Over the past seven months, consumers and automakers in the US have labored to understand the impact of the Inflation Reduction Act on consumer tax credits for electric vehicles. With the update released by the Treasury Department on April 17, buyers finally have clarity on which cars qualify for up to $7,500 in benefits.

In all, 17 EV models now qualify. Ten EV models will receive the full credit of $7,500. Six get a partial credit of $3,750. Tesla’s Model 3 receives either half the credit or the entire thing depending on which version a consumer buys. The 17–vehicle tally includes three GM models that have yet to go on sale, so the true number of models that consumers can purchase today is actually 14.

Under rules that have been in place since January 1, 2023, around 24 models qualified for the $7,500 credit by selling below the manufacturer’s suggested retail price (MSRP) cap and by meeting final assembly rules. These laxer rules are set to expire April 18, however.

The new list reflects changes mandated by the IRA, which Congress passed in August 2022. Under the law, fulfilling a requirement for manufacturing battery components in North America unlocks one half of the credit ($3,750), while sourcing critical minerals from a select list of US trade allies unlocks the other half, for a potential total of $7,500.

Qualifying vehicles must have ‘final assembly’ in North America and have a maximum manufacturer’s suggested retail price of $80,000 for SUVs, vans and pickups, or $55,000 for all other vehicles. There are also income thresholds on the clean car tax credit of up to $150,000 for a single filer and $300,000 for joint filers.

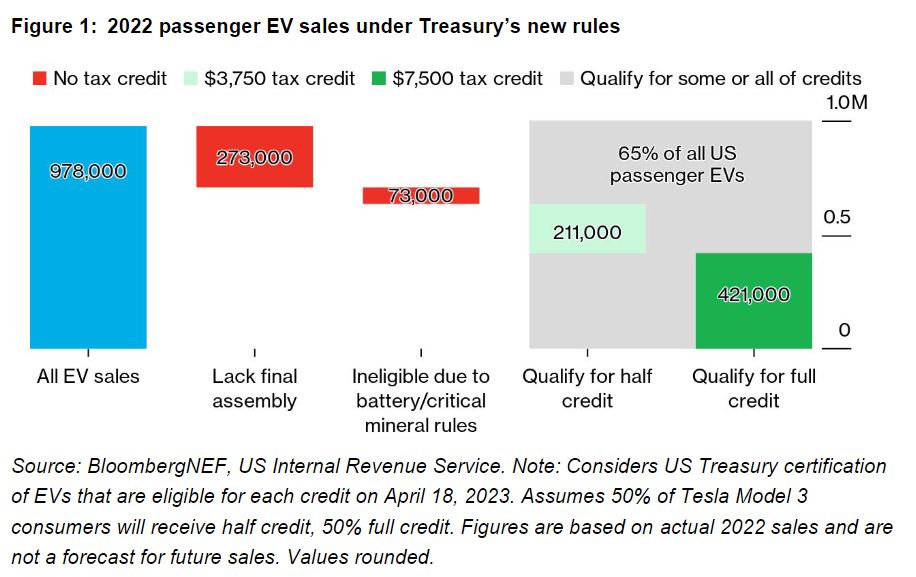

Had all these requirements been in place in 2022, BNEF finds that 65% of 978,000 EVs sold last year would have qualified for either the partial or the full credit.

While only a select few vehicles would have qualified for the full credit, these models represent 43% of 2022 passenger EV sales. Around 22% of 2022 passenger EV sales would have received half the credit. This calculation assumes an even split between the Tesla Model 3 standard range version and the Model 3’s performance models, which receive the half and full credit respectively. Tesla’s shorter–range Model 3 does not qualify for the full tax credit because it uses lithium iron phosphate cells sourced from CATL in China.

