydrogen and biofuels. BNEF’s New Energy Outlook US highlights that multiple policies are needed for the country to meet its net-zero emissions climate goal.

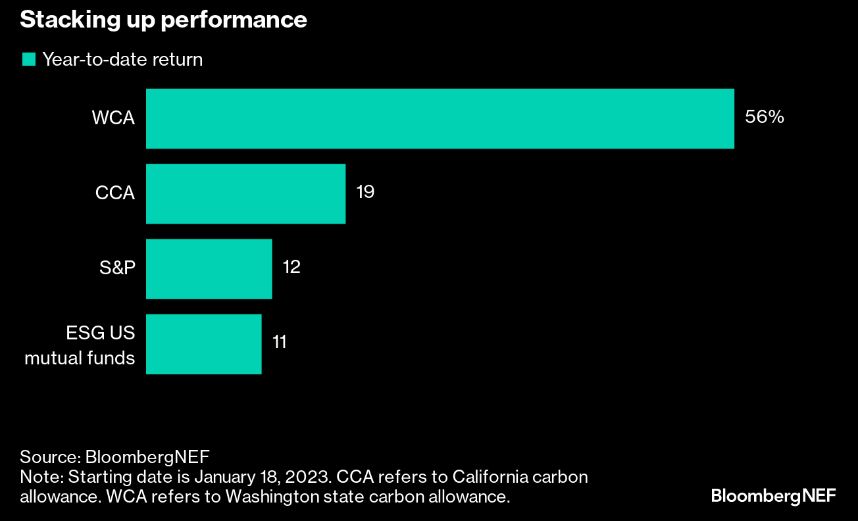

Carbon markets bind financials and regulators in a happy marriage. Investors can lower their portfolio’s carbon risks while hedging against inflation. The diversification can secure higher returns at lower risks. Most established markets also have a built-in upward price pressure due to ambitious expected supply cuts. Washington and California carbon allowances have performed better than the S&P index and most US ESG mutual funds.

Lawmakers get improved market liquidity and earlier abatement as a result of higher prices, helping them to move more funding to help the vulnerable groups reach their climate targets. Carbon markets fill the climate bank of lawmakers with auction revenues to support industries in transition and environmental justice. Taking the newest carbon market as an example, the latest reserve auction held on August 9 bumped Washington state’s total proceeds from auctions to $920 million for 2023.

There are now 35 compliance markets around the world, covering almost global 20% of greenhouse gas emissions.