By Colin McKerracher, Head of Advanced Transport, BloombergNEF

EV Uncertainty

With just two months left in 2023, it’s a good time to take stock of where things stand on global electric-vehicle adoption.

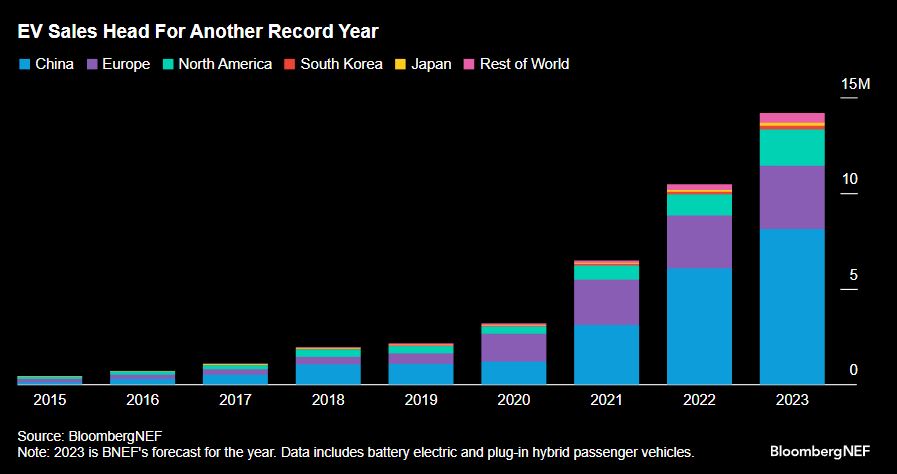

There’s plenty of good news. EVs are headed for over 14 million sales this year. That’s up 35% over last year’s total — yet another record for the industry.

China is driving the increase. The nation is firmly in the mass-market phase of adoption, with battery-powered vehicles making up 38% and 32% of passenger-car sales in August and September, respectively.

Europe has been surprisingly resilient. Sales in the region are on track to climb by a fifth this year, to around 3.3 million, though subsidy cuts in markets including Germany could still impact the final tally. While US sales are further behind, they’ve crossed the 1-million mark for the first time this year and are on pace to climb more than 40% from 2022 levels.

BloombergNEF expects Tesla’s Model Y to become the world’s best-selling vehicle of any type this year after breaking into the top five in 2022. Tesla and BYD combined will account for around 6% of the global vehicle market this year. BYD has been dramatically expanding its model lineup and manufacturing capacity. The Chinese company is now also pushing into Europe, and its growth from obscure battery manufacturer to global automobile behemoth is one of the most remarkable success stories in the industry’s history.

There’s also growing optimism on charging infrastructure and batteries. This year will see a record 1.4 million new public charging points installed. Utilization is finally getting high enough for operators to see favorable economics. Getting suitable grid connections is still a challenge, but there are an increasing number of large charging hubs being built around the world targeting both passenger cars and commercial trucks.

On the battery front, early indications are that battery prices in 2023 will resume their decades-long decline after inching higher last year. Lithium and other battery metal prices have tanked, giving manufacturers more room for maneuver. Importantly, there’s real progress being made on commercializing new chemistries at both the high end of the market – solid state batteries – and the low end in the form of sodium-ion batteries.

American Concerns

Despite all those positive developments, there’s more than a whiff of fear in the market right now. Ford and General Motors have pushed back their EV targets, while Elon Musk sounded pretty downbeat during Tesla’s most recent earnings call. EV inventories are rising for many established automakers, startups are mostly losing money, and consumers seem to grow more hesitant in several markets.

Several of the issues are native to the US, where electrifying big pickup trucks at competitive prices is still hard due to their excessive size and weight. EVs in the US are also becoming an increasingly politicized topic. The vast majority of sales so far have been in blue states, and there’s evidence that this correlation between EV buying and voting patterns may be getting stronger over time.

Macroeconomic conditions are also a factor, with higher interest rates, stalling house prices and stock market uncertainty all likely damping buyer enthusiasm. But blaming it all on these factors is a step too far; there are genuine questions about whether mass market buyers in the US are really interested in going electric — and at what price.

In theory, the US should have reached the takeoff point for EVs. Analysis shows that EVs tend to accelerate somewhere around 5% to 8% of sales, after which the steep part of the consumer adoption ‘S-curve’ hits and everything changes. But there are problems with assuming this will happen everywhere.

First, that takeoff point is based on a relatively small number of countries with different policy levers being pulled at the same time, making it hard to get a clear view of organic demand.

Second, the concept of the S-curve has mostly been calibrated on household or consumer goods — things like TVs, radios, microwaves and smartphones. None of these are at the upper limit of people’s purchasing power the way cars are. The steepness of the EV curve will be shaped by how fast costs continue to come down, not by how fast people adopted VCRs or the iPhone.

Lastly, most of the literature on how fast consumer products get adopted is derived based on their share of the total stock of something, not their share of new sales in any given year. This is quite different for cars, because while plug-in models will be around 18% of global vehicle sales this year – firmly in the early mass-market phase – they’re only 3% of the total vehicles on the road.

Plenty of people never buy a new car, so there’s an argument to be made that the share of new sales is the right metric, but the point is that we’re in relatively uncharted waters on this one.

Most global EV adoption forecasts were revised up over the last five years, including BNEF’s. If the US market stalls, the next few years could see some of the most optimistic projections being lowered for a change.