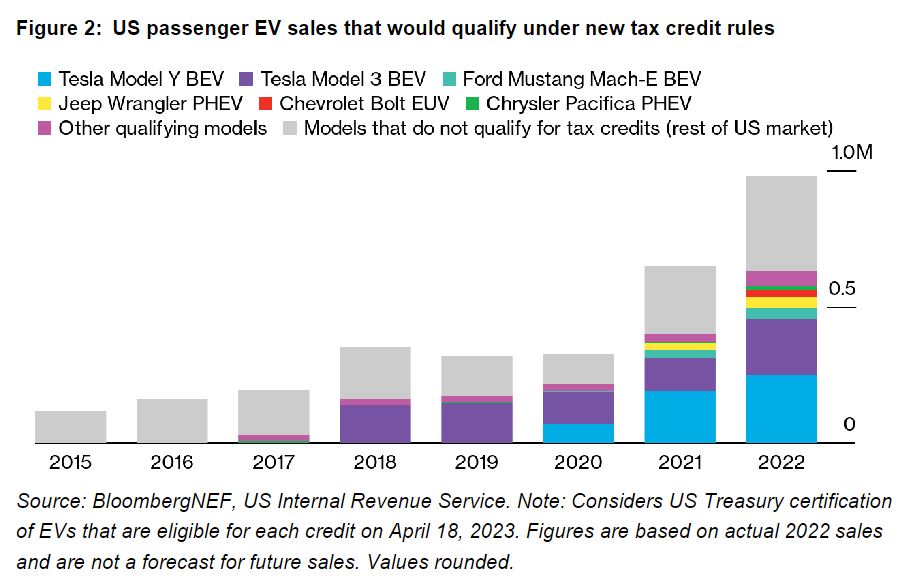

The automakers who benefit most from this new EV tax credit are – not surprisingly – mainly domestic manufacturers that had already built up a North American EV supply chain. Tesla’s vehicles no longer qualified for federal EV tax credits under the pre–IRA system. Now, Tesla’s consumers will receive credits for the Model 3 and Model Y, which together sold over 450,000 units in 2022.

GM and Ford also come out well, with most of their vehicles receiving at least partial credit. GM’s Bolt and Bolt EUV continue to receive the full $7,500, and its new–generation EVs are poised to see the full benefits of the tax credit as they arrive this year. Stellantis also receives $3,750 on most of its popular Jeep plug–in hybrid electric vehicle models, which were the highest–selling PHEVs in the country last year, and its Chrysler Pacifica PHEV receives the full $7,500.

PHEVs are arguably a popular option for manufacturers as they can be easier to produce in ways that meet the tax credit requirements. Because PHEVs contain smaller batteries than EVs, the battery component and critical mineral requirements can be met more easily.

Clearly losing out for the time being are popular EV models from foreign automakers. These include the Volkswagen ID.4 and the Nissan Leaf, which had been one of the most affordable EVs on the market. Neither car currently appears on Treasury’s list, although VW has stated that it expects its ID.4 model to eventually qualify.

Startups didn’t make the cut either. Rivian’s R1T and R1S models are both ineligible for the tax credit due to failure to comply with the battery component and critical mineral requirements.

US policymakers hope that the structure of the tax credit will encourage automakers to shift their manufacturing to North America and source critical minerals like lithium, cobalt and nickel from US–allied nations. According to BNEF analysis, there are enough critical minerals available from US trade partners to meet US EV demand – if those materials were all directed toward the US EV market. In reality, these minerals will likely be used in a wide array of markets as EV adoption grows.

The battery component portion of the credit will be easier to attain. Fulfilling that rule and unlocking the partial credit is likely a first step for many automakers, so long as they establish manufacturing facilities for assembly in North America.

In the meantime, automakers with EV models that are ineligible for credits under the clean car tax credit, like Nissan, VW, Toyota and Kia, may turn to using a version of the EV tax credit intended for commercial vehicles instead. In December, Treasury said automaker loans to consumers – i.e., car leases – would qualify under the commercial credit for $7,500. While consumers do not receive the full credit for themselves, automakers typically reduce the leasing cost to benefit the consumer by passing along some savings.

Treasury will update the eligible EV models for passenger clean car tax credits over time as automakers ramp up their EV production and introduce new models. However, the requirements for credits will only get more stringent in the future, so while the ground is settled for now, credit eligibility concerns will continue even as EV adoption grows.