The US is “at a historic inflection point […in its] global leadership in a carbon constrained world,” David Crane, Under Secretary for Infrastructure at the US Department of Energy, told the BloombergNEF Summit New York. This sentiment was echoed throughout the event by leaders of the clean energy community. For clean power, six key challenges emerged.

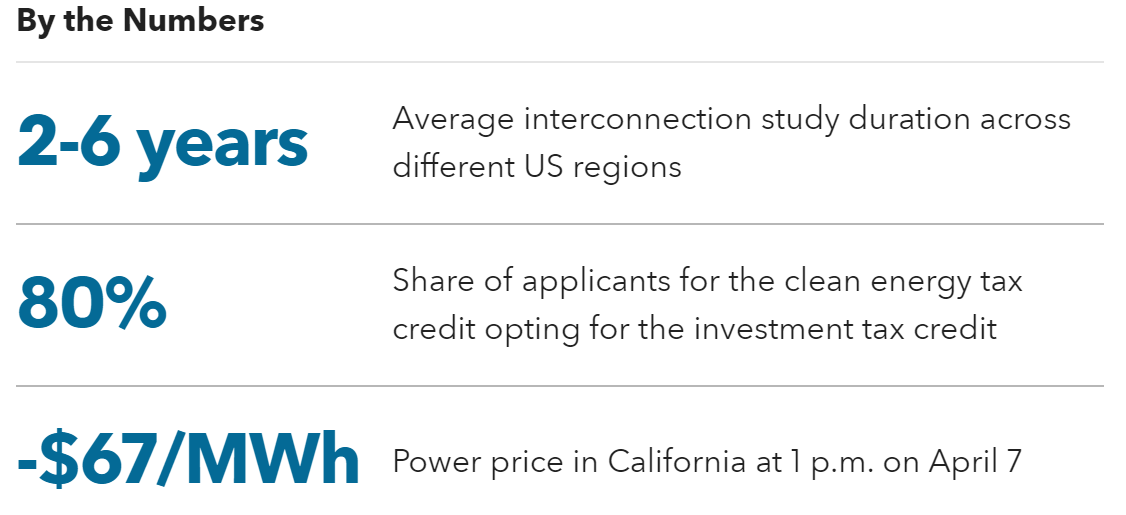

- Siting, permitting, and grids remain front of mind. Participants noted that these factors are a key constraint to the speed of new renewables deployment. Yet the grid itself is also hampered by challenges with siting and environmental permitting. Industry and government agree on a suite of solutions – including shot clocks, streamlining, pre-designation zones, community engagement and staffing – but their introduction is still nascent and patchworked.

- Supply chain uncertainty puts domestic tax credit add-ons at risk. Despite generous tax credits, industry players warn that supply chain localization won’t happen overnight – and may never happen for certain industries like solar. Developers are uncertain which projects will qualify for domestic tax credit add-ons given the challenges of proving US activity.

- A rude awakening is coming regarding negative pricing. Developers expressed concerns around negative pricing, both due to rising renewables build and the introduction of the production tax credit for solar. Attendees warned that the business models for renewables may change, looking more like those of gas peaker plants today, with most revenue earned in only a few hours of the year. This creates opportunities for battery storage, as well as a need for risk-sharing with offtakers.

- Tentative steps are being taken toward tax credit transferability. US renewable energy players are eager to take advantage of tax credit transferability to absorb the expected surge in planned projects that will generate tax credits, but they note that the market is still nascent. Hybrid deals were of particular interest, as were combining transferability with traditional power purchase agreements and raising debt off the back of transferability deals.

- Clean firming capacity lacks a route to market. Clean firming capacity is rising on the agenda, triggered by new Environmental Protection Agency regulations on coal and gas emissions, state and corporate net-zero goals and rising power demand. But these technologies still struggle to compete due to high costs and non-supportive market designs.

- Load growth changes utilities’ near-term decisions. After years of stagnation, US load growth from electric vehicles, data centers, cryptocurrency mining facilities and manufacturing is well under way. The impact of this change is hard to predict; for instance, data center demand will vary significantly based on application and semiconductor innovation. New load is also putting pressure on renewables, grid development timelines and firming capacity.

BNEF clients can access the full report here.