By Derrick Flakoll, North America Policy Associate, BloombergNEF

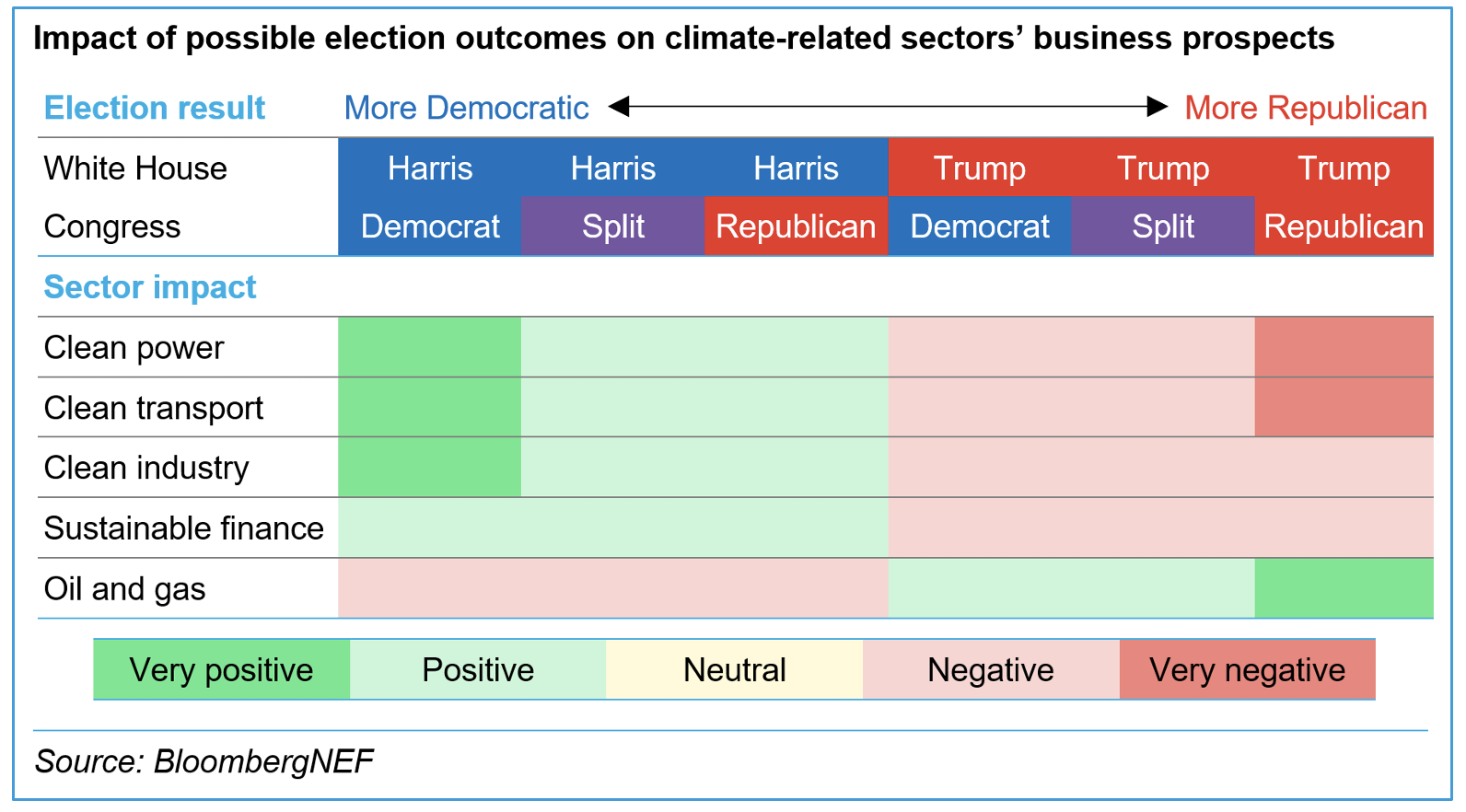

The upcoming US elections could reshape global climate progress. Former president Donald Trump and his Republican Party have vowed to repeal the Inflation Reduction Act, or IRA, a keystone climate law that Vice President Kamala Harris and her incumbent Democratic Party hope to build on.

The economic benefit of the US’s clean energy boom, and a closely divided Congress, will likely shield the IRA from major legislative changes regardless of who wins. But regulations – and looming tax bills – could still have a big impact.

Despite the parties’ seemingly opposing positions, Democrats and Republicans appear to be converging on different flavors of an ‘all-of-the-above’ energy strategy. Republicans are often skeptical of climate spending and favor expanding fossil-fuel production and exports – but post-IRA investments in factories and clean energy have overwhelmingly gone to Republican districts.

Democrats want to double down on the energy transition and encourage a green industrial revolution on US soil, but Harris has also lately praised the US’s record oil and gas production as she worries about the political impacts of higher gasoline (petrol) prices and alienating oil and gas workers in Pennsylvania, a keystone state for her election.

Regardless of the president, a narrowly divided legislature will limit what can – or can’t – get done on the energy front. Either Harris or Trump will need both houses of Congress to pass most proposals they’re campaigning on.

Democrats are almost certain to lose the Senate; Republicans may lose the House of Representatives even if Trump wins. Either result would limit the president’s ability to end or expand US climate laws like the IRA without a rare bipartisan deal. Only a ‘trifecta’ – in which one party simultaneously controls the presidency and both houses of Congress – would allow more ambitious partisan reforms.

Still, presidents can act alone in several key areas. They can rewrite rules and priorities for federal agencies and programs like the IRA’s tax credits, grants and loans, which could dramatically change the impact on both emissions and firms. They can set tariffs that can scramble supply chains or protect infant industries. And they can veto Congress’s proposed laws. Trump could use this power to roll back President Joe Biden’s most ambitious green policies or reorient them from a focus on emissions to economic growth alone, while Harris would likely consolidate and build on Biden’s nascent initiatives.

Meanwhile, Congress’s post-election agenda will be driven by fights over the IRA and tax policy. Key tax cuts passed during Trump’s first term expire at the end of 2025. While Republicans will be tempted to end IRA programs to ‘pay for’ these tax cuts, they likely lack the votes to repeal IRA tax credits, as such a repeal would undermine popular clean energy projects in Republican territory.

A group of 18 Republican Representatives – more than the party’s current majority in the House – have signed an open letter warning against a too-hasty repeal of IRA tax credits. Still, more polarizing credits like those tied to electric vehicles (EVs) are at higher risk, as are unspent grant and loan programs.

Whoever wins, US energy policy, and US cleantech sectors, will do what they always do: muddle through. Trump could deal the energy transition a blow, but he can’t stop or reverse it any more than he could during his first term. Harris, meanwhile, will need to make political compromises that will likely keep US climate and energy policy far behind what it needs to meet the country’s net-zero goals.

BloombergNEF estimates that annual US investment in the energy transition must triple from now through 2030 – and then rise even further after that – to hit net-zero emissions by 2050. No matter the outcome of this election, there’s a lot more work to do before the US gets there.